Chapter 5: Fraud, Internal Control, and Cash

Objective 5.1: Define fraud and internal control.

Fraud

Fraud can be defined as an attempt to deceive others for personal gain.

There are three categories for employee fraud:

Corruption:

Misusing one’s position and being dishonest for personal gain.

Commonly involves bribery, which is giving or receiving an offer that influences dishonest or illegal behavior.

Asset Misappropriation:

This is the act of theft, aka embezzlement.

One may embezzle cash, property, or private business information.

Out of the three categories, this one occurs most frequently

Financial Statement Fraud:

This is the act of creating false financial statements.

This creates a positive depiction of the company.

Three factors contribute and these factors are called the fraud triangle. The triangle includes incentives, opportunities, and rationalization.

Incentive:

The employee has a reason to commit fraud.

They may want to make the company look better, attract investors or partners, and to make it look as if they are meeting financial targets.

A loan covenant requires meeting financial targets. By not meeting the loan covenants, the company may face multiple consequences. This is an example of when an employee may report an inaccurate financial statement.

Opportunity:

The employees has a means of committing fraud.

This can be caused by weak internal controls.

An example would be having the opportunity for theft of cash.

Rationalization:

The employee perceives the misdeed as unavoidable or justified.

An example is someone using mental or medical conditions as a reason to commit fraud.

They justify their actions because of personal benefit and convincing themselves that they have “earned” it.

Fraud affects both private and public companies and also has an affect on the economy.

Sarbanes-Oxley Act (SOX)

The Sarbanes-Oxley Act (SOX) was passed to help protect investors avoid fraud and establish financial regulations for companies.

The requirements of SOX:

Counteract incentives - If an individual creates false representation for their company, they will face penalties like fines and possible jail time.

Reduce opportunities - Improving internal control to ensure fraud opportunities are not available, establish an audit committee of independent directors, and evaluate and report on the effectiveness of internal control over financial reporting.

Encourage honesty - Encourages employees to report concerns about certain activities. These employees are referred to as “whistleblowers'“.

Internal Control

Internal control involves people within a company enforcing policies to achieve objectives like:

Operations: working efficiently and avoiding fraud to protect assets.

Reporting: Reporting reliable and timely accounting information for internal and external users.

Compliance: Adhering to laws and regulations.

Framework for Analyzing Internal Control Systems

Components of internal control systems:

Control environment - Attitude towards internal control. Through integrity and ethical values, employees can understand the value and importance of internal controls.

Risk assessment - Analyzing the probability of fraud to protect the company.

Control activities - Creating policies and rules to to reduce risks.

Information and communication - Proper communication of information to help the decision making process within a company.

Monitoring activities - Observing work efforts and communicating the responsibilities to those within the organization

These components apply to all divisions in a company, whether entry level or higher up positions.

Objective 5.2: Explain common principles and limitations of internal control.

Principles of Control Activities

These principles correlate and strengthen the components of internal control.

The five common principles of internal control:

Establish responsibility

Give tasks to employees and company members.

By having individual employees do an individual tasks, detecting errors is easier.

Segregate duties

Distribute responsibilities amongst employees.

Segregation of duties is giving individual employees separate tasks and responsibilities in a process to avoid mistakes and create equal work.

This is the most effective method for record keeping and monitoring those who don’t have access to the company’s assets.

Restrict access

Assets should be secured and used only to fulfill responsibilities.

Physical assets should be locked up and electronic information should require a passcode.

Document procedures

Record activities within documents.

These can be activities such as transactions and transportations of goods.

These records can be referenced later if needed.

Independently verify

Check others’ work.

Verify employees are completing their tasks and doing so correctly.

Comparing or reviewing financial information.

Control Limitations

Errors may not always be detected.

One limitation is implementing internal controls only to the extent their benefits exceed their costs.

The second limitation is human error or fraud. An employee may not catch certain details or possible fraud.

Objective 5.3: Apply internal control principles to cash receipts and payments.

Controls for Cash Receipts

Internal control for cash is crucial and cash transactions should be monitored due to risk of errors and theft.

Cash receipts is an internal control to ensure the appropriate amount of cash is gained.

Cash received in person:

A cash transaction occurs, a receipt is given, then the cash is deposited into the bank.

The receipts are recorded.

