Econ HL (Semester 1 Term 1)

1.1 Basis of Economics

Micro-economics

Smaller discrete economic agents (ex. consumers, & producer in individual market (or businesses)).

Observes the choice they make in respond to change in a dynamic world → to improve economic well-being or efficiency.

How government intervention affect producer & consumers.

What to produce, How to produce, and whom to produce it to.

Macro-economics

Factors that affect the economy (as a whole).

Economic growth, and how it impacted economic well being.

Inflation and unemployment.

Unemployment low = Inflation rise. (When a lot of people are working they have more money which would allow them to buy the things they want/ need, thus increasing the demand (inflation will follow soon)).

Unemployment high = Inflation falls.

Role of policies.

Macroeconomic policy aims to provide a stable economic environment that is conducive to fostering strong and sustainable economic growth.

Key pillars of macro-economics: Fiscal policy, monetary policy, and exchange rate policy.

Fiscal Policy (controlled by government)→

Operates through changes in the level and composition of government spending, the level and types of taxes levied and the level and form of government borrowing.

Monetary Policy →

Decisions are implemented by changing the cash rate (the interest rate on overnight loans in the money market). The cash rate is determined in the money market by the forces of supply and demand for overnight funds.

Exchange rate policy →

Concerned with how the value of the domestic currency, relative to other currencies, is determined.

Dsitribution of income.

It is a measure of how income is distributed amongst individuals and households in a society. An equal distribution of income is associated with lower poverty rates in an economy.

Key Concepts: WISE ChoICES

Well-being

Interdependence → Greater level of interaction, greater the degree of interdependence. Decisions by certain economic actors will generate various economic consequences for other actors. Consideration is crucial when conducting economic analysis.

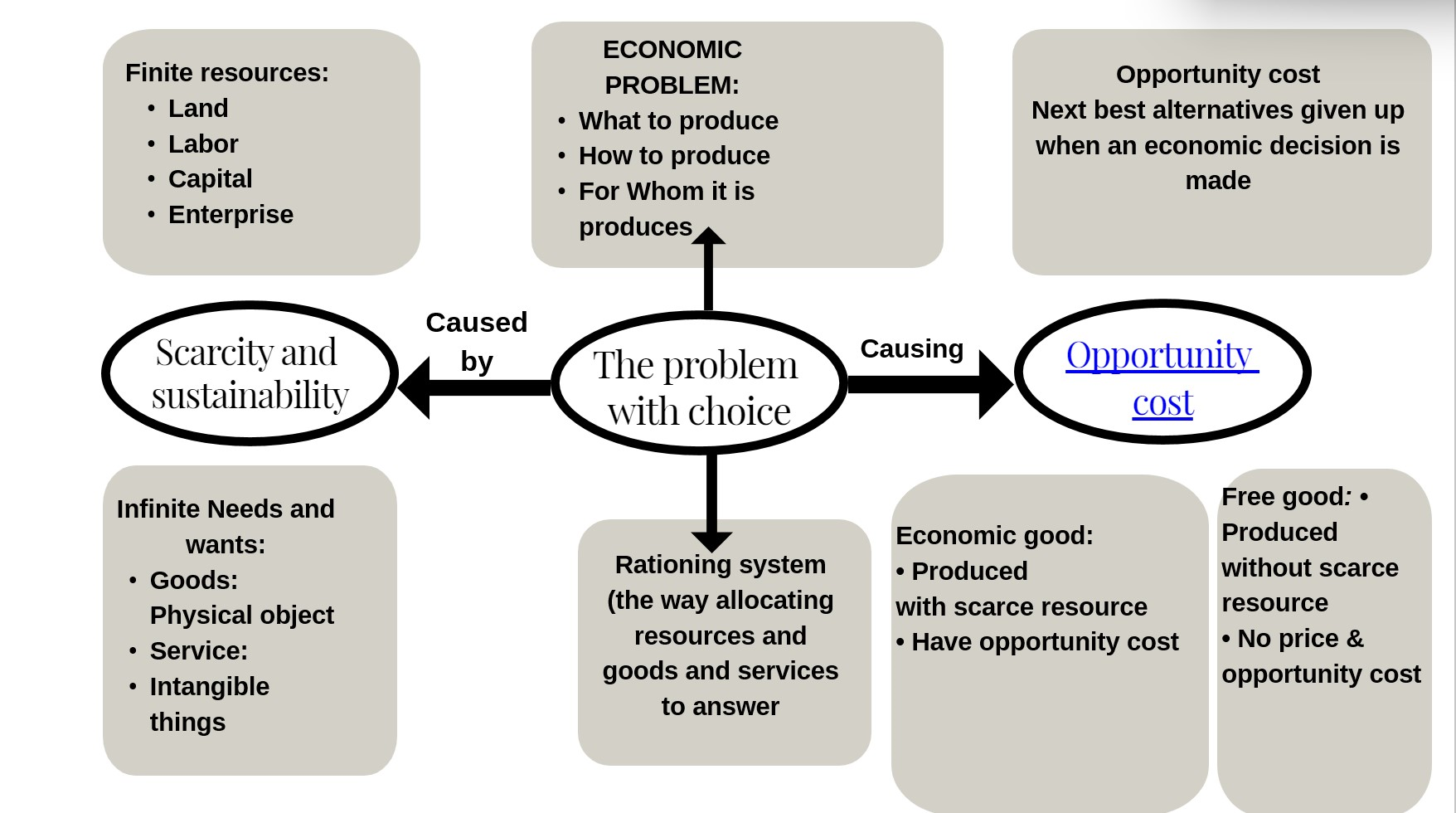

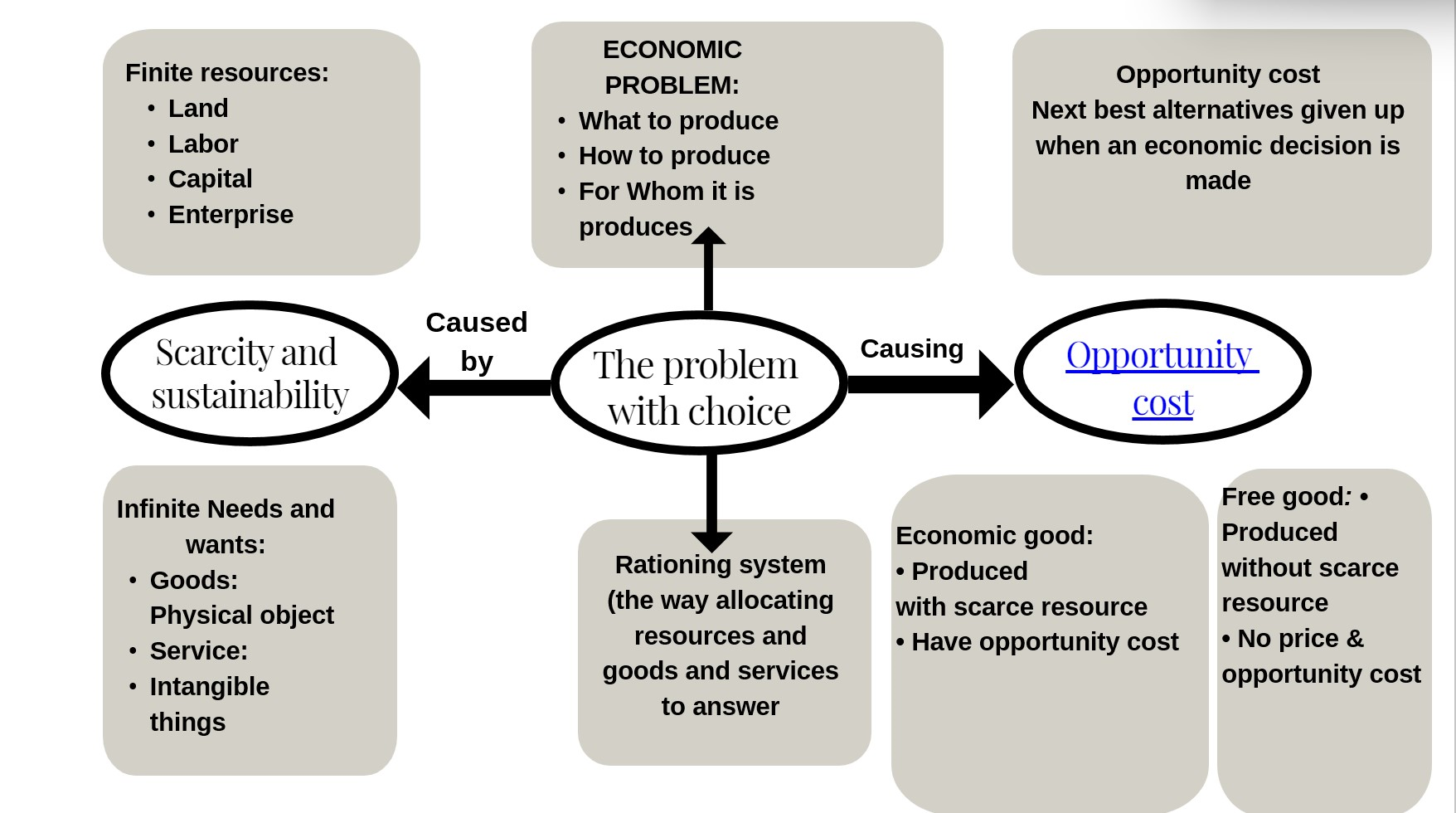

Scarcity → Limited resources, but unlimited demand. Economics are defined as the study of human behavior as a relationship between ends and scarce resources which have alternative uses.

Efficiency → Determined by ratio of useful output to total input. Allocative efficiency - Use the most of scarce resources to produce goods and services that are optimum for society, thus minimizing resource waste.

Choice → Not all needs/wants can be met, thus causing producers to have choices between competing alternatives, and idea of opportunity cost. There are consequences of these choices (present and future).

Intervention → Refers to government involvement in the workings of markets.

Change → Economic world is constantly in flux, and economists must be aware of it and adapt their thinking accordingly. In economic theory, economics focuses not on the level of the variables it invesitgates but on their change from one situation to another. Empirically, the world is always sibject to continuous and profound change at institutional, structural, technological, economic, and social levels.

Equity → Refers to the concept of fairness. Inequity: refer to inequality which may apply to the distribution of income, wealth, or economic opportunity.

