Parcial 1 - Economía II UFM

Si te ayudó a estudiar este resumen, déjame 5 estrellas :)

Encuentra el resto del contenido del semestre aquí

Mercado

La organización económica de un campo de concentración.

Competencia y monopolio

Monopoly: one seller. Organizations operating with the advantage of special privileges granted by the government.

We can define a commodity narrowly or broadly enough, so that everything is a monopoly, or nothing is.

There are always alternatives to a good.

Corporations were created by special government acts in the 19th century, making them monopolies.

Price taker: a seller that cannot affect the price by his own actions.

Price searcher: a seller that must choose a price.

Competitive markets: markets in which all buyers and sellers are price takers.

Optimal allocation of resources: no unit of the good is being produced whose marginal opportunity cost exceeds its marginal benefit. And every unit of the good whose marginal benefit exceeds its marginal cost is being produced.

When government place regulations, this optimal allocation can't be reached.

Characteristics of perfect competition:

There is a large number of buyers and sellers so nobody possesses market power.

Market participants possess full and complete information of alternatives.

Sellers produce a homogenous product.

There is costless mobility of resources.

Economic actors are price takers.

But this model has made two mistakes:

It has overlooked the entrepreneur, which is the driving force of real-world markets.

It also ignores the plan-adjustment process that characterizes real-world market activity.

Fair competition has open entry and exit.

Factores que dan poder monopólico:

Regulaciones del gobierno: licencias, permisos, impuestos

Innovación

Patentes, derechos de autor, marcas

Economías de escala

Externalidades de red

Cartel: cooperative arrangement between companies intended to promote a mutual interest. Sellers agreeing not to compete with each other.

They face two problems:

How to prevent competition among its members, who will try to circumvent the agreement

How to keep new competitors from trying to enter the market

A law that restricts competitors restricts competition.

Businesses are in favor of these because they want protection against competition.

This applies both to laws that restrict competitors and laws that "promote" competition.

Predatory price-cutting means reducing prices below cost in order to drive a rival out of business or prevent new rivals from entering with the intention of raising prices afterward to recoup all losses.

This is often untrue because businesses care more about total net revenue, than revenue of a single product.

Big firms are also not interested in small competitors.

Distribución del ingreso

Economic theory explains the distribution of income as the product of the supply and demand for productive services.

Income distribution systems: supply and demand, central-planning state.

Capital: produced means of production, or produced goods that can be used to produce future goods.

Productive capital: machinery and buildings.

Human capital: productive capabilities generated by investment and embodied in human beings, such as knowledge and skills.

There are three types of rights:

Actual: lo que de verdad tengo.

Legal: lo que la ley me dice que tengo.

Moral: lo que pienso que tengo.

The returns from investment decisions are future returns.

Lower rates of time preference encourage investment over consumption.

Unions: groups of organized workers.

They claim to compete against corporations, but in reality they want to exclude other workers who would do the same work for less.

To increase the real incomes of the members of society, it is necessary to increase the production of real goods.

The percentage of the population in poverty can be and has been greatly reduced, but often without any significant reduction in inequality.

The principal cause is increases in the supply of less skilled workers along with increases in the demand for more highly skilled workers.

Veil of Ignorance: Imagine you would have to choose the laws of society, but before choosing, you forgot everything about yourself.

Then you would place rules fair for everyone, not knowing where you would be

In choosing the rules behind the veil of ignorance, you would do your best to make sure no one was treated unfairly.=

Externalidades

Externalities: costs or benefits that fall on bystanders.

Negative externalities are costs imposed on others that are not taken into account when making a decision.

Also called spillover cost or external cost.

They cannot be completely eliminated because of transaction costs.

Positive externalities are benefits from an action that the decision-maker does not take into account.

Internalizing an externality is when the actor finds out about the consequences of his actions, takes the externality into account and chooses to alter his behavior.

We can minimize negative externalities by:

Negotiation: work it out for ourselves, it produces mutual gains from exchange.

Adjudication: a process for discovering who has which rights. It aims at maintaining the continuity of expectations.

Legislation: the creation of new rules.