This allows easy “pin pointing” to where and who may have created the error or committed theft.

Segregated duties are distributed to cashiers, supervisors, and the accounting department:

Cashiers scan products, collect cash, and prepares cash count sheets.

Supervisors compares cash in register to cash sheet, transfers cash to vault, and completes bank deposits.

The Accounting Department compares cash register records, the cash sheet, and the bank deposit slip. Then a journal entry is created.

Three important functions for in person cash exchanges:

Amount in transaction should be recorded.

Access to cash should be limited.

The total of cash sales should be documented.

Cash received from a remote source:

Cash received through mail:

Checks are mailed from customers who paid on account.

Instead of a cashier dealing with the money, a mail clerk lists the amounts received on a cash receipt list.

Mail clerks are supervised so they don’t steal the cash. In this case, the mail clerk and supervisor sign the the completed cash receipts list.

They must also be stamped “For Deposit Only” so the bank doesn’t exchange it for cash.

With the cash mailed in from the customer, there is usually a remittance advice note that explains the payment.

The accounting department compares the total on the cash receipts list with the deposit slip received from the bank.

The journal entry for this is a debit to Cash and a credit to Accounts Receivable.

Cash received electronically:

Cash received from electronic funds transfer (EFT) is when a customer transfers money from their bank account to the company’s bank account.

Company’s prefer EFTs because they are immediate and mailed in cash takes several days to be received.

EFTs eliminate need for some internal controls.

The journal entry for EFTs is to debit Cash and credit Accounts Receivable.

Controls for Cash Payments

Cash payments involve:

Writing a check or completing an electronic funds transfer (EFT) to a supplier

Paying employees via EFT

A petty cash system (when a company pays for a purchase using dollar bills and change)

The primary goal of internal controls for all cash payments is to ensure the business pays only for properly authorized transactions.

Cash Paid by Check for Purchases on Account

When company’s pay on account and are able to pay back, they use a check or EFT.

Checks and EFTs are considered to be part of the voucher system, which is a process for approving and documenting all purchases and payments made on account.

A voucher is a collection of documents prepared at each step in the system.

Some steps and documentations for obtaining goods or services include:

Requesting a good or service to be ordered needs a purchase requisition.

Ordering the goods or services requires purchase order documentation.

Receiving goods or services requires a receiving report.

Getting billed for goods or services requires a supplier invoice.

Writing a check or using an EFT to pay a bill requires a check or an EFT transaction number.

Robotic process automation (RPA) is a software that combines automation and artificial intelligence to perform certain responsibilities

Cash Paid to Employees via Electronic Funds Transfer

Direct deposits for employees are paid through EFTs from companies.

This payment to employees is fast and simple HOWEVER there is a risk of a bank possibly underpaying or overpaying an employee.

An imprest payroll system is used to pay employees and restricts the total amount paid to others by limiting the amount of money available to be transferred.

The total net pay of all employees is moved into a special account and later transferred into the individual employee’s checking accounts.

Detecting an error:

The special payroll account should be 0 after employees are paid.

An error has occurred if the balance is above or below 0.

Cash Paid to Reimburse Employees (Petty Cash)

A petty cash fund is a system used to reimburse employees for expenditures they may have made on behalf of the organizations.

It uses a limited amount cash for specific types of expenses.

The petty cash fund is physical cash looked after by a cash custodian.

The cash custodian should be supervised to ensure no theft occurs.

Controls From Bank Procedures

Bank services help businesses control cash in multiple ways by:

Restricting access and secure deposited cash.

Documenting business transactions such as payments by check or EFT.

Using bank statements to review a company’s cash records and see if they are accurate or require adjustments.

Objective 5.4: Perform the key control of reconciling cash to bank statements.

Cash Reporting

The balance in a company’s cash records is usually different from the balance in the bank’s records.

The process of comparing two sets of records is called reconciling, aka a bank reconciliation, which provides independent verification of all cash transactions the bank has processed for the company.

Bank reconciliations are prepared monthly.