Sustainability → Refers to the ability of the present generation to meet its needs without compromising the ability of future generations to meet its own needs.

Opportunity Cost

The value of the next best alternative is sacrificed.

Factors of Production (LLEC)

Land

Natural resources used for production (Ex. crude oil, coal, and water).

Labor

Human resources needed during production process (Ex. Accountant, barista, chef, & etc).

Capital

Manufactured products used in production process (Ex. machinery, tools, equipment, and vehicles).

Entrepreneurship/ Enterprise

Refers to the skills, creativity, and risk taking ability that a business person requires to successfully combine and manage the other 3 factors of production.

Rationing System (Market vs Government Intervention)

Planned Economy

What is being Produced?

Government decides what goods to produce, based on what they think society needs.

How to produce?

Decide how all resources are to be used and where people

For Whom?

Free Market Economy

What is being Produced?

How to produce?

For Whom?

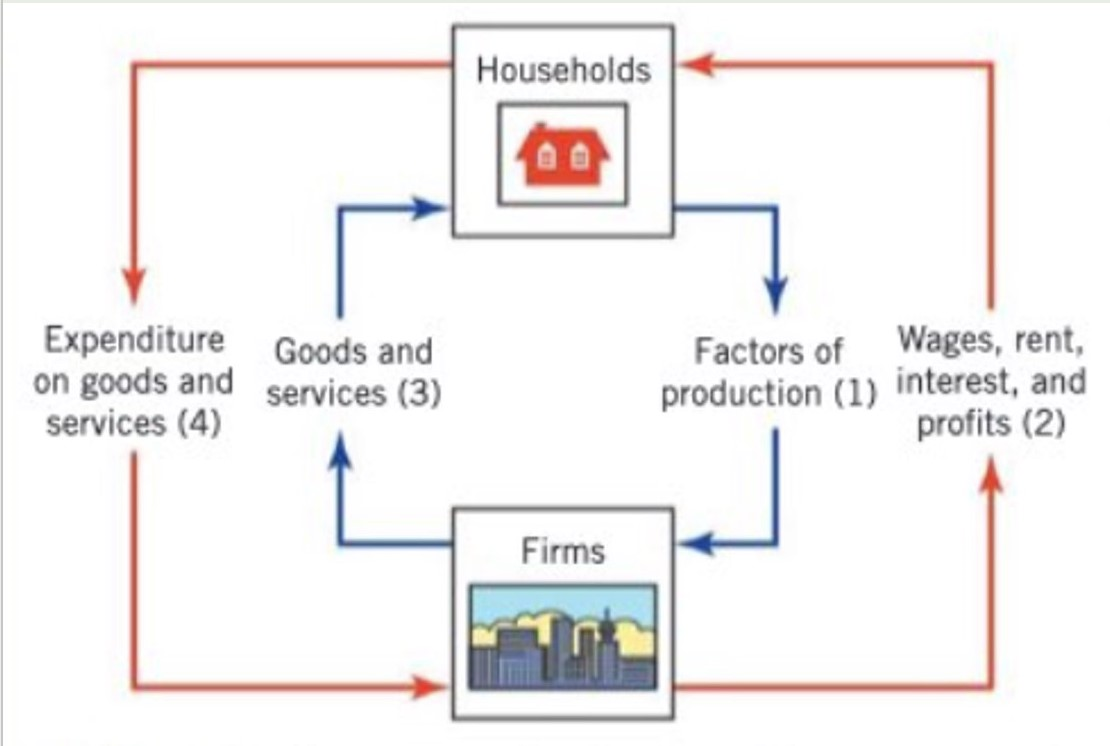

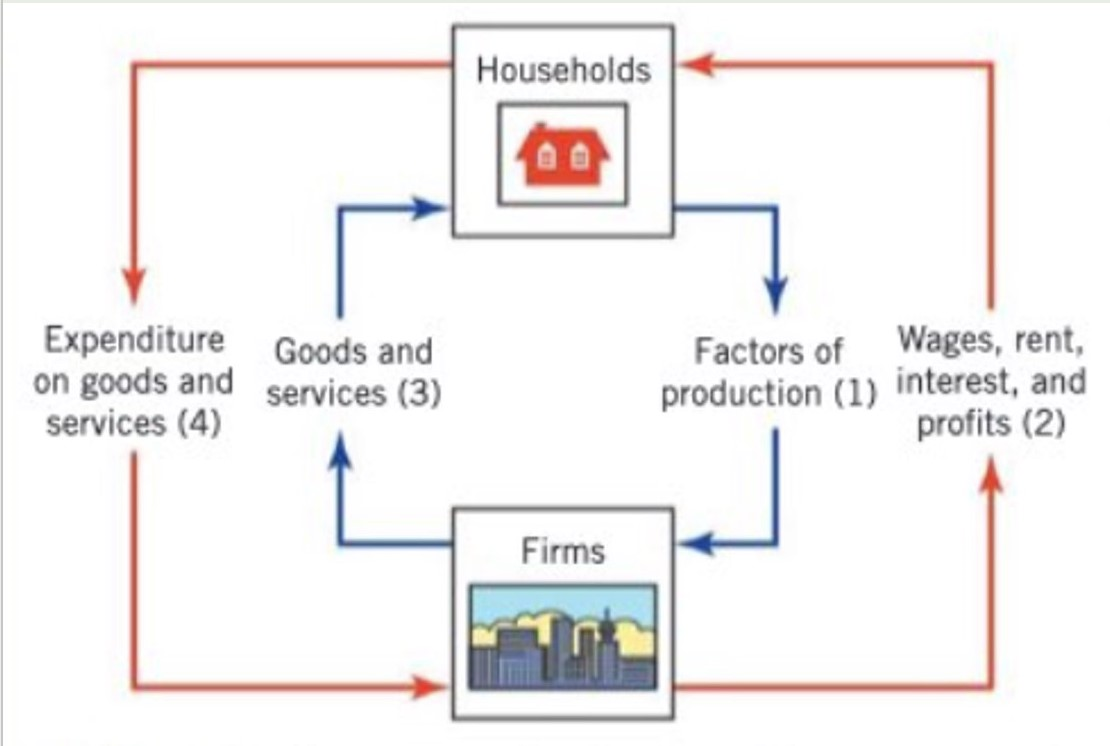

The Circular Flow of Income

Illustrated interindependence that exists between key economic decision makers. Provides a simplified presentation

There are 2 sector circular flow (closed system)

Assumptions: all factors of production, all belongs to households.

Household, they give factors of production to firms. Examples: Land, they rent out their land. Labour, they give services. Capital, Loan.

Firms produce goods and services, that households will buy/consume.

Open Circular flow:

5 sectors involved (Households, Firms, Government, Financial Market, and Foreign market)

The only difference is theres leakeges, and injections.

Foreign market: More monehy u spend on import goods = less u can spend on domestic products.

Injections: Money flows INTO economy. Governement : subsidies, taxes to (Injected) to government savings.

Financial market also return money back.

Exports, it increases the amount it goes back to the economic’s country.

If injections > leakages: Size of flow increases.

If leakages > injections: Size of flow decreases/shrink.

Macroeconomics video

firms provide household w goods and service.

Frims get factor of production from households.

Theres money flowing in opposite direction. They pay eachother.

Savings - money we dont spend (banks invest in firms by lending it to them). Investments flowing into the economy.

Government buys stuff aswell. They get money from taxes.

Countries → Trade (Imports: The money flows out the country to another country)

I/G/X → Injections.

S/T/N → Leakages/withdrawals.

Everything connects.

Size of economy - measuring GDP (total value of all final goods and services produced. within the borders of a country during a given period)

1.2 How do Economist Approach the World?

Economic Methodology

Positive vs Normative Economics

Positive Economics (can be proven) → Statement about what IS, what WAS. Positive statement could be false. Positive is preferred. If families with incomes over 250k → Positive (can test with DATA).

Characteristics: Tries to describe, explain, and predict economic events

It uses positive statements, about things that actually exist, happened in the past, or will happen in the future. Focuses on objective analysis of real world

Examples:

May DESCRIBE something (Ex. unemployment rate is 5%, industrial output grew by 3%).

May be statements in a hypothesis that tries to EXPLAIN something (cause and effect).

May be statements that PREDICT a future EVENT.

Role of positive economics

Use of logic → Statements based on LOGICAL reasoning. Economist use REASONING to draw out potential implications for economic behaviour.

Use of hypotheses, models, and theory → It provides HYPOTHESIS that could be proven by using models and theory.

The ceteries paribus assumption → Assumption is a statement thats supposed to be true for the purpose of building a hypothesis.

Ceteris paribus → assuming that other things are constant. We want to be able to isolate the effect each one of them individually. But in real world, everything is likely to change all the time. Its just a TOOL for economist to construst hypotheses models and theories. So itll be possible for us to study the effects of one variable at a time.

Latin phrase, meaning "other things equal";

Empirical evidence → Use real world information to test hypothesis.

Refutation or Falsifiability → If its false we use this. Hypothesis is rejected. It must be possible to subject it to empirical testing, where the data can be disprove if its false or invalid.

Normative Economics (cannot be proven & very objective) → Values, opinions, judgments. Ex. “Should”, “think”, “ought to”. Statement that cannot be tested. This still exists and plays a role in society. Ex. Rich people need to pay more taxes → Normative (bc we cannot prove it).

More objectives statement.

Complete opposite of POSITIVE economics. They use beliefs or values. Thinking deals with how things in the economy should or ought to be.

Examples:

May be BASED on BELIEF or VALUE. Example → The unemployment rate should (no specification?) be lower (what is low?).

May talk about VALUE.

May be a policy recommendation about what the government should do. Example → The government should (unclear) spend more money (how much?) on building schools.

Role of Normative Economics:

Value Judgement in making policy making: (1) Helps to identify economic problems. (2) Cannot be proven to be false (only agree/diasgree).

Meaning of equity and equality: (1) Equity → idea pf being fair or just. Fairness = normative (bc depends on value judgement. (2) Equality → State of being equal to something. (3)

Examples of Positive economic:

Income has fallen by 7%.

Free education will increase government spending by 3%.

Women are often paid less than men for the same work. (its actually based on data)

Examples of Normative economics:

Income inequality has increased too much.

Taxes are too low and should be increased.

Women and men should receive equal pay for the same work.