We can reduce pollution by:

Command and control: legislation of physical restrictions.

Imposing a tax per unit of emission and then allow each party to respond as it thought best.

They are often called "licenses to pollute".

Be allowed to buy and sell "rights to pollute": firms with more emissions can buy these rights, so the total amount of emissions stays the same.

The bubble concept: permit factories to exceed the limits at one point if they could make it up at another point.

Coase Theorem: a solution to externalities through the creation of new markets.

Pigouvian tax: a tax on a good that produces negative externalities, in hopes to reduce it.

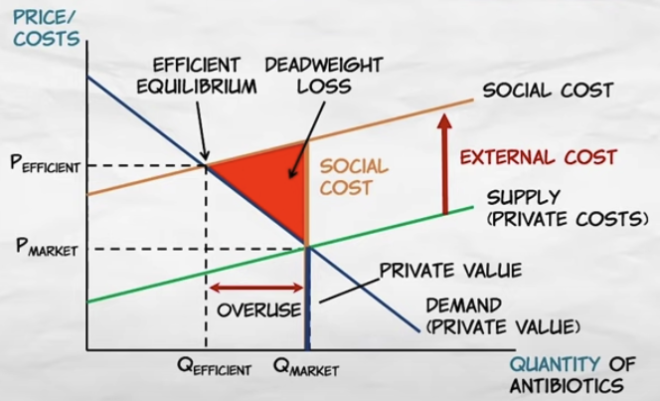

Externalities graph:

Private cost: the cost paid by the consumer or the producer

External cost: a cost paid by bystanders, by people other than the consumer or the producer

Social cost: the cost to everyone, the private cost plus the external cost

Network externalities: The value of a good or service increases the more people use it.

Mercado y gobierno

Structured individualism: el individuo carga con los beneficios y costos de sus acciones.

El gobierno no acata a esto.

Externalities can be expressed as market failures: the market process fails to achieve some optimal standard, and government corrective action can fix this.

"Economists who analyze market failure have a moral obligation to also analyze government failure."

Private sector: the market.

Also called the competitive sector.

Public sector: the government.

This doesn't mean that business managers pursue private interests whereas the government pursues the public interest.

To coerce means to induce cooperation by threatening to violently reduce people's options.

Government possesses a generally conceded and exclusive right to coerce adults.

Parents generally have the right to coerce children.

The reason laws expand our freedom is because they also coerce others.

To persuade means to induce cooperation by promising to expand people's options.

What would happen if there were no government at all?

Spillover benefits lower incentives for other people to buy services, such as security.

So the solution is to provide service to all equally.

Free riders: people who accept benefits without paying their share of the cost of providing those benefits.

Each will not do what is in the interest of all unless it is in the interest of each.

Government can be viewed as an institution for reducing transaction costs through the use of coercion.

Uniform and consistently enforced rules make it much easier for everyone to plan with confidence.

Paternalistic argument: the widely held belief that the powerful will take advantage of the weak unless government regulates certain kinds of voluntary exchange.

It has often been abused by special interests precisely to take advantage of the weak.

Persuasion always precedes coercion, because government will not act until particular people have been persuaded to act.

None of us knows enough to cast an adequately informed vote.

Even if we assume legislator's votes are adequately informed, should we assume they will be votes in the public interest?

Elected officials put an emphasis on the short run because results must be available by the next election.

Government will lean toward actions that harm many people just a little bit, rather than actions that displease a few people very much.