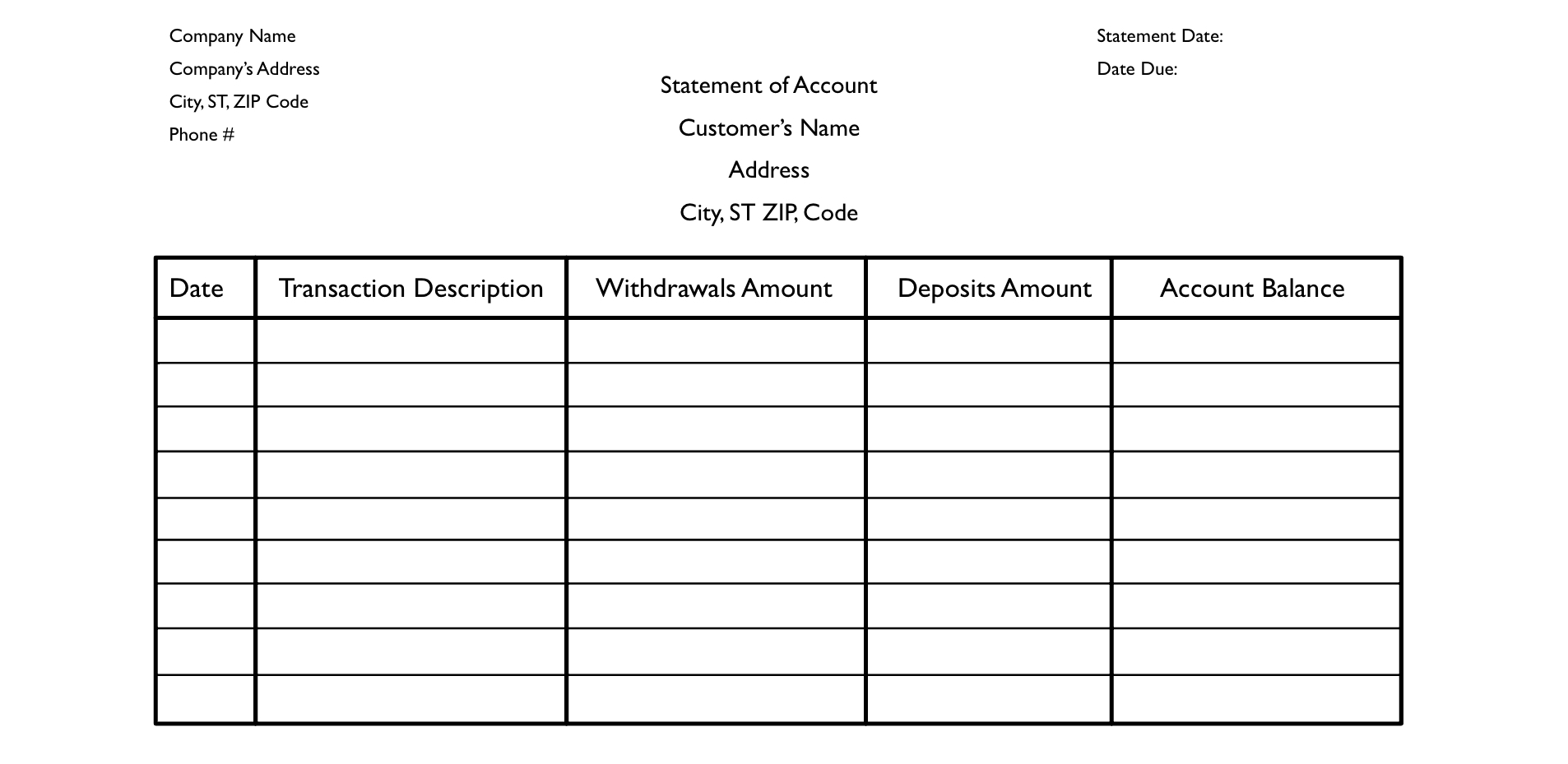

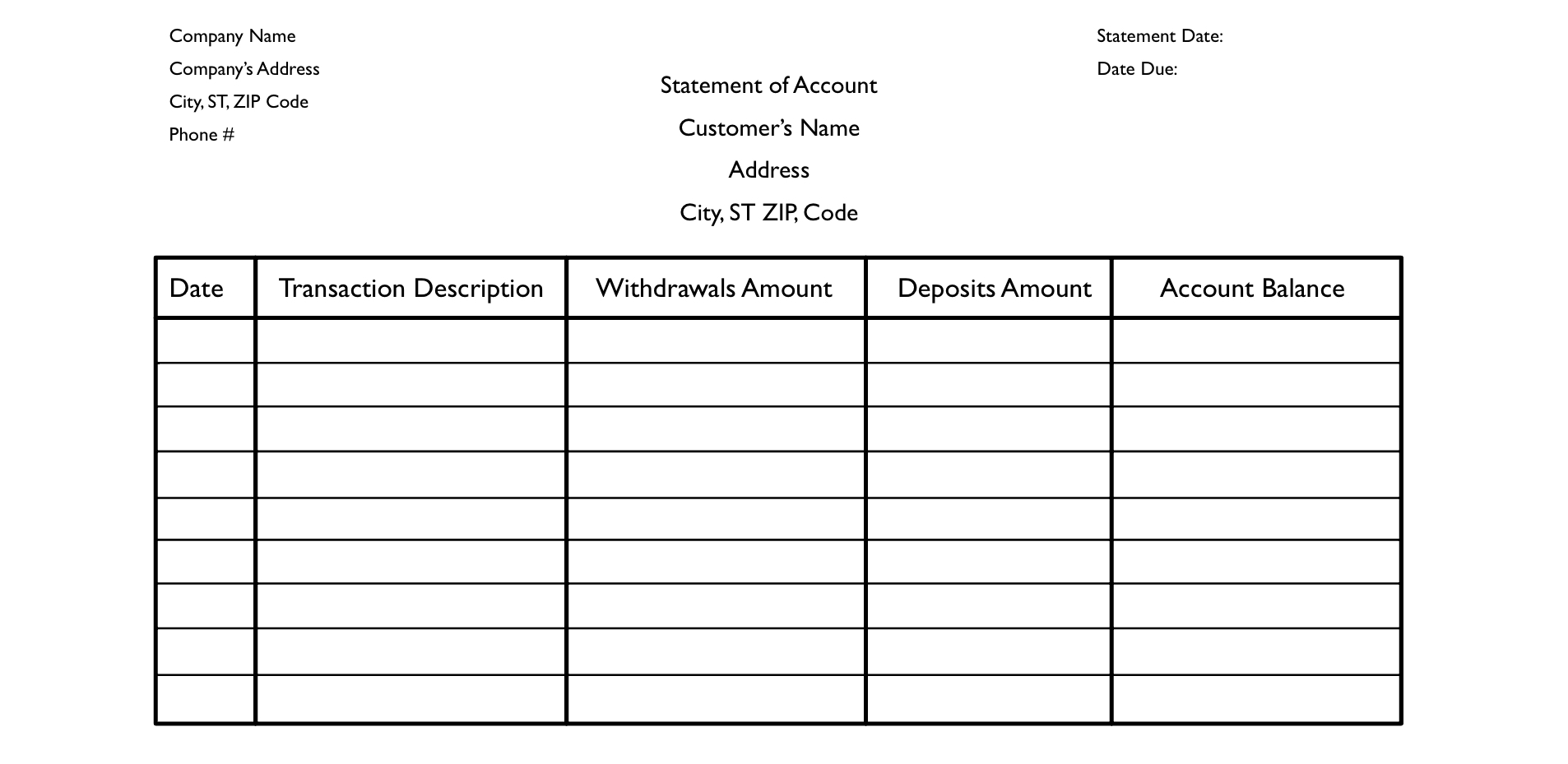

Bank Statement

Each account that a company has will have an online statement created by the bank.

The typical format includes:

The current balance

A transaction description

Withdrawals made

Deposits made

The overall balance of the account

Checks Cleared

The owner of the check can give the check to a financial institution for deposit OR can send a digital image of it.

After the check writer’s bank withdraws the amount of the check from the check writer’s account, it will be reported as a deduction on the bank statement.

The check is then said to have cleared the bank.

Checks are listed on bank statements in the order they are cleared.

Deposits Made

Deposits are listed on bank statements in the order they are processed.

Deposits made after “closing time” may not be processed until the next day.

Other Transactions

Bank account balances can increase and decrease based on activities.

Increases when:

Checks are deposited

Interest is earned

Funds are transferred electronically

Decreases when:

Service fees are charged

Funds are transferred out electronically

The bank statement is presented from the bank’s point of view**.**

A company’s account balance is considered a liability to the bank.

