AP Macroeconomics

Unit 4: Financial Sector

Gourishankar Residential English Medium School

financial assets

liquidity

stocks

bonds

loans

bank deposits

nominal v/s real interest rates

types of money

supply of money

monetary base

fractional reserve banking

money creation

money multiplier

the money market

money market equillibrium

investment demand

monetary policy

loanable funds market

Unit 4: Financial Sector

4.1 Financial Assets

Financial Assets

The firm invests in a physical asset if the expected rate of return is at least as high as the real interest rate.

Financial investments yield a rate of return.

Key Terms:

Liquidity:

The ease with which a financial asset can be assessed and converted into cash.

Most liquid asset: Cash

Rate of return:

Net gain/loss of an investment over a specified period.

Preference is given to investments with a higher rate of return.

Risk:

The chance that an outcome or an investment’s actual gains differ from the expected outcome.

Stocks

Stock - A certificate that represents a claim to, or share of the ownership of a firm.

Equity financing - The firm’s method of raising funds for investment by issuing shares of stock to the public.

Bonds

Bond - A certificate of indebtedness from the issuer to the bondholder.

When a firm wants to raise money by taking a loan (borrowing money), it can issue corporate bonds that promise the bondholders the principle amount plus interest with repayment on a specific date. This is a form of debt financing.

Bonds can be bought and sold in a secondary market.

Debt financing - A firm’s way of raising investment funds by issuing bonds to the public.

Loans

The process of borrowing money and repaying it with interest.

example: credit cards

Bank Deposits

The money in your bank account.

Checking account or Demand deposits.

Money can be used whenever you want.

No interest.

example: debit cards

Bonds and Interest Rates

Bond prices and interest rates have an inverse relationship.

People prefer higher interest rates as they are given a greater rate of return.

Bonds pay fixed interest rates, as interest rates fall, the price rises.

If interest rates are on a rise, consumers are less interested in fixed interest rates of bonds, and the price falls.

4.2 Nominal v/s Real Interest Rates

Interest Rates

It includes two types of interest rates:

Nominal interest rate

Real interest rate

Equation:

Nominal interest rate = real interest rate + inflation

Real interest rate = nominal interest rate - inflation

Nominal Interest Rates | Real Interest Rates |

|---|---|

Not adjusted for inflation | Adjusted for inflation |

Measures the price of money and reflects current rates and market conditions | Measures purchasing power and shows how much you or a lender actually earned from interest paid |

Predictions

When nominal interest rates are higher than inflation rates, real interest rates are positive.

When nominal interest rates are lower than inflation rates, real interest rates are negative.

Nominal and real interest rates are important because they play different roles in your financial decisions.

If a real interest rate is positive, it means you have more purchasing power.

If the real interest rate is negative, then it means you have less purchasing power—at least when it comes to investments and earning interest on your money.

When it comes to borrowing money, negative real interest rates may influence borrowers, such as potential homeowners who see low-interest rates as an attractive time to buy, thus pushing up the demand for houses and their prices.

At the same time, businesses may be more inclined to borrow money to finance projects or acquisitions. On the other hand, conservative investors may face difficult choices as to where to put their money.

4.3 Definition, Measurement, and Functions of Money

Types of Money

Fiat Money: The paper and coin money used today. Since it has no intrinsic value, it is backed by the public’s trust that the government maintains its value.

Commodity Money: It is something that performs the function of money and has an alternative, non-monetary use.

examples: tobacco, silver, gold, oil, precious metals, etc.

Functions of Money

Functions of money - Money serves three functions. It serves as a medium of exchange, a unit of account, and a store of value.

Medium of exchange - It follows the logic that your labor hours turn into money, the money turns into apples, the farmer then exchanges the money for an orchard’s apple crop, and so on.

Unit of account - Units of currency measure the relative worth of goods and services. In a barter economy, the value of a pound of cheese would equal a dozen eggs. With money, the value of goods is measured in a monetary unit.

Store of value - Money is a relatively good way to store value, when there’s no inflation because it keeps its value. A cheese maker would have to sell the cheese before it gets moldy to earn a profit.

Supply of Money

Money supply - The quantity of money in circulation as measured by the Federal Reserve (the Fed) as M1 and M2. It is assumed to be fixed at a given point in time.

