Chapters 29.3-29.5: Money Creation

Money-Creating Transactions of a Commercial Bank

Refer to worked example: https://knowt.io/note/e0389526-256f-4b2e-a266-ef2c3e59df10/AP-Macro-291-292-money-creation

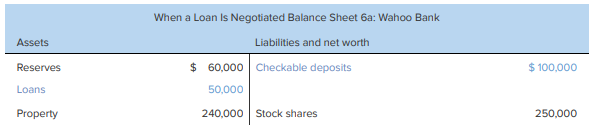

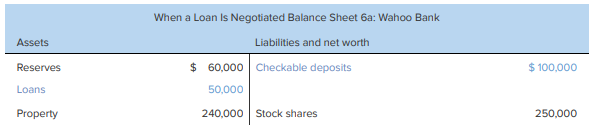

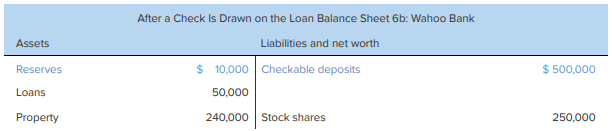

Transaction 6: Granting a Loan

a meat packing company requests and is granted a $50,000 loan from the Wahoo bank

the bank loans out its $50,000 of excess reserves

the company gets a $50,000 increase in its checkable-deposit account in the bank.

the $50,000 is an interest-earning loan (asset) and a checkable deposit (liability) to the bank

When a bank makes loans, it creates money

there is a change in the supply of money

Much of the money used in the United States is created through the extension of credit by commercial banks

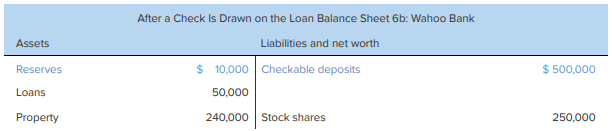

the borrower draws a check for its $50,000 loan and gives it to the construction company, who deposits it into another bank

After the check has been collected, Wahoo bank just meets the required reserve ratio of 20 percent (= $10,000/$50,000)

its excess reserves have gone from $50,000 to $0

it could not have lent more than its excess reserves (more than $50,000) because it wouldn’t meet the required reserve ratio afterwards

A single commercial bank in a multibank banking system can lend only an amount equal to its initial preloan excess reserves.

since a bank creates checkable-deposit money when it lends its excess reserves, money is “destroyed” when borrowers pay off loans

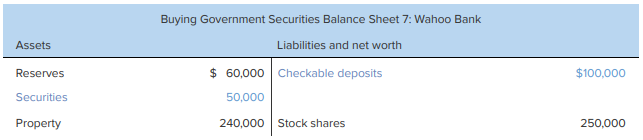

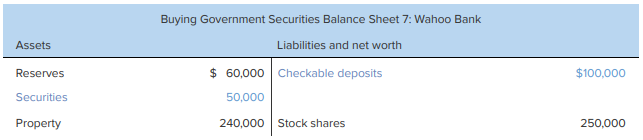

Transaction 7: Buying Government Securities

a bank creates money by buying government bonds from the public

suppose we go back to transaction 5

instead of making a $50,000 loan, the Wahoo bank buys $50,000 of government securities from a securities dealer.

The bank receives the interest bearing bonds (“Securities” asset) and gives the dealer an increase in its checkable deposit account (liabilities)

Bond purchases from the public by commercial banks increase the supply of money in the same way as lending to the public does

The bank accepts government bonds (which are not money) and gives the securities dealer an increase in its checkable deposits (which are money).

the selling of government bonds to the public by a commercial bank reduces the supply of money like repaying a loan does

Profits, Liquidity, and the Federal Funds Market

a banker has 2 conflicting goals:

profit

profit is why the bank makes loans and buys securities—the two major earning assets of commercial banks

liquidity

safety lies in liquid assets as cash and excess reserves.

A bank must be on guard for depositors who want to transform their checkable deposits into cash.

before the crisis of 2008

to balance profit and liquidity, banks that had excess reserves could lend them overnight to the banks that were deficient.

These loans allowed the banks that were deficient to meet their reserve requirements while also allowing the banks making the loans to earn a little interest.

this was the federal funds market

federal funds rate::

The interest rate that U.S. banks and other depository institutions charge one another on overnight loans made out of their excess reserves.