Increased liabilities are credited on the bank statement.

Decreased amounts are debited on the bank statement.

These activities may be labeled with symbols:

Debit memo

Credit memo

Bank Reconciliation

This process involves comparing a company’s records to their bank statement to see if they match up. The company’s record may be different because:

Errors made by the bank

Time lag

Deposits in transit refers to depositing a check after “closing time” and will be processed the next day.

Outstanding checks is a type of lag where the bank doesn’t know about the company’s deposit until the company deposits the check into its own bank, which notifies the other bank.

Adding interest to your records.

EFTs - Funds are coming in and out of your account

Service charges

The bank charges you for its services.

Journal entry for this case it debit Bank Charges Expense and credit Cash.

Deposited checks

NSF (non-sufficient funds) checks are checks from your customers that were rejected due to the insufficient balance is the the customer’s personal bank account.

The cash was put into an account, but taken back out upon the discovery of the NSF.

Company errors/your own errors - There may be times where things may have not been recorded properly or forgotten

Objective 5.5: Explain the reporting of cash.

Reporting Cash

Cash on the balance sheet includes:

Deposited cash with banks

Petty cash

Cash equivalents

Cash equivalents are short term and highly liquid investments purchased within three months of maturity. They are readily convertible to known amounts of cash. There is little risk their value will change.

Cash equivalents can include:

Certificates of deposit (CDs)

Money market funds

Government Treasury bills

Other highly liquid investments

Restricted Cash

Restricted cash is money a company must legally set aside for purposes not related to day to day operations.

It is reported separately on the balance sheet.

A company may use this set aside cash for future debt payments or promoting the company.

When restricted cash is separated from other cash, it gives a better portrayal of how much money a company has to cover liabilities.

Restricted cash used within a year is a current asset.

Restricted cash not used within a year is a non-current asset.

Chapter 5: Fraud, Internal Control, and Cash

Objective 5.1: Define fraud and internal control.

Fraud

Fraud can be defined as an attempt to deceive others for personal gain.

There are three categories for employee fraud:

Corruption:

Misusing one’s position and being dishonest for personal gain.

Commonly involves bribery, which is giving or receiving an offer that influences dishonest or illegal behavior.

Asset Misappropriation:

This is the act of theft, aka embezzlement.

One may embezzle cash, property, or private business information.

Out of the three categories, this one occurs most frequently

Financial Statement Fraud:

This is the act of creating false financial statements.

This creates a positive depiction of the company.

Three factors contribute and these factors are called the fraud triangle. The triangle includes incentives, opportunities, and rationalization.

Incentive:

The employee has a reason to commit fraud.

They may want to make the company look better, attract investors or partners, and to make it look as if they are meeting financial targets.

A loan covenant requires meeting financial targets. By not meeting the loan covenants, the company may face multiple consequences. This is an example of when an employee may report an inaccurate financial statement.

Opportunity:

The employees has a means of committing fraud.

This can be caused by weak internal controls.

An example would be having the opportunity for theft of cash.

Rationalization:

The employee perceives the misdeed as unavoidable or justified.

An example is someone using mental or medical conditions as a reason to commit fraud.

They justify their actions because of personal benefit and convincing themselves that they have “earned” it.

Fraud affects both private and public companies and also has an affect on the economy.

Sarbanes-Oxley Act (SOX)

The Sarbanes-Oxley Act (SOX) was passed to help protect investors avoid fraud and establish financial regulations for companies.

The requirements of SOX:

Counteract incentives - If an individual creates false representation for their company, they will face penalties like fines and possible jail time.

Reduce opportunities - Improving internal control to ensure fraud opportunities are not available, establish an audit committee of independent directors, and evaluate and report on the effectiveness of internal control over financial reporting.

Encourage honesty - Encourages employees to report concerns about certain activities. These employees are referred to as “whistleblowers'“.

Internal Control

Internal control involves people within a company enforcing policies to achieve objectives like:

Operations: working efficiently and avoiding fraud to protect assets.

Reporting: Reporting reliable and timely accounting information for internal and external users.

Compliance: Adhering to laws and regulations.

Framework for Analyzing Internal Control Systems

Components of internal control systems:

Control environment - Attitude towards internal control. Through integrity and ethical values, employees can understand the value and importance of internal controls.