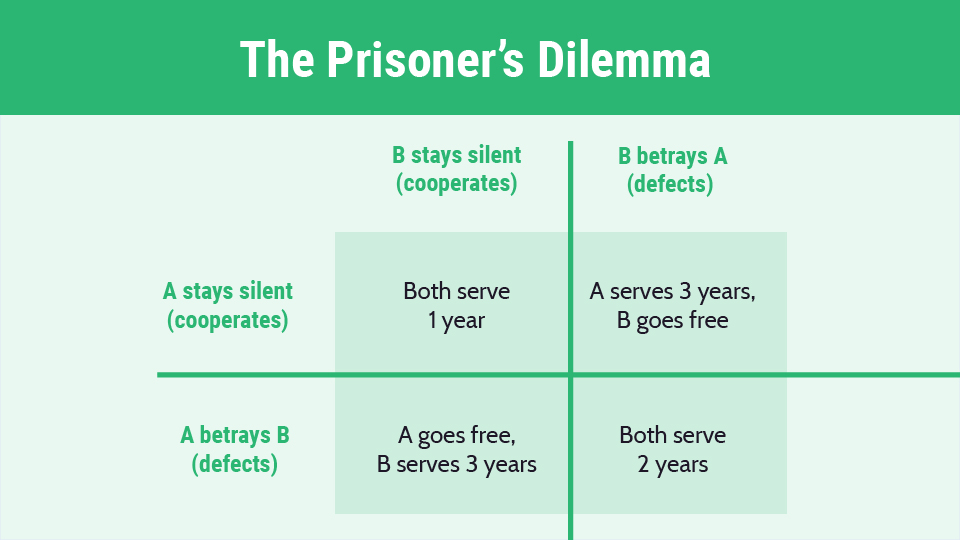

The Prisoner's Dilemma

People tend to idolize the government.

What the state is not: we are not the government, the government is not us.

What the state is: provides a legal, orderly, systematic channel for the predation of private property.

It is the monopoly of violence.

There are two mutually exclusive ways of acquiring wealth.

Economic means: production and exchange.

Political means: seizure of another's goods or services by the use of force and violence.

Impuestos

Three ways of raising government revenue:

Taxation

Public borrowing or debt issue

Money creation

Impuesto neutral: aquel impuesto que no cambia la conducta.

The principles of taxation can be divided into two general categories:

Positive principles of taxation: analyze who bears the burden of taxes and what other economic effects can be expected to result from the imposition of taxes.

Normative principles of taxation: how tax policy can be used to design as desirable a tax system as possible.

Unit tax: a tax charged per unit of a good exchanged.

Ad valorem taxes: based on the dollar value of the goods sold.

Retail sales tax: taxes calculated as a percentage of retail sales, a type of ad valorem tax.

Excise tax: taxes placed on particular types of goods, can be either unit or ad valorem.

Tax incidence: the ultimate burden of the tax, after shifting has taken place.

The more elastic a supply or demand schedule is, the greater the proportion of the tax that can be shifted to the other side of the market.

Welfare cost of taxation or excess burden or deadweight loss: all the exchanges that could be made, but are not made, because of a tax.

Arises because the taxpayers not only must pay the tax to the government, but also will alter their behavior in response to a tax to avoid it to some degree.

For a tax to have no excess burden, there must be no substitution effect.

Lump sum tax: a tax that completely eliminates the excess burden of taxation. Based on a fixed amount.

Ramsey's rule states that to minimize the excess burden of taxation, taxes should be placed on goods in inverse proportion to the elasticity of demand for the goods.

Costs associated with the tax system:

Compliance costs: the costs imposed on taxpayers to comply with the tax laws, such as collecting and keeping records.

Administrative costs: assumed by the government to collect taxes.

Political cost: assumed by the taxpayers and the government as a result of taxpayers trying to influence tax laws.

Earmarked taxes: taxes whose revenues are designated to a particular spending activity.

General fund financing: the tax revenues are placed in the general fund, from which government programs are financed. The alternative to earmarking.

Benefit principle: states that the people who benefit from the government's expenditures should be the ones who pay for them.

Ability-to-pay principle: states that individuals should pay taxes in proportion to their ability to pay.

Horizontal equity: individuals with an equal ability to pay should pay equal amounts of taxes (the same income).

Vertical equity: individuals with a greater ability to pay should pay more taxes (more income).

Tax systems can be classified according to the proportion of income that an individual taxpayer would pay in taxes as the taxpayer's income changes.

Proportional tax: a tax that is the same percentage of a taxpayer's income no matter what the level of income.

Progressive tax: a tax that is a larger percentage of the taxpayer's income as income rises.