Liquidity - A measure of how easily an asset can be converted to cash. The more easily it can be converted to cash, the more liquid the asset is.

M1 - The most liquid of money definitions and the basis for all other more broadly defined measures of money. M1 = Cash + Coins + Checking deposits + Traveler’s checks.

M2 - It is less liquid than M1. M2 = M1 + Savings deposits + Small time deposits + Money market deposits + Money market mutual funds.

At any point in time, the supply of money is constant, meaning that the current money supply curve is vertical.

Monetary Base (MO/MB)

Money circulation or in the bank reserves.

Physical paper and coin currency used by the economy.

Not included in the money supply.

Details the final settlement for the transaction.

example: if you use cash to pay off the debt it’s a monetary base whereas using a credit card would not be a monetary base.

Monetary base = currency in circulation + bank reserves

4.4 Banking and the Expansion of the Money Supply

Fractional Reserve Banking

Fractional reserve banking - A system in which only a fraction of the total money deposited in banks is held in reserve as currency.

Reserve ratio (rr) - The fraction of a bank’s total deposits that are kept on reserve.

Money Creation

Reserve ratio (rr) = Cash reserves/Total deposits.

Reserve requirement - Regulation set by the Fed that states the minimum reserve ratio for banks.

Excess reserves - The cash reserves held by banks above and beyond the minimum reserve requirement.

T-account or balance sheet - A tabular way to show the assets and liabilities of a bank. Total assets must equal liabilities.

Asset of a bank - Anything owned by the bank or owed to the bank is an asset of the bank.

Reserve cash is an asset and so are loans made to citizens.

Liability of a bank - Anything owned by depositors or lenders is a liability to the bank.

Checking deposits of citizens or loans made to the bank are liabilities to the bank.

Ex. → Katie takes $1,000 from under her mattress, deposits it at ECB, and opens a checking account. If the Federal Reserve tells the ECB that it must hold 10 percent of all deposits in reserve, then the ECB must comply and keep no less than $100 of Katie’s deposit as “required” reserves. The remaining $900 of the deposit are excess reserves and can be kept on reserve in the bank or lent to another person.

The Money Multiplier

Money multiplier - This measures the maximum amount of new checking deposits that can be created by a single dollar of excess reserves. M = 1/(reserve ratio) = 1/rr. The money multiplier is smaller if:

At any stage the banks keep more than the required dollars in reserve

At any stage borrowers do not redeposit funds into the bank and keep some as cash

Customers are not willing to borrow.

An initial amount of excess reserves multiplies by a factor of M, at most.

4.5 The Money Market

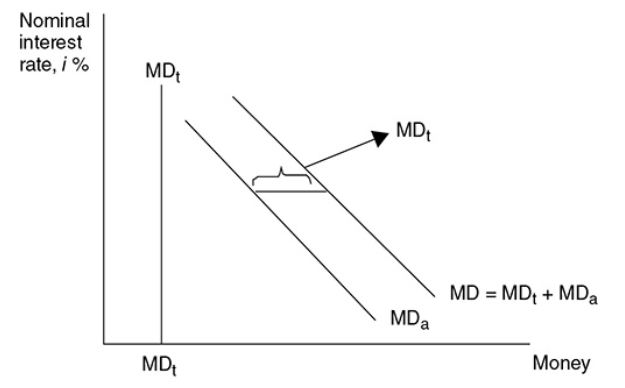

Demand for Money

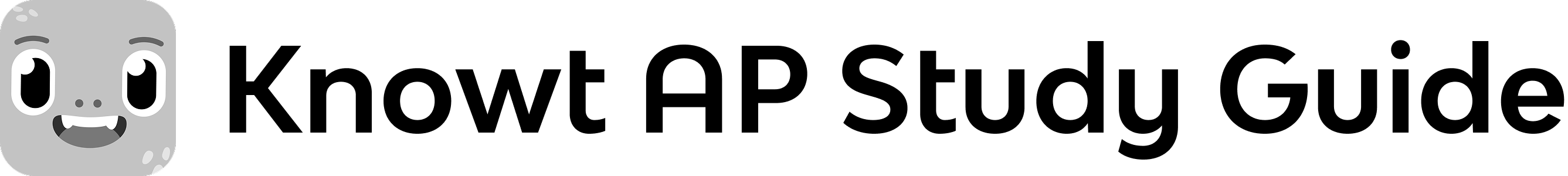

Transaction demand - The amount of money held in order to transactions. This is not related to the interest rate, but it increases as nominal GDP increases.