Risk assessment - Analyzing the probability of fraud to protect the company.

Control activities - Creating policies and rules to to reduce risks.

Information and communication - Proper communication of information to help the decision making process within a company.

Monitoring activities - Observing work efforts and communicating the responsibilities to those within the organization

These components apply to all divisions in a company, whether entry level or higher up positions.

Objective 5.2: Explain common principles and limitations of internal control.

Principles of Control Activities

These principles correlate and strengthen the components of internal control.

The five common principles of internal control:

Establish responsibility

Give tasks to employees and company members.

By having individual employees do an individual tasks, detecting errors is easier.

Segregate duties

Distribute responsibilities amongst employees.

Segregation of duties is giving individual employees separate tasks and responsibilities in a process to avoid mistakes and create equal work.

This is the most effective method for record keeping and monitoring those who don’t have access to the company’s assets.

Restrict access

Assets should be secured and used only to fulfill responsibilities.

Physical assets should be locked up and electronic information should require a passcode.

Document procedures

Record activities within documents.

These can be activities such as transactions and transportations of goods.

These records can be referenced later if needed.

Independently verify

Check others’ work.

Verify employees are completing their tasks and doing so correctly.

Comparing or reviewing financial information.

Control Limitations

Errors may not always be detected.

One limitation is implementing internal controls only to the extent their benefits exceed their costs.

The second limitation is human error or fraud. An employee may not catch certain details or possible fraud.

Objective 5.3: Apply internal control principles to cash receipts and payments.

Controls for Cash Receipts

Internal control for cash is crucial and cash transactions should be monitored due to risk of errors and theft.

Cash receipts is an internal control to ensure the appropriate amount of cash is gained.

Cash received in person:

A cash transaction occurs, a receipt is given, then the cash is deposited into the bank.

The receipts are recorded.

This allows easy “pin pointing” to where and who may have created the error or committed theft.

Segregated duties are distributed to cashiers, supervisors, and the accounting department:

Cashiers scan products, collect cash, and prepares cash count sheets.

Supervisors compares cash in register to cash sheet, transfers cash to vault, and completes bank deposits.

The Accounting Department compares cash register records, the cash sheet, and the bank deposit slip. Then a journal entry is created.

Three important functions for in person cash exchanges:

Amount in transaction should be recorded.

Access to cash should be limited.

The total of cash sales should be documented.

Cash received from a remote source:

Cash received through mail:

Checks are mailed from customers who paid on account.

Instead of a cashier dealing with the money, a mail clerk lists the amounts received on a cash receipt list.

Mail clerks are supervised so they don’t steal the cash. In this case, the mail clerk and supervisor sign the the completed cash receipts list.

They must also be stamped “For Deposit Only” so the bank doesn’t exchange it for cash.

With the cash mailed in from the customer, there is usually a remittance advice note that explains the payment.

The accounting department compares the total on the cash receipts list with the deposit slip received from the bank.

The journal entry for this is a debit to Cash and a credit to Accounts Receivable.

Cash received electronically:

Cash received from electronic funds transfer (EFT) is when a customer transfers money from their bank account to the company’s bank account.

Company’s prefer EFTs because they are immediate and mailed in cash takes several days to be received.

EFTs eliminate need for some internal controls.

The journal entry for EFTs is to debit Cash and credit Accounts Receivable.

Controls for Cash Payments

Cash payments involve:

Writing a check or completing an electronic funds transfer (EFT) to a supplier

Paying employees via EFT

A petty cash system (when a company pays for a purchase using dollar bills and change)

The primary goal of internal controls for all cash payments is to ensure the business pays only for properly authorized transactions.

Cash Paid by Check for Purchases on Account

When company’s pay on account and are able to pay back, they use a check or EFT.

Checks and EFTs are considered to be part of the voucher system, which is a process for approving and documenting all purchases and payments made on account.

A voucher is a collection of documents prepared at each step in the system.

Some steps and documentations for obtaining goods or services include:

Requesting a good or service to be ordered needs a purchase requisition.

Ordering the goods or services requires purchase order documentation.

Receiving goods or services requires a receiving report.

Getting billed for goods or services requires a supplier invoice.

Writing a check or using an EFT to pay a bill requires a check or an EFT transaction number.