Tax the rich sólo lastima a los pobres porque

Sube la barrera de rentabilidad necesaria para invertir

Y se confiscan los recursos no consumidos.

Regressive tax: a tax that is a smaller percentage of the taxpayer's income as income lowers.

Sumptuary tax or sin tax: taxes designed to discourage the consumption of the taxed good.

Revente-neutral carbon tax: el gobierno "devuelve" parte del impuesto sobre la contaminación

Equity and efficiency are important aspects of taxation.

A commodity tax is a tax on goods.

The economic incidence is not the same as the legal incidence.

Tax graph using a tax wedge:

Missing: El IVA y otras consideraciones a los impuestos - Fritz Thomas

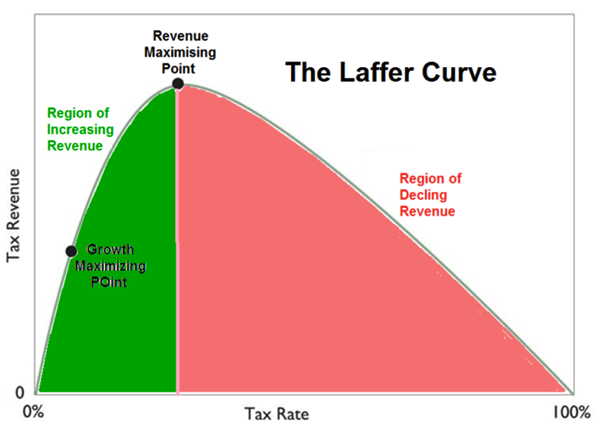

Laffer curve: belief that tax cuts generate additional revenue.

Government won't create any revenue if tax rates are zero.

Neither will it create revenue if tax rates are 100% because there will be more incentive to avoid taxes.

A revenue-maximizing tax rate exists.

Gasto público y deuda

What is folly in the conduct of a private family may be prudence in the conduct of the affairs of a great nation.

Armed with the Keynesian message, politicians can spend and spend without the apparent necessity to tax.

Classical fiscal practice, or the old-time fiscal religion was formed by notions of fiscal responsibility.

Deficits emerged primarily during periods of war; budgets normally produced surpluses during peacetime, and these surpluses were used to retire the debt created during war emergencies.

It held a theory of debt finance that said that resort to debt issue provided a means of reducing present burdens in exchange for the obligation to take on greater burdens in the future.

With taxation, the cost is placed on the current beneficiaries.

With borrowing, the cost is postponed until later periods, when interest payments come due.

Then came the Keynesian fiscal practice, which placed deficit financing in a central role.

Fiscal constitution: rules guiding fiscal choices.

Classical economists give us three reasons why unemployment exists

Workers are temporarily unemployed when moving jobs.

Individuals might elect not to work.

Wages are higher than employers can afford.

Keynes thought the real problem lay in lack of demand.

If market mechanisms were unable to stimulate economic recovery, it was the job of the state to step in to create demand, by running a very large budget deficit in order to create jobs.

Multiplier effect

By creating jobs, governments would save money that would have been spent on unemployment benefits.

The increase in the number of employed people would create additional spending power and therefore boost the economy and tax receipts.

Increased tax receipts would pay off the initial debt.

Public Choice

Public choice theory: the application of economic methods to the study of political processes.

Government is a complex social machine inhabited by people who are the same as everyone else, and in which periodic elections play a central role.

What policy is likely to emerge from real-world democratic politics, and how does that compare to market alternatives?

Democracy is the worst system of government, except for all the rest.

One of the most common refrains from people who advocate for an expanded role of government in society is the notion of market failure.

There are certain areas where market forces do not operate effectively and therefore we must have government corrective action.

The argument of market failure is wrong because it's based on a bifurcated view of human action.

We know that people in markets are driven by self-interest, but we must also accept that people in government are driven by the same thing.

Parcial 1 - Economía II UFM

Si te ayudó a estudiar este resumen, déjame 5 estrellas :)

Encuentra el resto del contenido del semestre aquí

Mercado

La organización económica de un campo de concentración.

