Ch 24 - Free Trade and Protectionism

Free trade: international trade (imports and exports) without government restrictions

Trade of goods and services without trade barriers

Protectionism:

Protection of domestic industries against foreign competition

Government restrictions are placed on the imports of foreign competitors (tariffs, quotas and subsidies)

Arguments for protectionism:

Protecting domestic employment

Protecting the economy from low cost labour

Protecting the economy from low cost labour

Protecting an infant (sunrise) industry

To conclude:

Protectionism raises prices to the consumers and producers of the input

Less choice for consumers

Competition would diminish and domestic firms would become inefficient

Reduced economic growth

Comparative advantage is distorted leading to inefficient use of world resources

Types of protectionism:

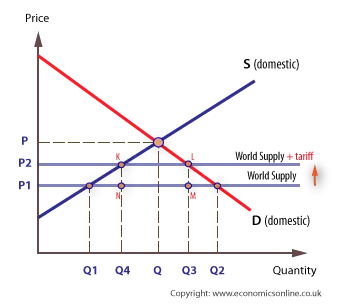

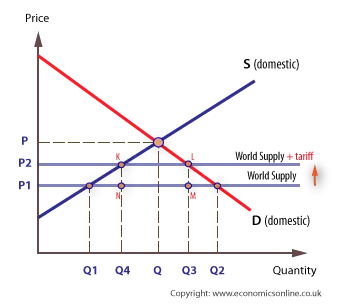

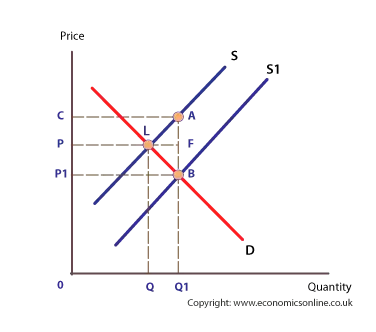

Tariff : a tax that is charged on an imported good. Any tax will cause suppliers to supply less

If wheat (example) is not purchased there is a deadweight loss of welfare

There is a deadweight loss of welfare

There is inefficiency of domestic products and a loss of world efficiency

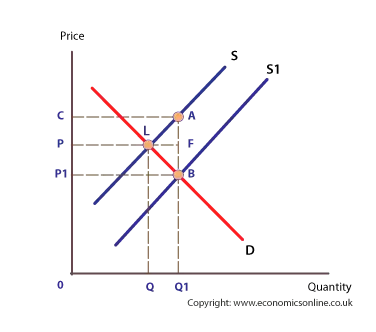

Subsidy: an amount of money paid by the government to a form per unit of output

Government is giving the subsidy to the fir to make it more competitive

Domestic supply curve will shift downward reducing the price

Consumers are indirectly affected by the government’s use of tax revenues to find the subsidy

Could lead to higher taxes and is an opportunity cost, governments could spend taxes on other things

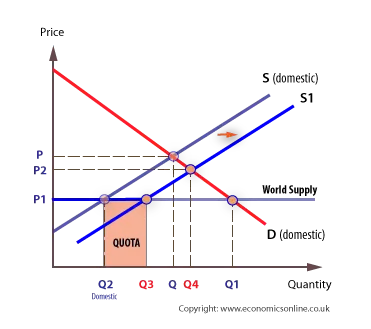

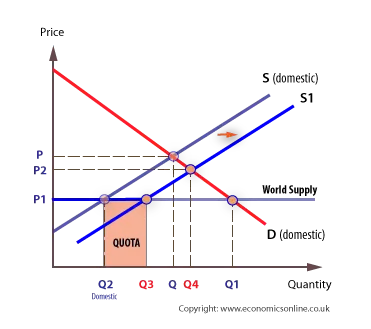

Quotas: physical limit on the number of value of goods that can be imported to a country

Excess demand of Q3Q2, prices begin to rise

As price rises, imports are not allowed to supply more

Domestic products begin to enter the market attracted by the high price of wheat

Voluntary export restraints:

Agreements between exporting and importing countries in which the exporting country agrees to limit the quality of exports of a specific good below a certain level

Administrative barriers:

When goods are imported there are always administrative processes

Health, safety, and environmental standards:

When restrictions are put on the type of goods that can sold in the domestic market

Embargoes: complete ban on imports

National embargoes: marketing campaigns to encourage people to buy domestic goods

Ch 24 - Free Trade and Protectionism

Free trade: international trade (imports and exports) without government restrictions

Trade of goods and services without trade barriers

Protectionism:

Protection of domestic industries against foreign competition

Government restrictions are placed on the imports of foreign competitors (tariffs, quotas and subsidies)

Arguments for protectionism:

Protecting domestic employment

Protecting the economy from low cost labour

Protecting the economy from low cost labour

Protecting an infant (sunrise) industry

To conclude:

Protectionism raises prices to the consumers and producers of the input

Less choice for consumers

Competition would diminish and domestic firms would become inefficient

Reduced economic growth

Comparative advantage is distorted leading to inefficient use of world resources

Types of protectionism:

Tariff : a tax that is charged on an imported good. Any tax will cause suppliers to supply less

If wheat (example) is not purchased there is a deadweight loss of welfare

There is a deadweight loss of welfare

There is inefficiency of domestic products and a loss of world efficiency

Subsidy: an amount of money paid by the government to a form per unit of output

Government is giving the subsidy to the fir to make it more competitive

Domestic supply curve will shift downward reducing the price

Consumers are indirectly affected by the government’s use of tax revenues to find the subsidy

Could lead to higher taxes and is an opportunity cost, governments could spend taxes on other things

Quotas: physical limit on the number of value of goods that can be imported to a country

Excess demand of Q3Q2, prices begin to rise

As price rises, imports are not allowed to supply more

Domestic products begin to enter the market attracted by the high price of wheat

Voluntary export restraints:

Agreements between exporting and importing countries in which the exporting country agrees to limit the quality of exports of a specific good below a certain level

Administrative barriers:

When goods are imported there are always administrative processes

Health, safety, and environmental standards:

When restrictions are put on the type of goods that can sold in the domestic market

Embargoes: complete ban on imports

National embargoes: marketing campaigns to encourage people to buy domestic goods

Knowt

Knowt