Chapter 29: Aggregate Demand and Aggregate Supply

Aggregate demand-aggregate supply model - Provides keen insights on inflation, recession, and unemployment

Aggregate demand - A schedule or curve that shows the amounts of real output (real GDP) that buyers collectively desire to purchase at each possible price level

When the price level rises, the quantity of real GDP demanded decreases; when the price level falls, the quantity of real GDP demanded increases

Downward-sloping aggregate demand curve

Real-balances effect - Higher price level reduces purchasing power + results in less consumption spending

Interest-rate effect - Higher price level increases demand for money

Foreign purchases effect - When the U.S. price level rises relative to foreign price levels (and exchange rates do not respond quickly or completely), foreigners buy fewer U.S. goods and Americans buy more foreign goods

Changes in aggregate demand

Determinants of aggregate demand - Factors that can shift the entire aggregate demand curve

Consumer spending - If those consumers decide to buy more output at each price level, the aggregate demand curve will shift to the right (and vice versa)

Consumer wealth - An unexpected decline in asset values will cause an unanticipated reduction in consumer wealth at each price level

Household borrowing - Consumers increasing their consumption spending by borrowing shifts the aggregate demand curve to the right

Consumer expectations - When people expect their future real incomes to rise, they tend to spend more of their current incomes. Thus, current consumption spending increases (current saving falls) and the aggregate demand curve shifts to the right

Personal taxes - Tax cuts shift the aggregate demand curve to the right, while tax increases reduce consumption spending and shift the curve to the left

Investment spending - A decline in investment spending at each price level will shift the aggregate demand curve to the left (and vice versa)

Real interest rates - Other things equal, an increase in real interest rates will lower investment spending and reduce aggregate demand

Expected returns

Expectations about future business conditions

Technology

Degree of excess capacity

Business taxes

Government spending - An increase in government purchases (for example, more military equipment) will shift the aggregate demand curve to the right (and vice versa)

Net export spending - A rise in net exports (higher exports relative to imports) shifts the aggregate demand curve to the right (and vice versa)

National income abroad - Rising national income abroad encourages foreigners to buy more US products, shifting the US aggregate demand curve to the right

Exchange rates - Changes in the dollar’s exchange rate—the price of foreign currencies in terms of the U.S. dollar—may affect U.S. exports and therefore aggregate demand

Aggregate supply - A schedule or curve showing the relationship between the price level and the amount of real domestic output that firms in the economy produce

Immediate short run

Lasts as long as both input prices and output prices stay fixed

Output prices fixed

Immediate short run aggregate supply curve - Calculated from all of the individual prices set by the various firms in the economy; horizontal shape implies that the total amount of output supplied in the economy depends directly on the volume of spending

Short run

Output prices are flexible, but input prices are either totally fixed or highly inflexible

Short run aggregate supply curve - Slopes upward because, with input prices fixed, changes in the price level will raise or lower real firm profits

As the economy expands in the short run, per-unit production costs generally rise because of reduced efficiency

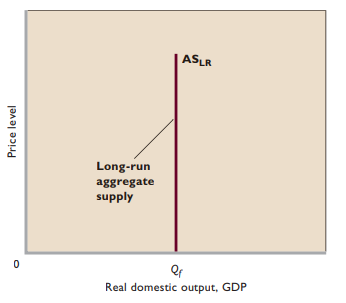

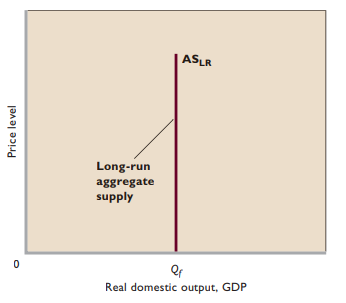

Long run

All output and input prices—including wage rates—are fully flexible

Long run aggregate supply curve - Vertical at economy’s full employment output; in the long run the economy will produce the full-employment output level no matter what the price level is

Process of rising input prices and falling profits continues until the rise in input prices exactly matches the initial change in output prices