Competencia y monopolio

Monopoly: one seller. Organizations operating with the advantage of special privileges granted by the government.

We can define a commodity narrowly or broadly enough, so that everything is a monopoly, or nothing is.

There are always alternatives to a good.

Corporations were created by special government acts in the 19th century, making them monopolies.

Price taker: a seller that cannot affect the price by his own actions.

Price searcher: a seller that must choose a price.

Competitive markets: markets in which all buyers and sellers are price takers.

Optimal allocation of resources: no unit of the good is being produced whose marginal opportunity cost exceeds its marginal benefit. And every unit of the good whose marginal benefit exceeds its marginal cost is being produced.

When government place regulations, this optimal allocation can't be reached.

Characteristics of perfect competition:

There is a large number of buyers and sellers so nobody possesses market power.

Market participants possess full and complete information of alternatives.

Sellers produce a homogenous product.

There is costless mobility of resources.

Economic actors are price takers.

But this model has made two mistakes:

It has overlooked the entrepreneur, which is the driving force of real-world markets.

It also ignores the plan-adjustment process that characterizes real-world market activity.

Fair competition has open entry and exit.

Factores que dan poder monopólico:

Regulaciones del gobierno: licencias, permisos, impuestos

Innovación

Patentes, derechos de autor, marcas

Economías de escala

Externalidades de red

Cartel: cooperative arrangement between companies intended to promote a mutual interest. Sellers agreeing not to compete with each other.

They face two problems:

How to prevent competition among its members, who will try to circumvent the agreement

How to keep new competitors from trying to enter the market

A law that restricts competitors restricts competition.

Businesses are in favor of these because they want protection against competition.

This applies both to laws that restrict competitors and laws that "promote" competition.

Predatory price-cutting means reducing prices below cost in order to drive a rival out of business or prevent new rivals from entering with the intention of raising prices afterward to recoup all losses.

This is often untrue because businesses care more about total net revenue, than revenue of a single product.

Big firms are also not interested in small competitors.

Distribución del ingreso

Economic theory explains the distribution of income as the product of the supply and demand for productive services.

Income distribution systems: supply and demand, central-planning state.

Capital: produced means of production, or produced goods that can be used to produce future goods.

Productive capital: machinery and buildings.

Human capital: productive capabilities generated by investment and embodied in human beings, such as knowledge and skills.

There are three types of rights:

Actual: lo que de verdad tengo.

Legal: lo que la ley me dice que tengo.

Moral: lo que pienso que tengo.

The returns from investment decisions are future returns.

Lower rates of time preference encourage investment over consumption.

Unions: groups of organized workers.

They claim to compete against corporations, but in reality they want to exclude other workers who would do the same work for less.

To increase the real incomes of the members of society, it is necessary to increase the production of real goods.

The percentage of the population in poverty can be and has been greatly reduced, but often without any significant reduction in inequality.

The principal cause is increases in the supply of less skilled workers along with increases in the demand for more highly skilled workers.

Veil of Ignorance: Imagine you would have to choose the laws of society, but before choosing, you forgot everything about yourself.

Then you would place rules fair for everyone, not knowing where you would be

In choosing the rules behind the veil of ignorance, you would do your best to make sure no one was treated unfairly.=

Externalidades

Externalities: costs or benefits that fall on bystanders.

Negative externalities are costs imposed on others that are not taken into account when making a decision.

Also called spillover cost or external cost.

They cannot be completely eliminated because of transaction costs.

Positive externalities are benefits from an action that the decision-maker does not take into account.

Internalizing an externality is when the actor finds out about the consequences of his actions, takes the externality into account and chooses to alter his behavior.

We can minimize negative externalities by:

Negotiation: work it out for ourselves, it produces mutual gains from exchange.

Adjudication: a process for discovering who has which rights. It aims at maintaining the continuity of expectations.

Legislation: the creation of new rules.

We can reduce pollution by:

Command and control: legislation of physical restrictions.

Imposing a tax per unit of emission and then allow each party to respond as it thought best.

They are often called "licenses to pollute".

Be allowed to buy and sell "rights to pollute": firms with more emissions can buy these rights, so the total amount of emissions stays the same.