Ex. → If nominal GDP is $1,000 and each dollar is spent an average of four times each year, money demand for transactions would be $1,000/4 = $250. If nominal GDP increases to $1,200, money demand for transactions increases to $1,200/4 = $300.

Asset demand - The amount of money demanded as an asset. As nominal interest rates rise, the opportunity cost of holding money begins to rise and you are more likely to lessen your asset demand for money.

Total demand - Plotted against the nominal interest rate, the transaction demand for money is a constant MDt. Adding this constant needed to make transactions to a downward-sloping asset demand for money (MDa) creates the total money demand curve.

Money demand - The demand for money is the sum of money demanded transactions and money demanded as an asset. It is inversely related to the nominal interest rate.

Shifters of the Demand for Money Curve

Price Level

Real GDP

Transaction Costs

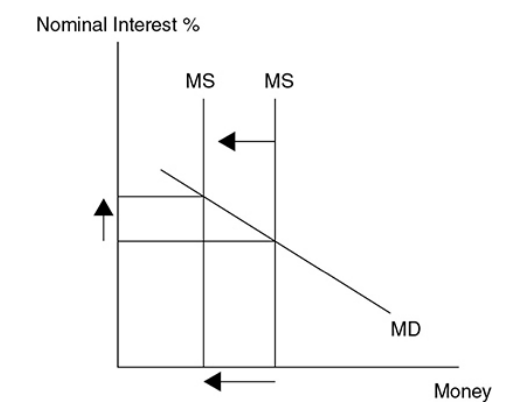

The Supply of Money

The monetary base of a nation is determined by the country’s central bank (FED).

Money supply is independent of the nominal interest rate.

The Federal Reserve has three general tools of monetary policy that they control:

Engaging in open market operations

Changing the discount rate

Changing the required reserve ratio

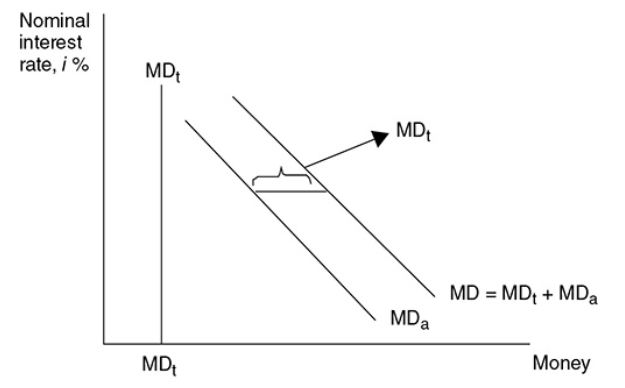

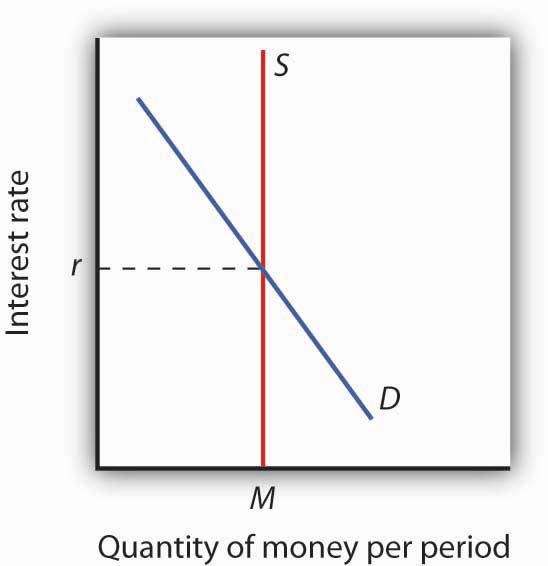

Money Market Equilibrium

The money market is the interaction among institutions through which money is supplied to individuals, firms, and other institutions that demand money.

Money market equilibrium occurs at the interest rate at which the quantity of money demanded is equal to the quantity of money supplied.