The Monetary Multiplier

monetary multiplier::

defines the relationship between any new excess reserves in the banking system and the magnified creation of new checkable-deposit money by banks as a group.

aka the checkable deposit multiplier

The monetary multiplier m is the reciprocal of the required reserve ratio R

m = 1 / R

m represents the maximum amount of new checkable-deposit money that can be created by a single dollar of excess reserves, given the value of R

By multiplying the excess reserves E by m, we can find the maximum amount of new checkable-deposit money, D, that can be created by the banking system

D = E * m

Higher reserve ratios mean lower monetary multipliers and less creation of new checkable-deposit money via loans

Smaller reserve ratios mean higher monetary multipliers and more creation of new checkable-deposit money via loans

Reversibility: The Multiple Destruction of Money

Loan repayment sets off a process of multiple destruction of money the opposite of the multiple creation process

If the dollar amount of loans made in some period exceeds the dollar amount of loans paid off, checkable deposits will expand and the money supply will increase.

if the dollar amount of loans is less than the dollar amount of loans paid off, checkable deposits will contract and the money supply will decline

Chapters 29.3-29.5: Money Creation

Money-Creating Transactions of a Commercial Bank

Refer to worked example: https://knowt.io/note/e0389526-256f-4b2e-a266-ef2c3e59df10/AP-Macro-291-292-money-creation

Transaction 6: Granting a Loan

a meat packing company requests and is granted a $50,000 loan from the Wahoo bank

the bank loans out its $50,000 of excess reserves

the company gets a $50,000 increase in its checkable-deposit account in the bank.

the $50,000 is an interest-earning loan (asset) and a checkable deposit (liability) to the bank

When a bank makes loans, it creates money

there is a change in the supply of money

Much of the money used in the United States is created through the extension of credit by commercial banks

the borrower draws a check for its $50,000 loan and gives it to the construction company, who deposits it into another bank

After the check has been collected, Wahoo bank just meets the required reserve ratio of 20 percent (= $10,000/$50,000)

its excess reserves have gone from $50,000 to $0

it could not have lent more than its excess reserves (more than $50,000) because it wouldn’t meet the required reserve ratio afterwards

A single commercial bank in a multibank banking system can lend only an amount equal to its initial preloan excess reserves.

since a bank creates checkable-deposit money when it lends its excess reserves, money is “destroyed” when borrowers pay off loans

Transaction 7: Buying Government Securities

a bank creates money by buying government bonds from the public

suppose we go back to transaction 5

instead of making a $50,000 loan, the Wahoo bank buys $50,000 of government securities from a securities dealer.

The bank receives the interest bearing bonds (“Securities” asset) and gives the dealer an increase in its checkable deposit account (liabilities)

Bond purchases from the public by commercial banks increase the supply of money in the same way as lending to the public does

The bank accepts government bonds (which are not money) and gives the securities dealer an increase in its checkable deposits (which are money).

the selling of government bonds to the public by a commercial bank reduces the supply of money like repaying a loan does

Profits, Liquidity, and the Federal Funds Market

a banker has 2 conflicting goals:

profit

profit is why the bank makes loans and buys securities—the two major earning assets of commercial banks

liquidity

safety lies in liquid assets as cash and excess reserves.

A bank must be on guard for depositors who want to transform their checkable deposits into cash.

before the crisis of 2008

to balance profit and liquidity, banks that had excess reserves could lend them overnight to the banks that were deficient.

These loans allowed the banks that were deficient to meet their reserve requirements while also allowing the banks making the loans to earn a little interest.

this was the federal funds market

federal funds rate::

The interest rate that U.S. banks and other depository institutions charge one another on overnight loans made out of their excess reserves.

The Monetary Multiplier

monetary multiplier::

defines the relationship between any new excess reserves in the banking system and the magnified creation of new checkable-deposit money by banks as a group.

aka the checkable deposit multiplier

The monetary multiplier m is the reciprocal of the required reserve ratio R

m = 1 / R

m represents the maximum amount of new checkable-deposit money that can be created by a single dollar of excess reserves, given the value of R

By multiplying the excess reserves E by m, we can find the maximum amount of new checkable-deposit money, D, that can be created by the banking system

D = E * m

Higher reserve ratios mean lower monetary multipliers and less creation of new checkable-deposit money via loans

Smaller reserve ratios mean higher monetary multipliers and more creation of new checkable-deposit money via loans

Reversibility: The Multiple Destruction of Money

Loan repayment sets off a process of multiple destruction of money the opposite of the multiple creation process

If the dollar amount of loans made in some period exceeds the dollar amount of loans paid off, checkable deposits will expand and the money supply will increase.

if the dollar amount of loans is less than the dollar amount of loans paid off, checkable deposits will contract and the money supply will decline

Knowt

Knowt