Changes in aggregate supply

Determinants of aggregate supply - Shift the aggregate supply curve when they change

Input prices

Domestic resource prices

Prices of imported resources

Productivity - A measure of the relationship between a nation’s level of real output and the amount of resources used to produce that output

Legal-institutional environment

Business taxes + subsidies

Gov’t regulation

Equilibrium + changes in equilibrium

Equilibrium price level and output - Established by the intersection of the aggregate demand curve AD and the aggregate supply curve AS

When equality occurs between the amounts of real output produced and purchased the economy has achieved equilibrium

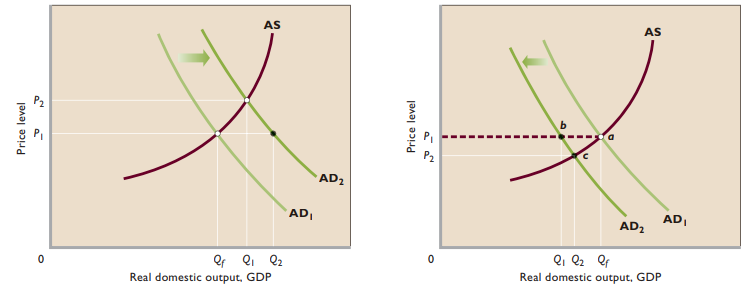

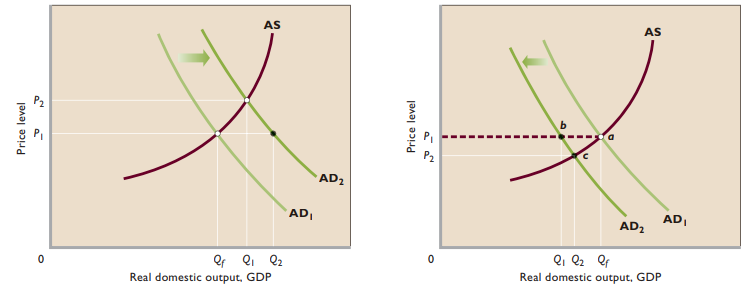

Demand pull inflation

Increase in aggregate demand beyond the full-employment level of output causes inflation

Increase in demand expands real output from the full employment level

Actual GDP exceeds potential GDP

Recession + cyclical unemployment

Deflation is a decline in the price level

This decline of real output constitutes a recession, and since fewer workers are needed to produce the lower output, cyclical unemployment arises

Real output takes the brunt of declines in aggregate demand

Menu costs - Firms that think a recession will be relatively short-lived may be reluctant to cut their prices

Efficiency wages - Wages that elicit maximum work effort and thus minimize labor costs per unit of output

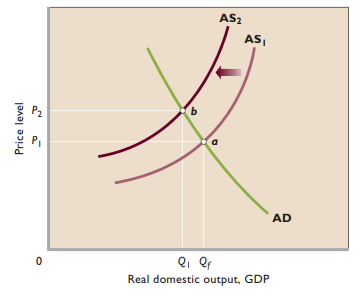

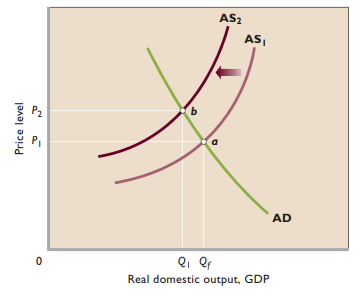

Cost push inflation

The effects of a leftward shift in aggregate supply

Price level rises + real output declines

Chapter 29: Aggregate Demand and Aggregate Supply

Aggregate demand-aggregate supply model - Provides keen insights on inflation, recession, and unemployment

Aggregate demand - A schedule or curve that shows the amounts of real output (real GDP) that buyers collectively desire to purchase at each possible price level

When the price level rises, the quantity of real GDP demanded decreases; when the price level falls, the quantity of real GDP demanded increases

Downward-sloping aggregate demand curve

Real-balances effect - Higher price level reduces purchasing power + results in less consumption spending