Higher taxes will result in lower disposable incomes.

There should be free university education.

Karl Marx (critique of classical economics) (19th century).

Karl Marx (Karl Heinrich Marx)

Who is he? → He was a revolutionary, sociologist, historian, and economist. Born May 5, 1818, Trier, Rhine province, Prussia [Germany]—died March 14, 1883, London, England).

Main theory (Development of Marxism) → His theories led to the development of Marxism. His books (Das Kapital & The Communist Manifesto) formed the basis of the manifesto.

Marxism → System of socioeconomic analysis. It is a broad philosophy developed by Karl Marx in the second half of the 19th century that unifies social, political, and economic theory. It is mainly concerned with the battle between the working class and the ownership class and favors communism and socialism over capitalism.

Critique of Classical Economics: Key Elements

key elements of Marx's critique:

Labor Theory of Value: Classical economists, including Smith and Ricardo, believed that the value of a commodity is determined by the amount of labor required to produce it. Marx agreed with this idea but took it further by arguing that the value of a commodity should be measured in terms of socially necessary labor time. He criticized classical economists for not fully understanding the social aspect of labor and for not recognizing the exploitation of labor under capitalism.

Exploitation and Surplus Value: Marx argued that capitalists extract surplus value from the labor of workers. Workers are paid wages that are equivalent to the value of their labor-power (the value of their labor necessary to reproduce themselves), but they actually produce more value during their working day than they receive in wages. The surplus value is appropriated by the capitalist as profit, resulting in the exploitation of the working class.

Contradictions of Capitalism: Marx saw inherent contradictions within the capitalist system. One such contradiction is the tendency of the rate of profit to fall over time due to technological advancements and the pressure to reduce labor costs. This, in turn, leads to economic crises and social instability.

Alienation of Labor: Marx criticized classical economists for not adequately addressing the alienation of labor under capitalism. He argued that workers become estranged from the products they produce, from the process of production, and from their own creative potential. This alienation results from the capitalist system's focus on maximizing profits and the division of labor.

Role of the State: Classical economists generally favored a minimal role for the state in the economy. Marx, on the other hand, saw the state as an instrument that primarily serves the interests of the ruling capitalist class and helps maintain the capitalist mode of production.

Class Struggle: Marx's critique emphasizes the importance of class struggle in shaping economic and social systems. He believed that history is a series of class struggles, and the resolution of these conflicts leads to the transformation of economic systems.

Historical Context:

Industrial Revolution: The Industrial Revolution was in full swing during Marx's time, transforming the economies of Europe and other parts of the world. This period witnessed the shift from agrarian economies to industrialized societies, characterized by the mechanization of production, the rise of factories, and the rapid urbanization of the working class. Marx observed the harsh working conditions, long hours, and exploitation of laborers in this new capitalist system, which deeply influenced his economic theories.

Rise of Capitalism: The 19th century saw the consolidation and expansion of capitalist economic systems. Classical economists like Adam Smith and David Ricardo laid the intellectual foundations of capitalist economic thought, emphasizing the principles of free markets, division of labor, and the invisible hand guiding economic interactions. Marx engaged with these ideas while critiquing their implications for the working class and the overall structure of society.

Social Inequality and Poverty: As industrial capitalism advanced, social inequality widened, and poverty became a significant problem in urban centers. Marx was critical of the immense wealth accumulated by capitalists through the exploitation of labor, while the working class struggled to make ends meet. He sought to understand the root causes of these social injustices and how they related to the capitalist mode of production.

Emergence of Working-Class Movements: The 19th century also witnessed the emergence of working-class movements and labor unions that demanded better working conditions, higher wages, and the protection of workers' rights. Marx engaged with these movements and analyzed the class struggles that were unfolding, seeking to provide a theoretical framework for understanding the dynamics of these conflicts.

Hegelian Philosophy and Dialectical Materialism: Marx was heavily influenced by German philosopher Georg Wilhelm Friedrich Hegel's dialectical method, which emphasized the development of ideas through contradictions and conflicts. Marx combined this philosophical approach with a materialistic view of history to develop his theory of historical materialism, which posited that the driving force of historical change is the struggle between social classes.

Political Revolutions: The 19th century saw several political revolutions and uprisings across Europe. The French Revolution and subsequent political movements inspired Marx's belief in the potential for revolutionary change as a means to address the problems he saw in capitalist societies.

Keynesian revolution (John M Keynes) (20 century).

Who’s John M Keynes? → Born in June 5th, 1883 (Cambridge, Cambridgeshire, England). Died in April 21st, 1946 (Firle, Sussex). Was an english economist, journalist, and financier known for his economic theories (Keynesian economics) → On the causes of prolonged unemployment.

Keynesian Revolution

When did it occur?

John Maynard Keynes and Keynesian economics were revolutionary in the 1930s and did much to shape post-World War II economies in the mid-20th century.

What is it?

John Maynard Keynes spearheaded a revolution in economic thinking that overturned the then-prevailing idea that free markets would automatically provide full employment—that is, that everyone who wanted a job would have one as long as workers were flexible in their wage demands (see box).

What caused it?

The driving force was the economic crisis of the Great Depression and the 1936 publication of The General Theory of Employment, Interest and Money by John Maynard Keynes, which was then reworked into a neoclassical framework by John Hicks, particularly the IS/LM model of 1936/37.

Keynesian economics → it’s a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation. Developed during the 1930s in an attempt to understand the Great Depression.

Keynesian beliefs - Because prices are somewhat rigid, fluctuations in any component of spending—consumption, investment, or government expenditures—cause output to change. If government spending increases, for example, and all other spending components remain constant, then output will increase.

Key takeaways - It argues that demand drives supply and that healthy economies spend or invest more than they save. To create jobs and boost consumer buying power during a recession, Keynes held that governments should increase spending, even if it means going into debt.

Historical context - Keynesian economics dominated economic theory and policy after World War II until the 1970s, when many advanced economies suffered both inflation and slow growth, a condition dubbed “stagflation.” Keynesian theory's popularity waned then because it had no appropriate policy response for stagflation.

What event inspired Keynesian economics? The Great Depression inspired Keynes to think differently about the nature of the economy. From these theories, he established real-world applications that could have implications for a society in economic crisis. Keynes rejected the idea that the economy would return to a natural state of equilibrium.

2.1-2.2 Intro to Microeconomics

2.1 Demand

Non-Price Determinants of Supply

Change = Cost of factor of production

Labour wages increases → Profit = Decreases. Therefore the Supply curve will shift to the right, and decrease the qty of supply.

Factor price rises = Production cost increases

Price determine cost of production

Prices of Related Goods

Jointly Supplied → Supplied jointly with another good. Price of other good rises, qty supply will also rise. Therefore there will be an increase in the supply of its by product, causing a rightward shift in its supply curve.

Ex. Beef & leather are jointly supply. Beef increases → supplier would want to supply more beef. The leather shifts to the right because the more beef, more leather aswell. There will also be a decrease in the supply curve of leather to shift to the left vice versa. Same resources, multiple uses.

Competitively Supplied → Only using same thing. A good that uses the same resources/ factors of production as another good. Therefore if the price of one of these goods rises then more of it will be supplied. More of the shared Factors of production will get into that good, and leaving less for the other, decreasing its supply, and etc.

Ex. If the price of housing increases, land owners will want to build houses because it is profitable. This will then cause farms to be produced/ made less.

Government Intervention

Taxes → Firms see taxes as cost of production, therefore they will increase the price of their goods. This will cause the supply to decrease and the curve shift to the left. Increase of existing tax = increase in production costs.

Subsidies → Amount of money granted by the government to a specific firm or industry. Has the opposite effects of taxes. Goods that are beneficial for people to make it cheaper, and to make firms produce more of the product.

Concept of Scarce → Unlimited limited resources.

Future Price Expectation

Future price expectation rise → Store & Wait → Current supply fall → Shift to the left.

Future price expectation fall → Sell immediate → Current supply rise → Shift to the right.

Changes in Technology

Lowers cost of production. Can cause the curve to shift to the right by efficiency/ increasing productivity - the amount of output per unit of input.

Could be because: Allowing production of more units of good with the same amount of resource, or by allowing production of more unites in same time thus making the production profitable.

Number of firms in the market

Increase firm in producing same goods, will result in the curve shifting to the right. Market supply is teh sum of all individual supplies

Number of firms decreases (produce same good) → market supply decreases shift to the left

Shock/ Sudden unpredictable events

Weather condition, war, pandemic, natural/ man made catastrophes can affect supply

Movement along supply curve → Change in qty supplied could be cause by price therefore reflected in a movement along the supply curve.

Shift in supply → Any other factros.

Practice:

What would happen to the supply of bicycles if there were a large increase in the tax on bicycles?

The supply of bicycles would decrease because the producer would be less inclined to produce more of it, and this is due to the demand decreasing which was affected by the price of bicycles increasing overall. The firms will increase the price of bicycles because they see tax as a part of the cost of production. Therefore this increase in the tax on bicycles will cause the curve to shift to the left. This is also considered an example of government intervention since the government are the ones increasing the tax of bicycles.

What would happen to the supply of foreign holidays if there were a fall in the price of foreign holidays?

A decrease in the price of foreign holidays could lead to an increase in demand. Lower prices make foreign holidays more affordable and attractive to a larger segment of the population. As a result, travel companies and tour operators might respond to the increased demand by expanding their offerings and increasing the supply of foreign holiday packages and thus causing the supply curve to shift to the left.

What would happen to the supply of vinyl records if there were a significant increase in the price of the components used to make vinyl records?

The supply of vinyl records would decrease, because if there is an increase in the price of the components/ materials used to produce vinyl the price of it in general would also increase. There would also be a decreasing/ declining movement along the curve because there is a change in the cost of a factor of production.

What would happen to the supply of cars if the government were to subsidize car production in order to encourage employment in the car industry?

The supply of cars would increase due to the increase of employment in the car industry since the production time would be faster. The curve would also shift to the right since there is government intervention.

What would happen to the supply of white bread if a firm were to discover that there has been a large increase in the demand for brown bread which they could also produce?

The firm would then increase their produce for the brown bread since it would enable them to gain profit more efficiently. They would decrease the production of white bread since there aren’t a lot of demand for it, if both of them were compared. This is also called as a competitively supply, which means that if the price of one of these goods rises then more of it will be supplied. This would also affect the supply curve by making it shift to the left.