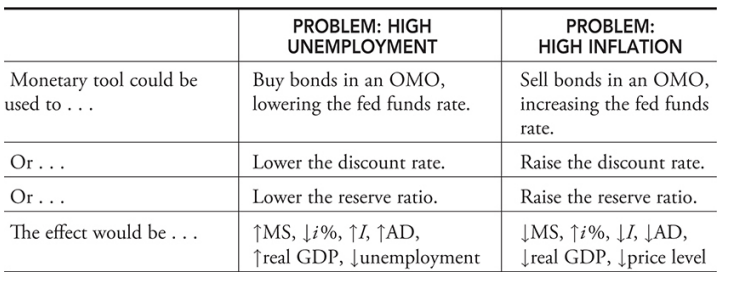

4.6 Monetary Policy

Types of Monetary Policy

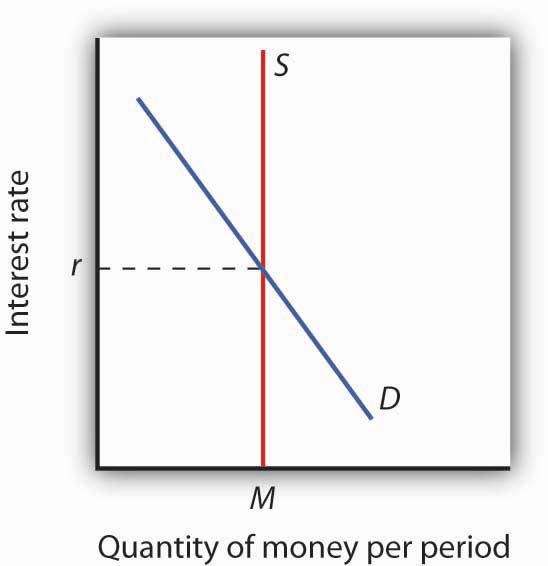

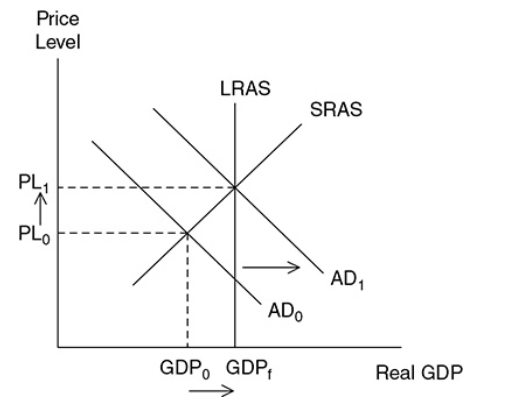

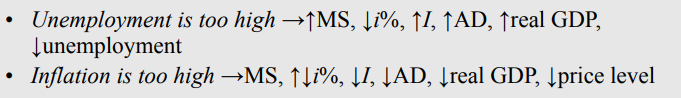

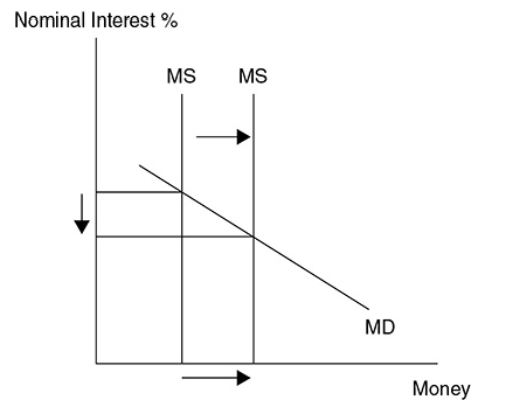

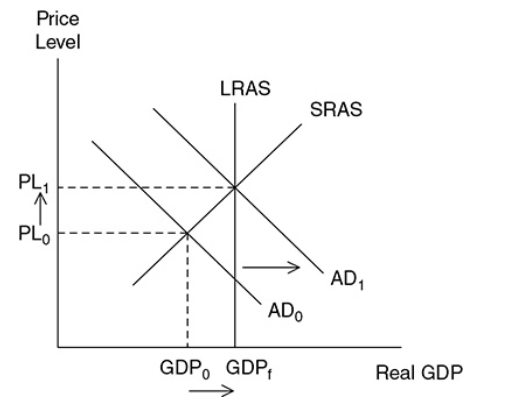

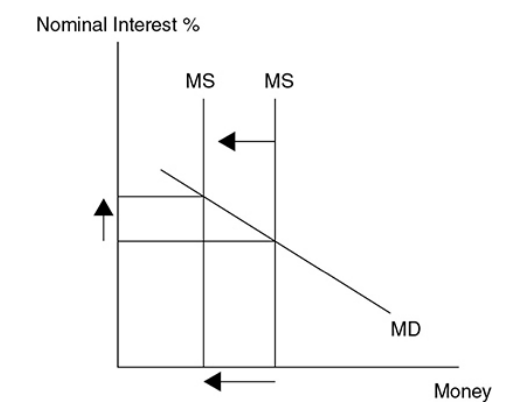

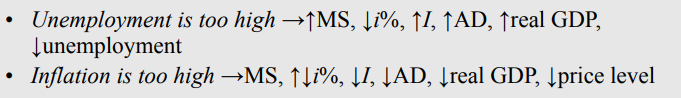

Expansionary monetary policy - Designed to fix a recession by lowering interest rates to increase aggregate demand, lower the unemployment rate, and increase real GDP, which may increase the price level.

By increasing the money supply, the interest rate gets lower. Lower interest increases private consumption and investments, which shifts the AD curve to the right.

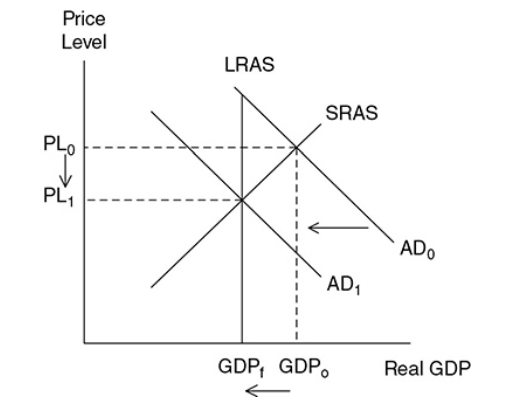

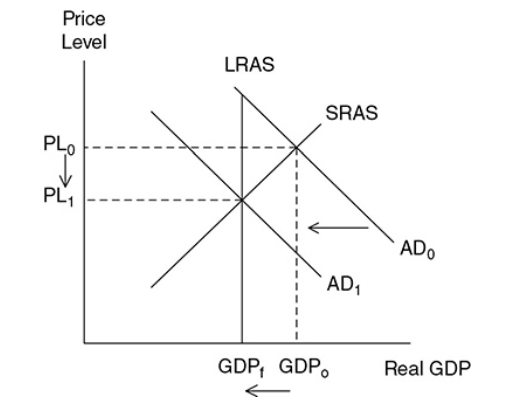

Contractionary monetary policy - Designed to avoid inflation by increasing interest rates to decrease aggregate demand, which lowers the price level and decreases real GDP back to full employment.

When the money supply is decreased, the interest rate increases causing a decrease in private consumption and investment shifting AD to the left.

Tools of Monetary Policy

Open market operations (OMOs) - A traditional tool of monetary policy, it involves the Fed’s buying (or selling) of securities from (to) commercial banks and the general public.

When securities (Treasury bonds) are bought from the banks by the Fed, the banks receive excess cash and the Fed gets bonds. When banks have excess reserves, the money supply increases and the interest rate falls.

When Fed buys, BB = BB → Buying Bonds = Bigger Bucks

The opposite happens when the banks buy securities from the Fed. The banks get the bonds and their excess reserves would fall causing the money supply to decrease increasing interest rates.

When Fed sells, SB = SB → Selling Bonds = Smaller Bucks

Federal funds rate - The interest rate paid on short-term loans made from one bank to another. When this rate is a target for an OMO, bonds are bought or sold accordingly until the interest rate target has been met.

If the FOMC wants to lower interest rates, it buys bonds.

If the FOMC wants to rise interest rates, it sells bonds.

Discount rate - The interest rate commercial banks pay on short-term loans from the Fed.

Lowering the discount rate (or federal funds rate) increases excess reserves in banks and expands the money supply.

Raising the discount rate (or federal funds rate) decreases excess reserves in commercial banks and contracts the money supply.

Required Reserve Ratio -

Lowering the reserve ratio increases excess reserves in commercial banks and expands the money supply.

Increasing the reserve ratio decreases excess reserves in commercial banks and contracts the money supply.