Interest-rate effect - Higher price level increases demand for money

Foreign purchases effect - When the U.S. price level rises relative to foreign price levels (and exchange rates do not respond quickly or completely), foreigners buy fewer U.S. goods and Americans buy more foreign goods

Changes in aggregate demand

Determinants of aggregate demand - Factors that can shift the entire aggregate demand curve

Consumer spending - If those consumers decide to buy more output at each price level, the aggregate demand curve will shift to the right (and vice versa)

Consumer wealth - An unexpected decline in asset values will cause an unanticipated reduction in consumer wealth at each price level

Household borrowing - Consumers increasing their consumption spending by borrowing shifts the aggregate demand curve to the right

Consumer expectations - When people expect their future real incomes to rise, they tend to spend more of their current incomes. Thus, current consumption spending increases (current saving falls) and the aggregate demand curve shifts to the right

Personal taxes - Tax cuts shift the aggregate demand curve to the right, while tax increases reduce consumption spending and shift the curve to the left

Investment spending - A decline in investment spending at each price level will shift the aggregate demand curve to the left (and vice versa)

Real interest rates - Other things equal, an increase in real interest rates will lower investment spending and reduce aggregate demand

Expected returns

Expectations about future business conditions

Technology

Degree of excess capacity

Business taxes

Government spending - An increase in government purchases (for example, more military equipment) will shift the aggregate demand curve to the right (and vice versa)

Net export spending - A rise in net exports (higher exports relative to imports) shifts the aggregate demand curve to the right (and vice versa)

National income abroad - Rising national income abroad encourages foreigners to buy more US products, shifting the US aggregate demand curve to the right

Exchange rates - Changes in the dollar’s exchange rate—the price of foreign currencies in terms of the U.S. dollar—may affect U.S. exports and therefore aggregate demand

Aggregate supply - A schedule or curve showing the relationship between the price level and the amount of real domestic output that firms in the economy produce

Immediate short run

Lasts as long as both input prices and output prices stay fixed

Output prices fixed

Immediate short run aggregate supply curve - Calculated from all of the individual prices set by the various firms in the economy; horizontal shape implies that the total amount of output supplied in the economy depends directly on the volume of spending

Short run

Output prices are flexible, but input prices are either totally fixed or highly inflexible

Short run aggregate supply curve - Slopes upward because, with input prices fixed, changes in the price level will raise or lower real firm profits

As the economy expands in the short run, per-unit production costs generally rise because of reduced efficiency

Long run

All output and input prices—including wage rates—are fully flexible

Long run aggregate supply curve - Vertical at economy’s full employment output; in the long run the economy will produce the full-employment output level no matter what the price level is

Process of rising input prices and falling profits continues until the rise in input prices exactly matches the initial change in output prices

Changes in aggregate supply

Determinants of aggregate supply - Shift the aggregate supply curve when they change

Input prices

Domestic resource prices

Prices of imported resources

Productivity - A measure of the relationship between a nation’s level of real output and the amount of resources used to produce that output

Legal-institutional environment

Business taxes + subsidies

Gov’t regulation

Equilibrium + changes in equilibrium

Equilibrium price level and output - Established by the intersection of the aggregate demand curve AD and the aggregate supply curve AS

When equality occurs between the amounts of real output produced and purchased the economy has achieved equilibrium

Demand pull inflation

Increase in aggregate demand beyond the full-employment level of output causes inflation

Increase in demand expands real output from the full employment level

Actual GDP exceeds potential GDP

Recession + cyclical unemployment

Deflation is a decline in the price level

This decline of real output constitutes a recession, and since fewer workers are needed to produce the lower output, cyclical unemployment arises

Real output takes the brunt of declines in aggregate demand

Menu costs - Firms that think a recession will be relatively short-lived may be reluctant to cut their prices

Efficiency wages - Wages that elicit maximum work effort and thus minimize labor costs per unit of output

Cost push inflation

The effects of a leftward shift in aggregate supply

Price level rises + real output declines

Knowt

Knowt