What would happen to the supply of bottled water if there were an improvement in the technology used to produce it?

The supply would increase in a faster rate since the new and developed technology allows manufacturers to produce bottled water faster, and more efficiently. This event is also known as changes in technology, and this benefits the manufacturers by decreasing the cost of production. Therefore by utilizing improved technology to produce bottled water, this would cause the supply curve to shift to the right.

What would happen to the supply of carrots if the farmer decided to preserve the environment by farming in a more traditional matter instead of making more profit?

The supply of carrots would decrease since it will take a lot more time to harvest them. Although it does make the production of carrots less efficient, it does benefit the environment greatly. This event is also known as the cost of factor of production, and this is due to there being a change in the manufacturer. Therefore it will cause the supply curve to shift to the left.

5 Non-Price Determinants of Income

2.2 Supply

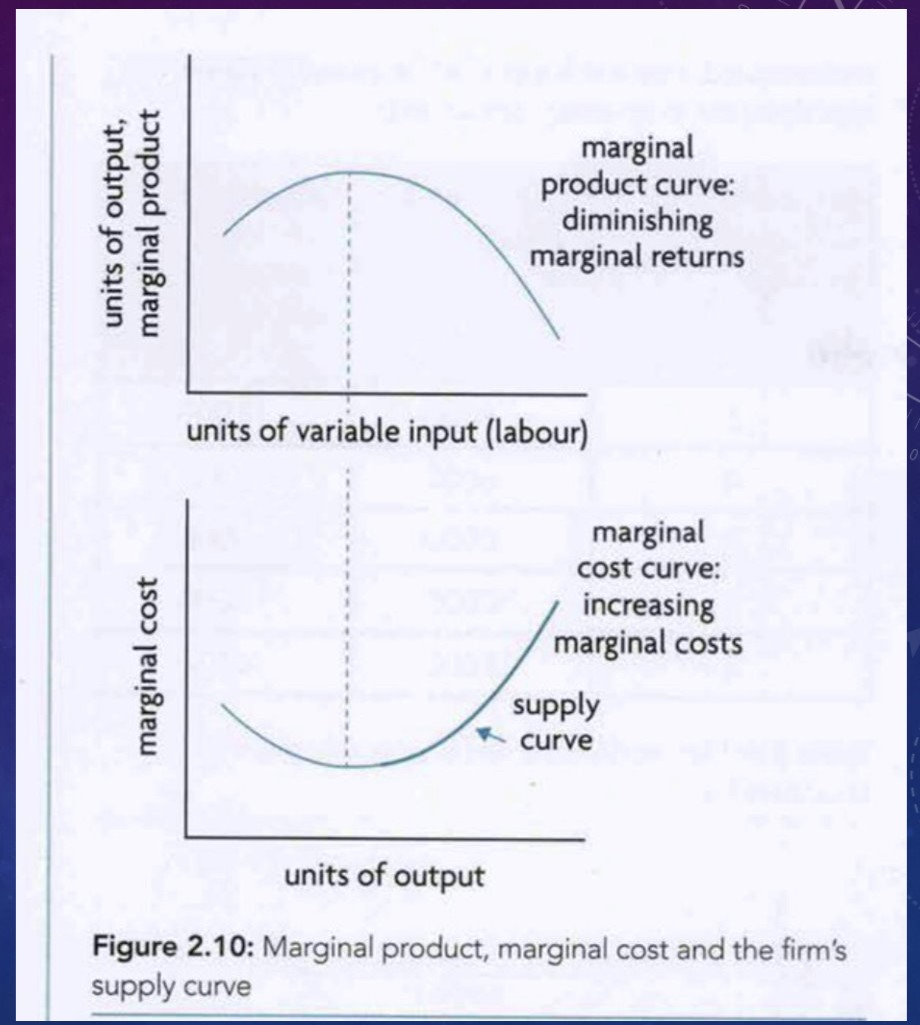

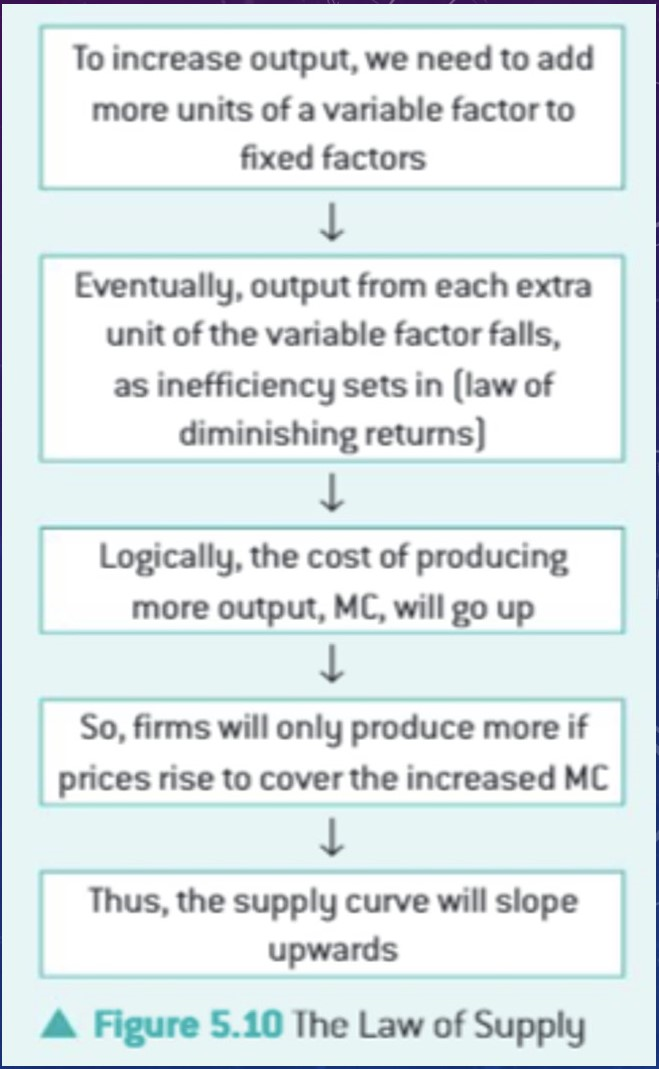

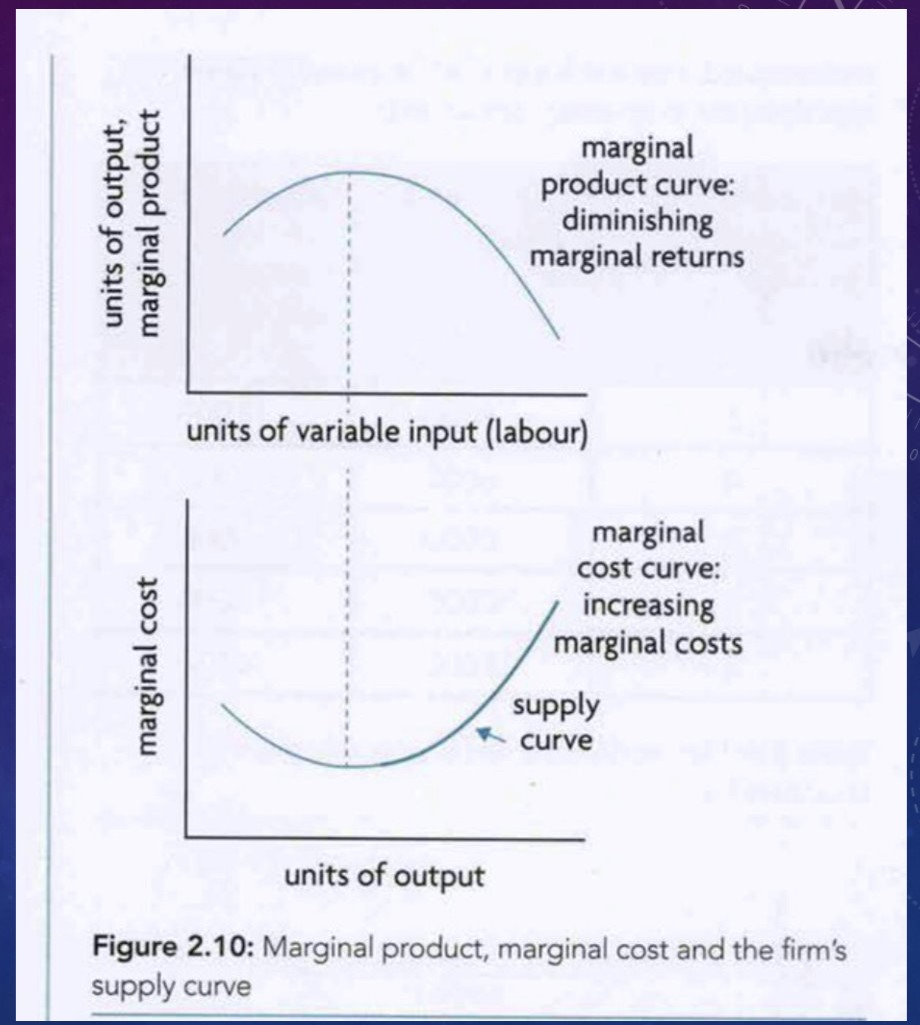

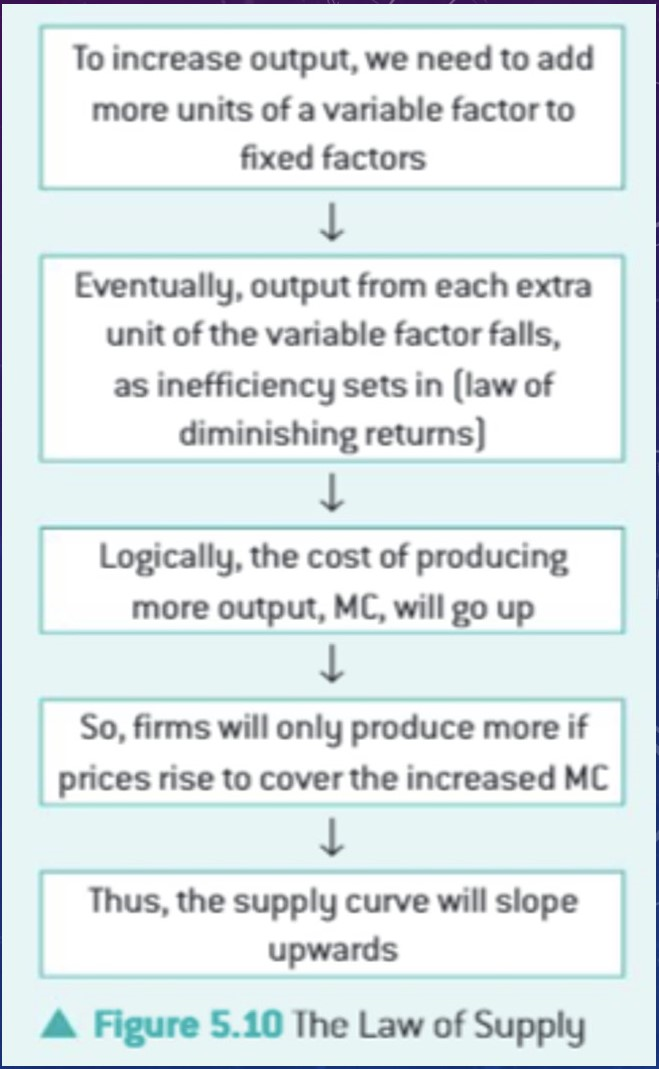

Law of diminishing martial and return (suppliers perspective) → short run and long run.