4.7 The Loanable Funds Market

The demand of Loanable Funds

It is the quantity of credit wanted and needed at every real interest rate by borrowers in an economy.

The relationship between real interest rates and the number of loanable funds demanded is inverse.

Shifters for the demand of Loanable Funds

F = Foreign Demand for domestic currency

A = All Borrowing, Lending, and Credit

D = Deficit Spending

E = Expectations for the Future

Supply of Loanable Funds

It is the quantity of credit provided at every real interest rates by banks and other lenders in an economy.

The relationship between real interest rates and the quantity of loanable funds number is direct, or positive.

Determinants for the Supply of Loanable Funds

S = Savings rate

E = Expectations for the Future

L = Lending at the Discount Window

F = Foreign Purchases of Domestic Assets

Loanable Funds Market

When borrowers and lenders come together, we refer to this as the loanable funds market.

Conclusion

When the demand for loanable funds increases then the real interest rate will increase.

When the demand for loanable funds decreases then the real interest rate will decrease.

When the supply of loanable funds increases then the real interest rate will decrease.

When the supply of loanable funds decreases then the real interest rate will increase

Unit 4: Financial Sector

4.1 Financial Assets

Financial Assets

The firm invests in a physical asset if the expected rate of return is at least as high as the real interest rate.

Financial investments yield a rate of return.

Key Terms:

Liquidity:

The ease with which a financial asset can be assessed and converted into cash.

Most liquid asset: Cash

Rate of return:

Net gain/loss of an investment over a specified period.

Preference is given to investments with a higher rate of return.

Risk:

The chance that an outcome or an investment’s actual gains differ from the expected outcome.

Stocks

Stock - A certificate that represents a claim to, or share of the ownership of a firm.

Equity financing - The firm’s method of raising funds for investment by issuing shares of stock to the public.

Bonds

Bond - A certificate of indebtedness from the issuer to the bondholder.

When a firm wants to raise money by taking a loan (borrowing money), it can issue corporate bonds that promise the bondholders the principle amount plus interest with repayment on a specific date. This is a form of debt financing.

Bonds can be bought and sold in a secondary market.

Debt financing - A firm’s way of raising investment funds by issuing bonds to the public.

Loans

The process of borrowing money and repaying it with interest.

example: credit cards

Bank Deposits

The money in your bank account.

Checking account or Demand deposits.

Money can be used whenever you want.

No interest.

example: debit cards

Bonds and Interest Rates

Bond prices and interest rates have an inverse relationship.

People prefer higher interest rates as they are given a greater rate of return.

Bonds pay fixed interest rates, as interest rates fall, the price rises.

If interest rates are on a rise, consumers are less interested in fixed interest rates of bonds, and the price falls.

4.2 Nominal v/s Real Interest Rates

Interest Rates

It includes two types of interest rates:

Nominal interest rate

Real interest rate

Equation:

Nominal interest rate = real interest rate + inflation

Real interest rate = nominal interest rate - inflation

Nominal Interest Rates | Real Interest Rates |

|---|---|

Not adjusted for inflation | Adjusted for inflation |

Measures the price of money and reflects current rates and market conditions | Measures purchasing power and shows how much you or a lender actually earned from interest paid |

Predictions

When nominal interest rates are higher than inflation rates, real interest rates are positive.

When nominal interest rates are lower than inflation rates, real interest rates are negative.

Nominal and real interest rates are important because they play different roles in your financial decisions.

If a real interest rate is positive, it means you have more purchasing power.

If the real interest rate is negative, then it means you have less purchasing power—at least when it comes to investments and earning interest on your money.

When it comes to borrowing money, negative real interest rates may influence borrowers, such as potential homeowners who see low-interest rates as an attractive time to buy, thus pushing up the demand for houses and their prices.

At the same time, businesses may be more inclined to borrow money to finance projects or acquisitions. On the other hand, conservative investors may face difficult choices as to where to put their money.

4.3 Definition, Measurement, and Functions of Money

Types of Money

Fiat Money: The paper and coin money used today. Since it has no intrinsic value, it is backed by the public’s trust that the government maintains its value.

Commodity Money: It is something that performs the function of money and has an alternative, non-monetary use.

examples: tobacco, silver, gold, oil, precious metals, etc.

Functions of Money

Functions of money - Money serves three functions. It serves as a medium of exchange, a unit of account, and a store of value.