The bubble concept: permit factories to exceed the limits at one point if they could make it up at another point.

Coase Theorem: a solution to externalities through the creation of new markets.

Pigouvian tax: a tax on a good that produces negative externalities, in hopes to reduce it.

Externalities graph:

Private cost: the cost paid by the consumer or the producer

External cost: a cost paid by bystanders, by people other than the consumer or the producer

Social cost: the cost to everyone, the private cost plus the external cost

Network externalities: The value of a good or service increases the more people use it.

Mercado y gobierno

Structured individualism: el individuo carga con los beneficios y costos de sus acciones.

El gobierno no acata a esto.

Externalities can be expressed as market failures: the market process fails to achieve some optimal standard, and government corrective action can fix this.

"Economists who analyze market failure have a moral obligation to also analyze government failure."

Private sector: the market.

Also called the competitive sector.

Public sector: the government.

This doesn't mean that business managers pursue private interests whereas the government pursues the public interest.

To coerce means to induce cooperation by threatening to violently reduce people's options.

Government possesses a generally conceded and exclusive right to coerce adults.

Parents generally have the right to coerce children.

The reason laws expand our freedom is because they also coerce others.

To persuade means to induce cooperation by promising to expand people's options.

What would happen if there were no government at all?

Spillover benefits lower incentives for other people to buy services, such as security.

So the solution is to provide service to all equally.

Free riders: people who accept benefits without paying their share of the cost of providing those benefits.

Each will not do what is in the interest of all unless it is in the interest of each.

Government can be viewed as an institution for reducing transaction costs through the use of coercion.

Uniform and consistently enforced rules make it much easier for everyone to plan with confidence.

Paternalistic argument: the widely held belief that the powerful will take advantage of the weak unless government regulates certain kinds of voluntary exchange.

It has often been abused by special interests precisely to take advantage of the weak.

Persuasion always precedes coercion, because government will not act until particular people have been persuaded to act.

None of us knows enough to cast an adequately informed vote.

Even if we assume legislator's votes are adequately informed, should we assume they will be votes in the public interest?

Elected officials put an emphasis on the short run because results must be available by the next election.

Government will lean toward actions that harm many people just a little bit, rather than actions that displease a few people very much.

The Prisoner's Dilemma

People tend to idolize the government.

What the state is not: we are not the government, the government is not us.

What the state is: provides a legal, orderly, systematic channel for the predation of private property.

It is the monopoly of violence.

There are two mutually exclusive ways of acquiring wealth.

Economic means: production and exchange.

Political means: seizure of another's goods or services by the use of force and violence.

Impuestos

Three ways of raising government revenue:

Taxation

Public borrowing or debt issue

Money creation

Impuesto neutral: aquel impuesto que no cambia la conducta.

The principles of taxation can be divided into two general categories:

Positive principles of taxation: analyze who bears the burden of taxes and what other economic effects can be expected to result from the imposition of taxes.

Normative principles of taxation: how tax policy can be used to design as desirable a tax system as possible.

Unit tax: a tax charged per unit of a good exchanged.

Ad valorem taxes: based on the dollar value of the goods sold.

Retail sales tax: taxes calculated as a percentage of retail sales, a type of ad valorem tax.

Excise tax: taxes placed on particular types of goods, can be either unit or ad valorem.

Tax incidence: the ultimate burden of the tax, after shifting has taken place.

The more elastic a supply or demand schedule is, the greater the proportion of the tax that can be shifted to the other side of the market.

Welfare cost of taxation or excess burden or deadweight loss: all the exchanges that could be made, but are not made, because of a tax.

Arises because the taxpayers not only must pay the tax to the government, but also will alter their behavior in response to a tax to avoid it to some degree.

For a tax to have no excess burden, there must be no substitution effect.

Lump sum tax: a tax that completely eliminates the excess burden of taxation. Based on a fixed amount.

Ramsey's rule states that to minimize the excess burden of taxation, taxes should be placed on goods in inverse proportion to the elasticity of demand for the goods.