Short run → at least one factor of production is fixed. What happens? How is it related to Law of diminishing martial and return? As u keep adding more variable inputs into a fixed input ur system will fall

Whats the formula for martial product? Change : variable

What’s Increasing/ diminishing marginal cost → Extra cost producing one more unit of output. Tells us how much total cost has increased if there is an increase in output by one unit. It usually increases in the beginning then decreases.

What’s marginal product? → Change in output as a result of one additional unit of input being added to production.

It goes up until a certain point, then it falls (starts diminishing) due to overpopulation or inefficiency.

Linked to one another, cuz still same amount of wage. Marginal cost go up when. MP decreasing → MC increase.

Formula: MC = TC (Total change in cost)/Q (Qty)

How is marginal cost related to diminishing marginal return? It increases then decreases (reverse of diminishing marginal return).

MP increase → MC decrease.

If output produced by each addition worker (MP) begins to fall, yet each worker cost the same (Pay same wage regardless of how much they produce), then cost of producing each extra unit (MC) begins to increase. → Helps us explain law of supply (high price → more qty supplied)

Supply curve has a positive relationship. When one factor goes up, the other do the same.

Price go up, manufacturers more declined to producce.

Supply go up → Demand downward sloping.

2.3 Competitive Market Equilibrium

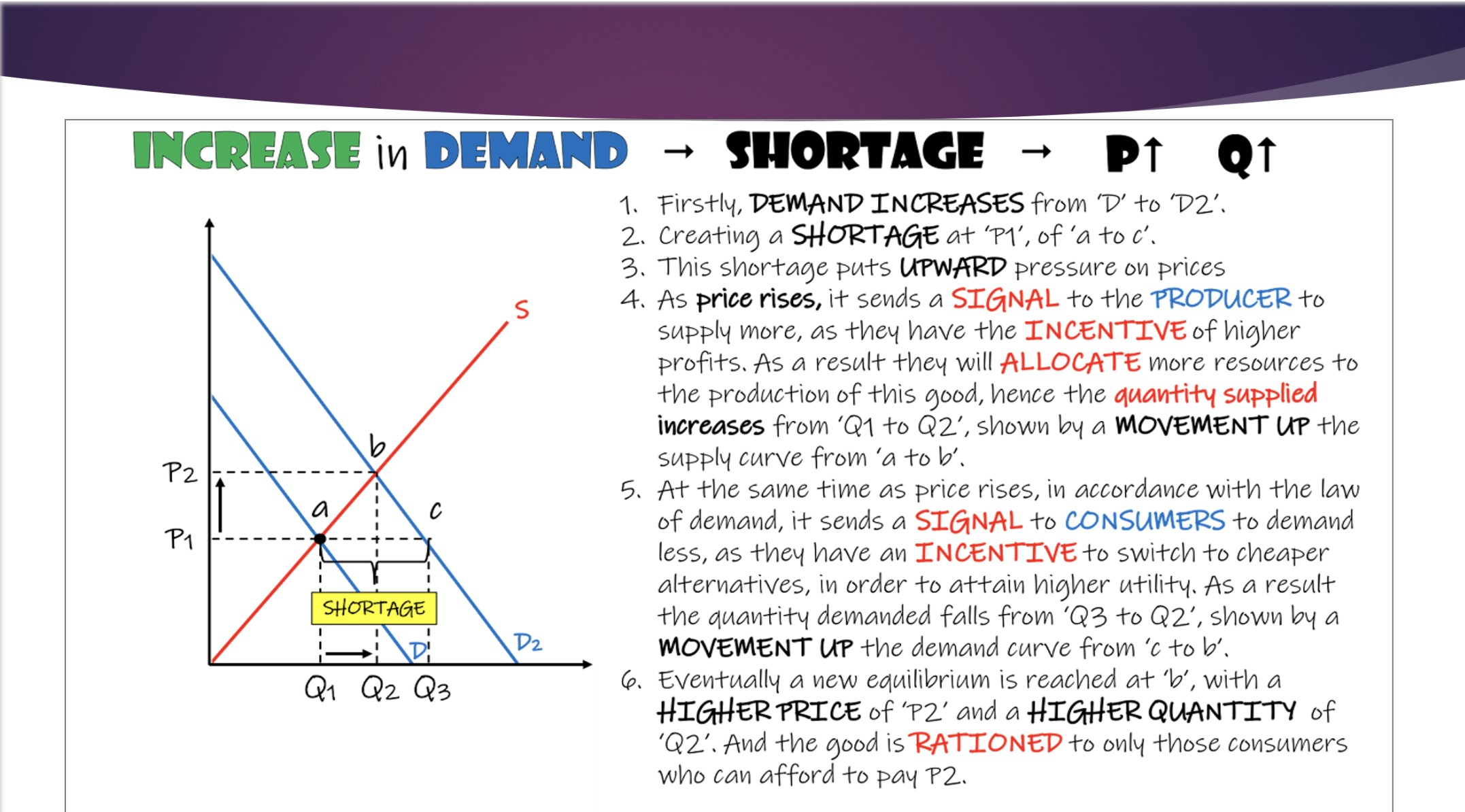

What’s Market equilibrium? → Qty demanded = Qty supplied.

Supply intersects with demand (Demand meets supply).

Equilibrium price → Qty consumers are willing to buy = to the qty firms are willing to sell.

PRICE is called the Equilibrium price, QUANTITY is the Equilibrium quantity.

Market disequilibrium

Questions

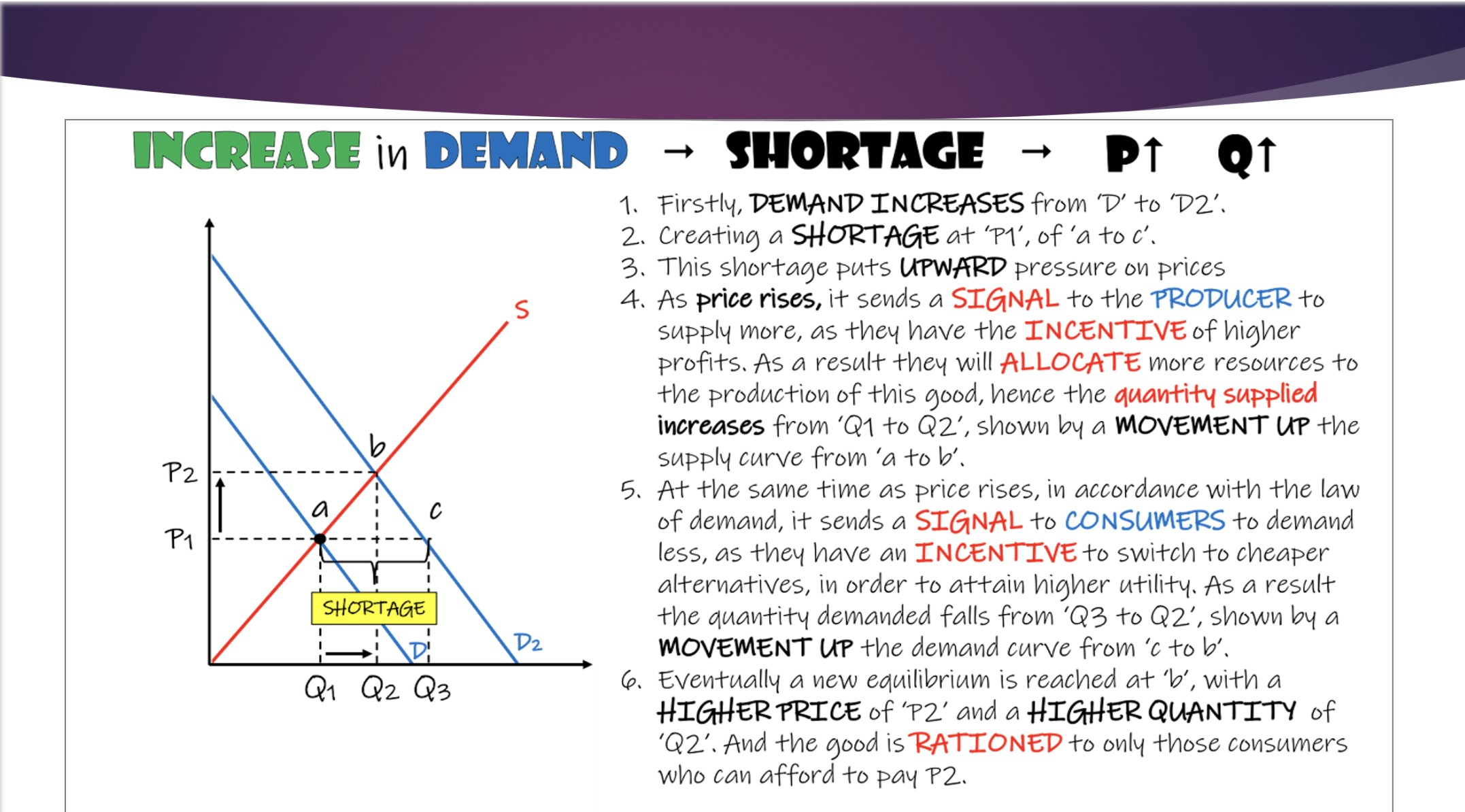

What could cause shortages and surpluses?