Robotic process automation (RPA) is a software that combines automation and artificial intelligence to perform certain responsibilities

Cash Paid to Employees via Electronic Funds Transfer

Direct deposits for employees are paid through EFTs from companies.

This payment to employees is fast and simple HOWEVER there is a risk of a bank possibly underpaying or overpaying an employee.

An imprest payroll system is used to pay employees and restricts the total amount paid to others by limiting the amount of money available to be transferred.

The total net pay of all employees is moved into a special account and later transferred into the individual employee’s checking accounts.

Detecting an error:

The special payroll account should be 0 after employees are paid.

An error has occurred if the balance is above or below 0.

Cash Paid to Reimburse Employees (Petty Cash)

A petty cash fund is a system used to reimburse employees for expenditures they may have made on behalf of the organizations.

It uses a limited amount cash for specific types of expenses.

The petty cash fund is physical cash looked after by a cash custodian.

The cash custodian should be supervised to ensure no theft occurs.

Controls From Bank Procedures

Bank services help businesses control cash in multiple ways by:

Restricting access and secure deposited cash.

Documenting business transactions such as payments by check or EFT.

Using bank statements to review a company’s cash records and see if they are accurate or require adjustments.

Objective 5.4: Perform the key control of reconciling cash to bank statements.

Cash Reporting

The balance in a company’s cash records is usually different from the balance in the bank’s records.

The process of comparing two sets of records is called reconciling, aka a bank reconciliation, which provides independent verification of all cash transactions the bank has processed for the company.

Bank reconciliations are prepared monthly.

Bank Statement

Each account that a company has will have an online statement created by the bank.

The typical format includes:

The current balance

A transaction description

Withdrawals made

Deposits made

The overall balance of the account

Checks Cleared

The owner of the check can give the check to a financial institution for deposit OR can send a digital image of it.

After the check writer’s bank withdraws the amount of the check from the check writer’s account, it will be reported as a deduction on the bank statement.

The check is then said to have cleared the bank.

Checks are listed on bank statements in the order they are cleared.

Deposits Made

Deposits are listed on bank statements in the order they are processed.

Deposits made after “closing time” may not be processed until the next day.

Other Transactions

Bank account balances can increase and decrease based on activities.

Increases when:

Checks are deposited

Interest is earned

Funds are transferred electronically

Decreases when:

Service fees are charged

Funds are transferred out electronically

The bank statement is presented from the bank’s point of view**.**

A company’s account balance is considered a liability to the bank.

Increased liabilities are credited on the bank statement.

Decreased amounts are debited on the bank statement.

These activities may be labeled with symbols:

Debit memo

Credit memo

Bank Reconciliation

This process involves comparing a company’s records to their bank statement to see if they match up. The company’s record may be different because:

Errors made by the bank

Time lag

Deposits in transit refers to depositing a check after “closing time” and will be processed the next day.

Outstanding checks is a type of lag where the bank doesn’t know about the company’s deposit until the company deposits the check into its own bank, which notifies the other bank.

Adding interest to your records.

EFTs - Funds are coming in and out of your account

Service charges

The bank charges you for its services.

Journal entry for this case it debit Bank Charges Expense and credit Cash.

Deposited checks

NSF (non-sufficient funds) checks are checks from your customers that were rejected due to the insufficient balance is the the customer’s personal bank account.

The cash was put into an account, but taken back out upon the discovery of the NSF.

Company errors/your own errors - There may be times where things may have not been recorded properly or forgotten

Objective 5.5: Explain the reporting of cash.

Reporting Cash

Cash on the balance sheet includes:

Deposited cash with banks

Petty cash

Cash equivalents

Cash equivalents are short term and highly liquid investments purchased within three months of maturity. They are readily convertible to known amounts of cash. There is little risk their value will change.

Cash equivalents can include:

Certificates of deposit (CDs)

Money market funds

Government Treasury bills

Other highly liquid investments

Restricted Cash

Restricted cash is money a company must legally set aside for purposes not related to day to day operations.

It is reported separately on the balance sheet.

A company may use this set aside cash for future debt payments or promoting the company.

When restricted cash is separated from other cash, it gives a better portrayal of how much money a company has to cover liabilities.

Restricted cash used within a year is a current asset.

Restricted cash not used within a year is a non-current asset.

Knowt

Knowt