Medium of exchange - It follows the logic that your labor hours turn into money, the money turns into apples, the farmer then exchanges the money for an orchard’s apple crop, and so on.

Unit of account - Units of currency measure the relative worth of goods and services. In a barter economy, the value of a pound of cheese would equal a dozen eggs. With money, the value of goods is measured in a monetary unit.

Store of value - Money is a relatively good way to store value, when there’s no inflation because it keeps its value. A cheese maker would have to sell the cheese before it gets moldy to earn a profit.

Supply of Money

Money supply - The quantity of money in circulation as measured by the Federal Reserve (the Fed) as M1 and M2. It is assumed to be fixed at a given point in time.

Liquidity - A measure of how easily an asset can be converted to cash. The more easily it can be converted to cash, the more liquid the asset is.

M1 - The most liquid of money definitions and the basis for all other more broadly defined measures of money. M1 = Cash + Coins + Checking deposits + Traveler’s checks.

M2 - It is less liquid than M1. M2 = M1 + Savings deposits + Small time deposits + Money market deposits + Money market mutual funds.

At any point in time, the supply of money is constant, meaning that the current money supply curve is vertical.

Monetary Base (MO/MB)

Money circulation or in the bank reserves.

Physical paper and coin currency used by the economy.

Not included in the money supply.

Details the final settlement for the transaction.

example: if you use cash to pay off the debt it’s a monetary base whereas using a credit card would not be a monetary base.

Monetary base = currency in circulation + bank reserves

4.4 Banking and the Expansion of the Money Supply

Fractional Reserve Banking

Fractional reserve banking - A system in which only a fraction of the total money deposited in banks is held in reserve as currency.

Reserve ratio (rr) - The fraction of a bank’s total deposits that are kept on reserve.

Money Creation

Reserve ratio (rr) = Cash reserves/Total deposits.

Reserve requirement - Regulation set by the Fed that states the minimum reserve ratio for banks.

Excess reserves - The cash reserves held by banks above and beyond the minimum reserve requirement.

T-account or balance sheet - A tabular way to show the assets and liabilities of a bank. Total assets must equal liabilities.

Asset of a bank - Anything owned by the bank or owed to the bank is an asset of the bank.

Reserve cash is an asset and so are loans made to citizens.

Liability of a bank - Anything owned by depositors or lenders is a liability to the bank.

Checking deposits of citizens or loans made to the bank are liabilities to the bank.

Ex. → Katie takes $1,000 from under her mattress, deposits it at ECB, and opens a checking account. If the Federal Reserve tells the ECB that it must hold 10 percent of all deposits in reserve, then the ECB must comply and keep no less than $100 of Katie’s deposit as “required” reserves. The remaining $900 of the deposit are excess reserves and can be kept on reserve in the bank or lent to another person.

The Money Multiplier

Money multiplier - This measures the maximum amount of new checking deposits that can be created by a single dollar of excess reserves. M = 1/(reserve ratio) = 1/rr. The money multiplier is smaller if:

At any stage the banks keep more than the required dollars in reserve

At any stage borrowers do not redeposit funds into the bank and keep some as cash

Customers are not willing to borrow.

An initial amount of excess reserves multiplies by a factor of M, at most.

4.5 The Money Market

Demand for Money

Transaction demand - The amount of money held in order to transactions. This is not related to the interest rate, but it increases as nominal GDP increases.

Ex. → If nominal GDP is $1,000 and each dollar is spent an average of four times each year, money demand for transactions would be $1,000/4 = $250. If nominal GDP increases to $1,200, money demand for transactions increases to $1,200/4 = $300.

Asset demand - The amount of money demanded as an asset. As nominal interest rates rise, the opportunity cost of holding money begins to rise and you are more likely to lessen your asset demand for money.

Total demand - Plotted against the nominal interest rate, the transaction demand for money is a constant MDt. Adding this constant needed to make transactions to a downward-sloping asset demand for money (MDa) creates the total money demand curve.

Money demand - The demand for money is the sum of money demanded transactions and money demanded as an asset. It is inversely related to the nominal interest rate.

Shifters of the Demand for Money Curve

Price Level

Real GDP

Transaction Costs

The Supply of Money

The monetary base of a nation is determined by the country’s central bank (FED).

Money supply is independent of the nominal interest rate.