There are 2 types → Shortage and Surpluses

Shortage → Qty demanded larger (>) than quantity supplied, excess demand

When does it occur? It occurs when price of product is set BELOW equilibrium price.

Guideline touches demand curve → qty demanded. Guide Line touches supply demanded → qty supplied.

Producers noticed that products getting sold quickly, and so they increase price, but demand falls and supply increase → will happen until the equilibrium price.

The market will always go back to market equilibrium

Surpluses → Qty demanded smaller (<) than quantity supplied, excess supply

When does it occur? It is a reverse of ‘shortage’ meaning that it is when the price is set ABOVE equilibrium price.

Why does this occur? Because too much product (supply) in the market, compared to demand.

Changes in Market Equilibrium

When price reaches equilibrium level, consumers and firms are satisfied and will not engage in any action to make it change.

But if theres a change in the …

E.g. ‘Increase price of substitutes’ → Demand curve will shift to the right.

Price substitute expensive so they will buy diff product.

Price Mechanism

What is it? A system where the forces of demand and supply determine the price of a commodity and how the price changes lead to a reallocation of resources.

How can we find the key to the market’s ability to allocate resources?

Signaling and incentive functions of price in resource allocation.

Signals → Price communicates info to decision makers.

Incentive → Price motivates decision-makers to respond to the info.

The function of Price Mechanism

Resource allocation

How do we determine how much resource we put in production.

Signaling → As signal price communicates info to decision maker.

Incentive → Price motivates decision-makers to respond to the information.

Rationing

How do we distribute those types of goods?

Prices Rationing → Whether or not a customer will get good is determined by the price of it. All those who are willing to pay the price will get the goods.

Shortage → Price bids up (leaving only those with willingness and ability to pay buy).

What happened?

Producer

Signaling → Prices go up give producers signal that there is shortage in the goods market.

Incentive/ Motivation → Price increases also a sign for producers to supply/ increase price of products to gain more profit.

Consumers

New price signals that consumers should buy less bc producers increased the pricce.

Conclusion

The increase in pricce of goods resulted in the reallocation of resources. More resources are now allocated to strawberry production.

Examples:

Consumers de

Assignment:

08/21/2023

Use demand and supply diagrams to show in each of the following cases how the change in demand or supply for product A creates a disequilibrium consisting of excess demand or excess supply, and how the change in price eliminates the disequilibrium.

Consumer income increases (A is a normal good)

shift to the right.

Demand of normal good will increase

Consumer income falls (A is an inferior good)

Shift to the right.

The demand of inferior goods will increase.

There is an increase in labour costs

Producers will employ fewer people, and might even fire them. Thus resulting in the decrease of supply.

Shift to the left.

Price of substitute good B falls.

Demand increases due to price.

Supply decrease due to price decreasing.

Fall downwards.

Number of firms in the industry producing product A increases.

Supply increase.

Price decrease.

A successful advertising campaign emphasises the health benefits of product A.

The demand of product A will increase.

Supply will also increase.

Shifting to the right.

Demand Curve = Marginal benefit curve

Supply curve as a marginal cost

Producing of one more additional output

Used to show price that the firm is willing to accept in order to produce one more unit of good.

Marginal cost increases as the units of output increase.

Ex. producing 1st marker = $1, producing 2nd marker = $1.2 → Price increases.

Allocative efficiency

Whats allocative efficiency? Socially optimal situation when resources are distributed in a way that allows consumers and producers get the maximum possible benefit.

When do these occur? Occurs when community or social surplus is maximized.

Extra benefit to society of getting one more unit of good is = to extra cost to society of producing one more good.

What happens to society resources when it happens? Society resources is used to produce the right qty of goods.

If MC>MB then it means it would cost society more to produce than the benefit that society will receive so we should produce less.

Consumer surplus → Satisfaction/ benefit

What is it? Highest price willing to pay minus actual price paid.

Function of Price Mechanism

What’s price of mechanism? It is the means by which decisions of consumers and businesses interact to determine the allocation of resources.

Resource allocation

→ Signalling: Prices communicate information to decision-makers.

→ Incentive: Prices motivate decision maker to respond to the information

Rationing

→ What’s prices rationing? Whether or not a customer gets a good is determined by the price of the good. People who are willing and able to pay for it, will get it (duh).

→ What happens when there is a shortage? The price is bid up - leaving with consumers who are willing and able to pay.

Good example of explaining a graph:

Section A

Microeconomics

(a) explain how a decrease in income might affect the demand for normal goods and the demand for inferior goods.

Define terms first (definitions of demand, normal good, and inferior good). Identify all economic terms.

Diagrams to show how a decrease in income affects the demand for normal good and inferior goods.

Explanation of how a decrease in income reduces the demand for normal goods and increases the demand for inferior goods.

Examples of normal goods and inferior goods (use particular brand).

Because they have less purchasing power consumers are less willing and able to purchase at each given price ← lets examiners know that its only price.

(b) discusss the significance of income elasticity of demand for producers of primary products and producers of manufactured goods when incomes are rising.

(a) Explain the impact on consumers, producers and the govern,ent of a price floor being introduced in an agricultural market.

(b) Evaluate the view that a price ceiling is an ineffective___

determinants of demand and supply.

Econ HL (Semester 1 Term 1)

1.1 Basis of Economics

Micro-economics

Smaller discrete economic agents (ex. consumers, & producer in individual market (or businesses)).

Observes the choice they make in respond to change in a dynamic world → to improve economic well-being or efficiency.

How government intervention affect producer & consumers.

What to produce, How to produce, and whom to produce it to.

Macro-economics

Factors that affect the economy (as a whole).

Economic growth, and how it impacted economic well being.

Inflation and unemployment.

Unemployment low = Inflation rise. (When a lot of people are working they have more money which would allow them to buy the things they want/ need, thus increasing the demand (inflation will follow soon)).

Unemployment high = Inflation falls.

Role of policies.

Macroeconomic policy aims to provide a stable economic environment that is conducive to fostering strong and sustainable economic growth.

Key pillars of macro-economics: Fiscal policy, monetary policy, and exchange rate policy.

Fiscal Policy (controlled by government)→

Operates through changes in the level and composition of government spending, the level and types of taxes levied and the level and form of government borrowing.

Monetary Policy →

Decisions are implemented by changing the cash rate (the interest rate on overnight loans in the money market). The cash rate is determined in the money market by the forces of supply and demand for overnight funds.

Exchange rate policy →

Concerned with how the value of the domestic currency, relative to other currencies, is determined.

Dsitribution of income.

It is a measure of how income is distributed amongst individuals and households in a society. An equal distribution of income is associated with lower poverty rates in an economy.

Key Concepts: WISE ChoICES

Well-being

Interdependence → Greater level of interaction, greater the degree of interdependence. Decisions by certain economic actors will generate various economic consequences for other actors. Consideration is crucial when conducting economic analysis.

Scarcity → Limited resources, but unlimited demand. Economics are defined as the study of human behavior as a relationship between ends and scarce resources which have alternative uses.

Efficiency → Determined by ratio of useful output to total input. Allocative efficiency - Use the most of scarce resources to produce goods and services that are optimum for society, thus minimizing resource waste.

Choice → Not all needs/wants can be met, thus causing producers to have choices between competing alternatives, and idea of opportunity cost. There are consequences of these choices (present and future).

Intervention → Refers to government involvement in the workings of markets.

Change → Economic world is constantly in flux, and economists must be aware of it and adapt their thinking accordingly. In economic theory, economics focuses not on the level of the variables it invesitgates but on their change from one situation to another. Empirically, the world is always sibject to continuous and profound change at institutional, structural, technological, economic, and social levels.

Equity → Refers to the concept of fairness. Inequity: refer to inequality which may apply to the distribution of income, wealth, or economic opportunity.

Sustainability → Refers to the ability of the present generation to meet its needs without compromising the ability of future generations to meet its own needs.

Opportunity Cost

The value of the next best alternative is sacrificed.

Factors of Production (LLEC)

Land

Natural resources used for production (Ex. crude oil, coal, and water).

Labor

Human resources needed during production process (Ex. Accountant, barista, chef, & etc).

Capital

Manufactured products used in production process (Ex. machinery, tools, equipment, and vehicles).

Entrepreneurship/ Enterprise

Refers to the skills, creativity, and risk taking ability that a business person requires to successfully combine and manage the other 3 factors of production.

Rationing System (Market vs Government Intervention)

Planned Economy

What is being Produced?

Government decides what goods to produce, based on what they think society needs.

How to produce?

Decide how all resources are to be used and where people

For Whom?

Free Market Economy

What is being Produced?

How to produce?

For Whom?

The Circular Flow of Income

Illustrated interindependence that exists between key economic decision makers. Provides a simplified presentation

There are 2 sector circular flow (closed system)

Assumptions: all factors of production, all belongs to households.

Household, they give factors of production to firms. Examples: Land, they rent out their land. Labour, they give services. Capital, Loan.

Firms produce goods and services, that households will buy/consume.

Open Circular flow:

5 sectors involved (Households, Firms, Government, Financial Market, and Foreign market)

The only difference is theres leakeges, and injections.

Foreign market: More monehy u spend on import goods = less u can spend on domestic products.

Injections: Money flows INTO economy. Governement : subsidies, taxes to (Injected) to government savings.

Financial market also return money back.

Exports, it increases the amount it goes back to the economic’s country.

If injections > leakages: Size of flow increases.

If leakages > injections: Size of flow decreases/shrink.

Macroeconomics video

firms provide household w goods and service.

Frims get factor of production from households.

Theres money flowing in opposite direction. They pay eachother.

Savings - money we dont spend (banks invest in firms by lending it to them). Investments flowing into the economy.

Government buys stuff aswell. They get money from taxes.

Countries → Trade (Imports: The money flows out the country to another country)

I/G/X → Injections.

S/T/N → Leakages/withdrawals.

Everything connects.

Size of economy - measuring GDP (total value of all final goods and services produced. within the borders of a country during a given period)

1.2 How do Economist Approach the World?

Economic Methodology

Positive vs Normative Economics

Positive Economics (can be proven) → Statement about what IS, what WAS. Positive statement could be false. Positive is preferred. If families with incomes over 250k → Positive (can test with DATA).