Costs associated with the tax system:

Compliance costs: the costs imposed on taxpayers to comply with the tax laws, such as collecting and keeping records.

Administrative costs: assumed by the government to collect taxes.

Political cost: assumed by the taxpayers and the government as a result of taxpayers trying to influence tax laws.

Earmarked taxes: taxes whose revenues are designated to a particular spending activity.

General fund financing: the tax revenues are placed in the general fund, from which government programs are financed. The alternative to earmarking.

Benefit principle: states that the people who benefit from the government's expenditures should be the ones who pay for them.

Ability-to-pay principle: states that individuals should pay taxes in proportion to their ability to pay.

Horizontal equity: individuals with an equal ability to pay should pay equal amounts of taxes (the same income).

Vertical equity: individuals with a greater ability to pay should pay more taxes (more income).

Tax systems can be classified according to the proportion of income that an individual taxpayer would pay in taxes as the taxpayer's income changes.

Proportional tax: a tax that is the same percentage of a taxpayer's income no matter what the level of income.

Progressive tax: a tax that is a larger percentage of the taxpayer's income as income rises.

Tax the rich sólo lastima a los pobres porque

Sube la barrera de rentabilidad necesaria para invertir

Y se confiscan los recursos no consumidos.

Regressive tax: a tax that is a smaller percentage of the taxpayer's income as income lowers.

Sumptuary tax or sin tax: taxes designed to discourage the consumption of the taxed good.

Revente-neutral carbon tax: el gobierno "devuelve" parte del impuesto sobre la contaminación

Equity and efficiency are important aspects of taxation.

A commodity tax is a tax on goods.

The economic incidence is not the same as the legal incidence.

Tax graph using a tax wedge:

Missing: El IVA y otras consideraciones a los impuestos - Fritz Thomas

Laffer curve: belief that tax cuts generate additional revenue.

Government won't create any revenue if tax rates are zero.

Neither will it create revenue if tax rates are 100% because there will be more incentive to avoid taxes.

A revenue-maximizing tax rate exists.

Gasto público y deuda

What is folly in the conduct of a private family may be prudence in the conduct of the affairs of a great nation.

Armed with the Keynesian message, politicians can spend and spend without the apparent necessity to tax.

Classical fiscal practice, or the old-time fiscal religion was formed by notions of fiscal responsibility.

Deficits emerged primarily during periods of war; budgets normally produced surpluses during peacetime, and these surpluses were used to retire the debt created during war emergencies.

It held a theory of debt finance that said that resort to debt issue provided a means of reducing present burdens in exchange for the obligation to take on greater burdens in the future.

With taxation, the cost is placed on the current beneficiaries.

With borrowing, the cost is postponed until later periods, when interest payments come due.

Then came the Keynesian fiscal practice, which placed deficit financing in a central role.

Fiscal constitution: rules guiding fiscal choices.

Classical economists give us three reasons why unemployment exists

Workers are temporarily unemployed when moving jobs.

Individuals might elect not to work.

Wages are higher than employers can afford.

Keynes thought the real problem lay in lack of demand.

If market mechanisms were unable to stimulate economic recovery, it was the job of the state to step in to create demand, by running a very large budget deficit in order to create jobs.

Multiplier effect

By creating jobs, governments would save money that would have been spent on unemployment benefits.

The increase in the number of employed people would create additional spending power and therefore boost the economy and tax receipts.

Increased tax receipts would pay off the initial debt.

Public Choice

Public choice theory: the application of economic methods to the study of political processes.

Government is a complex social machine inhabited by people who are the same as everyone else, and in which periodic elections play a central role.

What policy is likely to emerge from real-world democratic politics, and how does that compare to market alternatives?

Democracy is the worst system of government, except for all the rest.

One of the most common refrains from people who advocate for an expanded role of government in society is the notion of market failure.

There are certain areas where market forces do not operate effectively and therefore we must have government corrective action.

The argument of market failure is wrong because it's based on a bifurcated view of human action.

We know that people in markets are driven by self-interest, but we must also accept that people in government are driven by the same thing.

Knowt

Knowt