The Federal Reserve has three general tools of monetary policy that they control:

Engaging in open market operations

Changing the discount rate

Changing the required reserve ratio

Money Market Equilibrium

The money market is the interaction among institutions through which money is supplied to individuals, firms, and other institutions that demand money.

Money market equilibrium occurs at the interest rate at which the quantity of money demanded is equal to the quantity of money supplied.

4.6 Monetary Policy

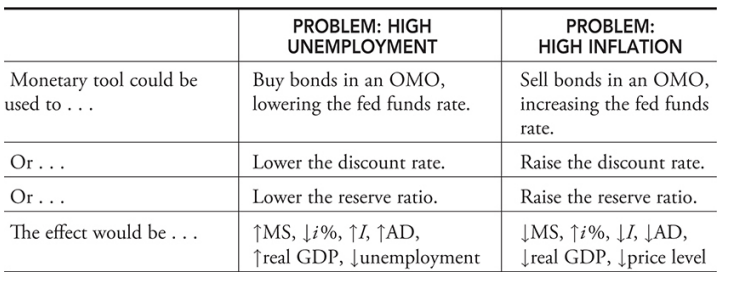

Types of Monetary Policy

Expansionary monetary policy - Designed to fix a recession by lowering interest rates to increase aggregate demand, lower the unemployment rate, and increase real GDP, which may increase the price level.

By increasing the money supply, the interest rate gets lower. Lower interest increases private consumption and investments, which shifts the AD curve to the right.

Contractionary monetary policy - Designed to avoid inflation by increasing interest rates to decrease aggregate demand, which lowers the price level and decreases real GDP back to full employment.

When the money supply is decreased, the interest rate increases causing a decrease in private consumption and investment shifting AD to the left.

Tools of Monetary Policy

Open market operations (OMOs) - A traditional tool of monetary policy, it involves the Fed’s buying (or selling) of securities from (to) commercial banks and the general public.

When securities (Treasury bonds) are bought from the banks by the Fed, the banks receive excess cash and the Fed gets bonds. When banks have excess reserves, the money supply increases and the interest rate falls.

When Fed buys, BB = BB → Buying Bonds = Bigger Bucks

The opposite happens when the banks buy securities from the Fed. The banks get the bonds and their excess reserves would fall causing the money supply to decrease increasing interest rates.

When Fed sells, SB = SB → Selling Bonds = Smaller Bucks

Federal funds rate - The interest rate paid on short-term loans made from one bank to another. When this rate is a target for an OMO, bonds are bought or sold accordingly until the interest rate target has been met.

If the FOMC wants to lower interest rates, it buys bonds.

If the FOMC wants to rise interest rates, it sells bonds.

Discount rate - The interest rate commercial banks pay on short-term loans from the Fed.

Lowering the discount rate (or federal funds rate) increases excess reserves in banks and expands the money supply.

Raising the discount rate (or federal funds rate) decreases excess reserves in commercial banks and contracts the money supply.

Required Reserve Ratio -

Lowering the reserve ratio increases excess reserves in commercial banks and expands the money supply.

Increasing the reserve ratio decreases excess reserves in commercial banks and contracts the money supply.

4.7 The Loanable Funds Market

The demand of Loanable Funds

It is the quantity of credit wanted and needed at every real interest rate by borrowers in an economy.

The relationship between real interest rates and the number of loanable funds demanded is inverse.

Shifters for the demand of Loanable Funds

F = Foreign Demand for domestic currency

A = All Borrowing, Lending, and Credit

D = Deficit Spending

E = Expectations for the Future

Supply of Loanable Funds

It is the quantity of credit provided at every real interest rates by banks and other lenders in an economy.

The relationship between real interest rates and the quantity of loanable funds number is direct, or positive.

Determinants for the Supply of Loanable Funds

S = Savings rate

E = Expectations for the Future

L = Lending at the Discount Window

F = Foreign Purchases of Domestic Assets

Loanable Funds Market

When borrowers and lenders come together, we refer to this as the loanable funds market.

Conclusion

When the demand for loanable funds increases then the real interest rate will increase.

When the demand for loanable funds decreases then the real interest rate will decrease.

When the supply of loanable funds increases then the real interest rate will decrease.

When the supply of loanable funds decreases then the real interest rate will increase

Knowt

Knowt