Characteristics: Tries to describe, explain, and predict economic events

It uses positive statements, about things that actually exist, happened in the past, or will happen in the future. Focuses on objective analysis of real world

Examples:

May DESCRIBE something (Ex. unemployment rate is 5%, industrial output grew by 3%).

May be statements in a hypothesis that tries to EXPLAIN something (cause and effect).

May be statements that PREDICT a future EVENT.

Role of positive economics

Use of logic → Statements based on LOGICAL reasoning. Economist use REASONING to draw out potential implications for economic behaviour.

Use of hypotheses, models, and theory → It provides HYPOTHESIS that could be proven by using models and theory.

The ceteries paribus assumption → Assumption is a statement thats supposed to be true for the purpose of building a hypothesis.

Ceteris paribus → assuming that other things are constant. We want to be able to isolate the effect each one of them individually. But in real world, everything is likely to change all the time. Its just a TOOL for economist to construst hypotheses models and theories. So itll be possible for us to study the effects of one variable at a time.

Latin phrase, meaning "other things equal";

Empirical evidence → Use real world information to test hypothesis.

Refutation or Falsifiability → If its false we use this. Hypothesis is rejected. It must be possible to subject it to empirical testing, where the data can be disprove if its false or invalid.

Normative Economics (cannot be proven & very objective) → Values, opinions, judgments. Ex. “Should”, “think”, “ought to”. Statement that cannot be tested. This still exists and plays a role in society. Ex. Rich people need to pay more taxes → Normative (bc we cannot prove it).

More objectives statement.

Complete opposite of POSITIVE economics. They use beliefs or values. Thinking deals with how things in the economy should or ought to be.

Examples:

May be BASED on BELIEF or VALUE. Example → The unemployment rate should (no specification?) be lower (what is low?).

May talk about VALUE.

May be a policy recommendation about what the government should do. Example → The government should (unclear) spend more money (how much?) on building schools.

Role of Normative Economics:

Value Judgement in making policy making: (1) Helps to identify economic problems. (2) Cannot be proven to be false (only agree/diasgree).

Meaning of equity and equality: (1) Equity → idea pf being fair or just. Fairness = normative (bc depends on value judgement. (2) Equality → State of being equal to something. (3)

Examples of Positive economic:

Income has fallen by 7%.

Free education will increase government spending by 3%.

Women are often paid less than men for the same work. (its actually based on data)

Examples of Normative economics:

Income inequality has increased too much.

Taxes are too low and should be increased.

Women and men should receive equal pay for the same work.

Higher taxes will result in lower disposable incomes.

There should be free university education.

Karl Marx (critique of classical economics) (19th century).

Karl Marx (Karl Heinrich Marx)

Who is he? → He was a revolutionary, sociologist, historian, and economist. Born May 5, 1818, Trier, Rhine province, Prussia [Germany]—died March 14, 1883, London, England).

Main theory (Development of Marxism) → His theories led to the development of Marxism. His books (Das Kapital & The Communist Manifesto) formed the basis of the manifesto.

Marxism → System of socioeconomic analysis. It is a broad philosophy developed by Karl Marx in the second half of the 19th century that unifies social, political, and economic theory. It is mainly concerned with the battle between the working class and the ownership class and favors communism and socialism over capitalism.

Critique of Classical Economics: Key Elements

key elements of Marx's critique:

Labor Theory of Value: Classical economists, including Smith and Ricardo, believed that the value of a commodity is determined by the amount of labor required to produce it. Marx agreed with this idea but took it further by arguing that the value of a commodity should be measured in terms of socially necessary labor time. He criticized classical economists for not fully understanding the social aspect of labor and for not recognizing the exploitation of labor under capitalism.

Exploitation and Surplus Value: Marx argued that capitalists extract surplus value from the labor of workers. Workers are paid wages that are equivalent to the value of their labor-power (the value of their labor necessary to reproduce themselves), but they actually produce more value during their working day than they receive in wages. The surplus value is appropriated by the capitalist as profit, resulting in the exploitation of the working class.

Contradictions of Capitalism: Marx saw inherent contradictions within the capitalist system. One such contradiction is the tendency of the rate of profit to fall over time due to technological advancements and the pressure to reduce labor costs. This, in turn, leads to economic crises and social instability.

Alienation of Labor: Marx criticized classical economists for not adequately addressing the alienation of labor under capitalism. He argued that workers become estranged from the products they produce, from the process of production, and from their own creative potential. This alienation results from the capitalist system's focus on maximizing profits and the division of labor.

Role of the State: Classical economists generally favored a minimal role for the state in the economy. Marx, on the other hand, saw the state as an instrument that primarily serves the interests of the ruling capitalist class and helps maintain the capitalist mode of production.

Class Struggle: Marx's critique emphasizes the importance of class struggle in shaping economic and social systems. He believed that history is a series of class struggles, and the resolution of these conflicts leads to the transformation of economic systems.

Historical Context:

Industrial Revolution: The Industrial Revolution was in full swing during Marx's time, transforming the economies of Europe and other parts of the world. This period witnessed the shift from agrarian economies to industrialized societies, characterized by the mechanization of production, the rise of factories, and the rapid urbanization of the working class. Marx observed the harsh working conditions, long hours, and exploitation of laborers in this new capitalist system, which deeply influenced his economic theories.

Rise of Capitalism: The 19th century saw the consolidation and expansion of capitalist economic systems. Classical economists like Adam Smith and David Ricardo laid the intellectual foundations of capitalist economic thought, emphasizing the principles of free markets, division of labor, and the invisible hand guiding economic interactions. Marx engaged with these ideas while critiquing their implications for the working class and the overall structure of society.

Social Inequality and Poverty: As industrial capitalism advanced, social inequality widened, and poverty became a significant problem in urban centers. Marx was critical of the immense wealth accumulated by capitalists through the exploitation of labor, while the working class struggled to make ends meet. He sought to understand the root causes of these social injustices and how they related to the capitalist mode of production.

Emergence of Working-Class Movements: The 19th century also witnessed the emergence of working-class movements and labor unions that demanded better working conditions, higher wages, and the protection of workers' rights. Marx engaged with these movements and analyzed the class struggles that were unfolding, seeking to provide a theoretical framework for understanding the dynamics of these conflicts.

Hegelian Philosophy and Dialectical Materialism: Marx was heavily influenced by German philosopher Georg Wilhelm Friedrich Hegel's dialectical method, which emphasized the development of ideas through contradictions and conflicts. Marx combined this philosophical approach with a materialistic view of history to develop his theory of historical materialism, which posited that the driving force of historical change is the struggle between social classes.

Political Revolutions: The 19th century saw several political revolutions and uprisings across Europe. The French Revolution and subsequent political movements inspired Marx's belief in the potential for revolutionary change as a means to address the problems he saw in capitalist societies.

Keynesian revolution (John M Keynes) (20 century).

Who’s John M Keynes? → Born in June 5th, 1883 (Cambridge, Cambridgeshire, England). Died in April 21st, 1946 (Firle, Sussex). Was an english economist, journalist, and financier known for his economic theories (Keynesian economics) → On the causes of prolonged unemployment.

Keynesian Revolution

When did it occur?

John Maynard Keynes and Keynesian economics were revolutionary in the 1930s and did much to shape post-World War II economies in the mid-20th century.

What is it?

John Maynard Keynes spearheaded a revolution in economic thinking that overturned the then-prevailing idea that free markets would automatically provide full employment—that is, that everyone who wanted a job would have one as long as workers were flexible in their wage demands (see box).

What caused it?

The driving force was the economic crisis of the Great Depression and the 1936 publication of The General Theory of Employment, Interest and Money by John Maynard Keynes, which was then reworked into a neoclassical framework by John Hicks, particularly the IS/LM model of 1936/37.

Keynesian economics → it’s a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation. Developed during the 1930s in an attempt to understand the Great Depression.

Keynesian beliefs - Because prices are somewhat rigid, fluctuations in any component of spending—consumption, investment, or government expenditures—cause output to change. If government spending increases, for example, and all other spending components remain constant, then output will increase.

Key takeaways - It argues that demand drives supply and that healthy economies spend or invest more than they save. To create jobs and boost consumer buying power during a recession, Keynes held that governments should increase spending, even if it means going into debt.

Historical context - Keynesian economics dominated economic theory and policy after World War II until the 1970s, when many advanced economies suffered both inflation and slow growth, a condition dubbed “stagflation.” Keynesian theory's popularity waned then because it had no appropriate policy response for stagflation.

What event inspired Keynesian economics? The Great Depression inspired Keynes to think differently about the nature of the economy. From these theories, he established real-world applications that could have implications for a society in economic crisis. Keynes rejected the idea that the economy would return to a natural state of equilibrium.

2.1-2.2 Intro to Microeconomics

2.1 Demand

Non-Price Determinants of Supply

Change = Cost of factor of production

Labour wages increases → Profit = Decreases. Therefore the Supply curve will shift to the right, and decrease the qty of supply.

Factor price rises = Production cost increases

Price determine cost of production

Prices of Related Goods

Jointly Supplied → Supplied jointly with another good. Price of other good rises, qty supply will also rise. Therefore there will be an increase in the supply of its by product, causing a rightward shift in its supply curve.

Ex. Beef & leather are jointly supply. Beef increases → supplier would want to supply more beef. The leather shifts to the right because the more beef, more leather aswell. There will also be a decrease in the supply curve of leather to shift to the left vice versa. Same resources, multiple uses.

Competitively Supplied → Only using same thing. A good that uses the same resources/ factors of production as another good. Therefore if the price of one of these goods rises then more of it will be supplied. More of the shared Factors of production will get into that good, and leaving less for the other, decreasing its supply, and etc.

Ex. If the price of housing increases, land owners will want to build houses because it is profitable. This will then cause farms to be produced/ made less.

Government Intervention

Taxes → Firms see taxes as cost of production, therefore they will increase the price of their goods. This will cause the supply to decrease and the curve shift to the left. Increase of existing tax = increase in production costs.

Subsidies → Amount of money granted by the government to a specific firm or industry. Has the opposite effects of taxes. Goods that are beneficial for people to make it cheaper, and to make firms produce more of the product.

Concept of Scarce → Unlimited limited resources.

Future Price Expectation

Future price expectation rise → Store & Wait → Current supply fall → Shift to the left.

Future price expectation fall → Sell immediate → Current supply rise → Shift to the right.

Changes in Technology

Lowers cost of production. Can cause the curve to shift to the right by efficiency/ increasing productivity - the amount of output per unit of input.

Could be because: Allowing production of more units of good with the same amount of resource, or by allowing production of more unites in same time thus making the production profitable.

Number of firms in the market

Increase firm in producing same goods, will result in the curve shifting to the right. Market supply is teh sum of all individual supplies

Number of firms decreases (produce same good) → market supply decreases shift to the left

Shock/ Sudden unpredictable events

Weather condition, war, pandemic, natural/ man made catastrophes can affect supply

Movement along supply curve → Change in qty supplied could be cause by price therefore reflected in a movement along the supply curve.

Shift in supply → Any other factros.

Practice:

What would happen to the supply of bicycles if there were a large increase in the tax on bicycles?

The supply of bicycles would decrease because the producer would be less inclined to produce more of it, and this is due to the demand decreasing which was affected by the price of bicycles increasing overall. The firms will increase the price of bicycles because they see tax as a part of the cost of production. Therefore this increase in the tax on bicycles will cause the curve to shift to the left. This is also considered an example of government intervention since the government are the ones increasing the tax of bicycles.

What would happen to the supply of foreign holidays if there were a fall in the price of foreign holidays?

A decrease in the price of foreign holidays could lead to an increase in demand. Lower prices make foreign holidays more affordable and attractive to a larger segment of the population. As a result, travel companies and tour operators might respond to the increased demand by expanding their offerings and increasing the supply of foreign holiday packages and thus causing the supply curve to shift to the left.

What would happen to the supply of vinyl records if there were a significant increase in the price of the components used to make vinyl records?

The supply of vinyl records would decrease, because if there is an increase in the price of the components/ materials used to produce vinyl the price of it in general would also increase. There would also be a decreasing/ declining movement along the curve because there is a change in the cost of a factor of production.

What would happen to the supply of cars if the government were to subsidize car production in order to encourage employment in the car industry?

The supply of cars would increase due to the increase of employment in the car industry since the production time would be faster. The curve would also shift to the right since there is government intervention.

What would happen to the supply of white bread if a firm were to discover that there has been a large increase in the demand for brown bread which they could also produce?

The firm would then increase their produce for the brown bread since it would enable them to gain profit more efficiently. They would decrease the production of white bread since there aren’t a lot of demand for it, if both of them were compared. This is also called as a competitively supply, which means that if the price of one of these goods rises then more of it will be supplied. This would also affect the supply curve by making it shift to the left.

What would happen to the supply of bottled water if there were an improvement in the technology used to produce it?

The supply would increase in a faster rate since the new and developed technology allows manufacturers to produce bottled water faster, and more efficiently. This event is also known as changes in technology, and this benefits the manufacturers by decreasing the cost of production. Therefore by utilizing improved technology to produce bottled water, this would cause the supply curve to shift to the right.

What would happen to the supply of carrots if the farmer decided to preserve the environment by farming in a more traditional matter instead of making more profit?

The supply of carrots would decrease since it will take a lot more time to harvest them. Although it does make the production of carrots less efficient, it does benefit the environment greatly. This event is also known as the cost of factor of production, and this is due to there being a change in the manufacturer. Therefore it will cause the supply curve to shift to the left.

5 Non-Price Determinants of Income

2.2 Supply

Law of diminishing martial and return (suppliers perspective) → short run and long run.

Short run → at least one factor of production is fixed. What happens? How is it related to Law of diminishing martial and return? As u keep adding more variable inputs into a fixed input ur system will fall

Whats the formula for martial product? Change : variable

What’s Increasing/ diminishing marginal cost → Extra cost producing one more unit of output. Tells us how much total cost has increased if there is an increase in output by one unit. It usually increases in the beginning then decreases.

What’s marginal product? → Change in output as a result of one additional unit of input being added to production.

It goes up until a certain point, then it falls (starts diminishing) due to overpopulation or inefficiency.

Linked to one another, cuz still same amount of wage. Marginal cost go up when. MP decreasing → MC increase.

Formula: MC = TC (Total change in cost)/Q (Qty)

How is marginal cost related to diminishing marginal return? It increases then decreases (reverse of diminishing marginal return).

MP increase → MC decrease.

If output produced by each addition worker (MP) begins to fall, yet each worker cost the same (Pay same wage regardless of how much they produce), then cost of producing each extra unit (MC) begins to increase. → Helps us explain law of supply (high price → more qty supplied)

Supply curve has a positive relationship. When one factor goes up, the other do the same.

Price go up, manufacturers more declined to producce.

Supply go up → Demand downward sloping.

2.3 Competitive Market Equilibrium

What’s Market equilibrium? → Qty demanded = Qty supplied.

Supply intersects with demand (Demand meets supply).

Equilibrium price → Qty consumers are willing to buy = to the qty firms are willing to sell.

PRICE is called the Equilibrium price, QUANTITY is the Equilibrium quantity.

Market disequilibrium

Questions

What could cause shortages and surpluses?

There are 2 types → Shortage and Surpluses

Shortage → Qty demanded larger (>) than quantity supplied, excess demand

When does it occur? It occurs when price of product is set BELOW equilibrium price.

Guideline touches demand curve → qty demanded. Guide Line touches supply demanded → qty supplied.

Producers noticed that products getting sold quickly, and so they increase price, but demand falls and supply increase → will happen until the equilibrium price.

The market will always go back to market equilibrium

Surpluses → Qty demanded smaller (<) than quantity supplied, excess supply

When does it occur? It is a reverse of ‘shortage’ meaning that it is when the price is set ABOVE equilibrium price.

Why does this occur? Because too much product (supply) in the market, compared to demand.

Changes in Market Equilibrium

When price reaches equilibrium level, consumers and firms are satisfied and will not engage in any action to make it change.

But if theres a change in the …

E.g. ‘Increase price of substitutes’ → Demand curve will shift to the right.

Price substitute expensive so they will buy diff product.

Price Mechanism

What is it? A system where the forces of demand and supply determine the price of a commodity and how the price changes lead to a reallocation of resources.

How can we find the key to the market’s ability to allocate resources?

Signaling and incentive functions of price in resource allocation.

Signals → Price communicates info to decision makers.

Incentive → Price motivates decision-makers to respond to the info.

The function of Price Mechanism

Resource allocation

How do we determine how much resource we put in production.

Signaling → As signal price communicates info to decision maker.

Incentive → Price motivates decision-makers to respond to the information.

Rationing

How do we distribute those types of goods?

Prices Rationing → Whether or not a customer will get good is determined by the price of it. All those who are willing to pay the price will get the goods.

Shortage → Price bids up (leaving only those with willingness and ability to pay buy).

What happened?

Producer

Signaling → Prices go up give producers signal that there is shortage in the goods market.

Incentive/ Motivation → Price increases also a sign for producers to supply/ increase price of products to gain more profit.

Consumers

New price signals that consumers should buy less bc producers increased the pricce.

Conclusion

The increase in pricce of goods resulted in the reallocation of resources. More resources are now allocated to strawberry production.

Examples:

Consumers de

Assignment:

08/21/2023

Use demand and supply diagrams to show in each of the following cases how the change in demand or supply for product A creates a disequilibrium consisting of excess demand or excess supply, and how the change in price eliminates the disequilibrium.

Consumer income increases (A is a normal good)

shift to the right.

Demand of normal good will increase

Consumer income falls (A is an inferior good)

Shift to the right.

The demand of inferior goods will increase.

There is an increase in labour costs

Producers will employ fewer people, and might even fire them. Thus resulting in the decrease of supply.

Shift to the left.

Price of substitute good B falls.

Demand increases due to price.

Supply decrease due to price decreasing.

Fall downwards.

Number of firms in the industry producing product A increases.

Supply increase.

Price decrease.

A successful advertising campaign emphasises the health benefits of product A.

The demand of product A will increase.

Supply will also increase.

Shifting to the right.

Demand Curve = Marginal benefit curve

Supply curve as a marginal cost

Producing of one more additional output

Used to show price that the firm is willing to accept in order to produce one more unit of good.

Marginal cost increases as the units of output increase.

Ex. producing 1st marker = $1, producing 2nd marker = $1.2 → Price increases.

Allocative efficiency

Whats allocative efficiency? Socially optimal situation when resources are distributed in a way that allows consumers and producers get the maximum possible benefit.

When do these occur? Occurs when community or social surplus is maximized.

Extra benefit to society of getting one more unit of good is = to extra cost to society of producing one more good.

What happens to society resources when it happens? Society resources is used to produce the right qty of goods.

If MC>MB then it means it would cost society more to produce than the benefit that society will receive so we should produce less.

Consumer surplus → Satisfaction/ benefit

What is it? Highest price willing to pay minus actual price paid.

Function of Price Mechanism

What’s price of mechanism? It is the means by which decisions of consumers and businesses interact to determine the allocation of resources.

Resource allocation

→ Signalling: Prices communicate information to decision-makers.

→ Incentive: Prices motivate decision maker to respond to the information

Rationing

→ What’s prices rationing? Whether or not a customer gets a good is determined by the price of the good. People who are willing and able to pay for it, will get it (duh).

→ What happens when there is a shortage? The price is bid up - leaving with consumers who are willing and able to pay.

Good example of explaining a graph:

Section A

Microeconomics

(a) explain how a decrease in income might affect the demand for normal goods and the demand for inferior goods.

Define terms first (definitions of demand, normal good, and inferior good). Identify all economic terms.

Diagrams to show how a decrease in income affects the demand for normal good and inferior goods.

Explanation of how a decrease in income reduces the demand for normal goods and increases the demand for inferior goods.

Examples of normal goods and inferior goods (use particular brand).

Because they have less purchasing power consumers are less willing and able to purchase at each given price ← lets examiners know that its only price.

(b) discusss the significance of income elasticity of demand for producers of primary products and producers of manufactured goods when incomes are rising.

(a) Explain the impact on consumers, producers and the govern,ent of a price floor being introduced in an agricultural market.

(b) Evaluate the view that a price ceiling is an ineffective___

determinants of demand and supply.

Knowt

Knowt