Chapter 1: Business Decisions and Financial Accounting

Objective 1.1: Describe various organizational forms and business decision makers.

The Three Types of Businesses

1.) Sole Proprietorship

Business that is owned by one individual.

The owner is liable for the debts of the business.

It is the easiest form of business to start.

No special legal maneuvers are required.

The profits or losses from the business become a part of the owner’s tax return/income.

2.) Partnership

Business owned by 2 or more individuals.

Each partner is personally liable for the debts of their business.

It is slightly more expense to create and needs a lawyer to come up with a partnership agreement.

The profits or losses are split between the owners.

3.) Corporation

Considered a separate legal entity and is formed by documents filed with a state.

A lawyer is required and legal fees are high.

The owners of the corporations, stockholders, are not personally liable for the debts.

Income taxes are paid by the corporation and the owners (dividends).

Can be a public or private company:

Public company: Your stock is readily available for people to buy

Private company: The stock is owned by individuals and privately conducts the process of buying and selling to others

Corporations commonly start as a private company, but can “go public” if needed.

Initial Public Offering (IPO) - “Going public”. This is the very first day that stock is traded on an established stock market.

Limited Liability Companies

Limited Liability Companies (LLC) - A company that is a combination of a corporation and a sole proprietorship or a partnership.

It can have characteristics from the three types of business, depending on the number of owners.

You must file with the state to become a LLC.

Primary characteristics:

Has limited liability like a corporation.

Has access to pass through income taxation like a partnership or sole proprietorship.

If there are two owners, it can be taxed as a partnership.

The Accounting System

In accounting, you are analyzing, recording, and summarizing financial information and reporting the outcome of business activity.

There are two types of reports that can be produced:

1.) Managerial Reports

For internal users

Reports on the operating activities of a business

Includes financial plans

2.) Financial Statements

For external users (those who are not employed at the company)

Periodic statements

There are four types of external users:

1.) creditors (ex: banks)

2.) investors (the stockholders)

3.) directors ( aka the board of directors)

4.) government (ex: IRS, SEC)

Different types of business activities can be reported:

Operating activities generate profit and involve short term expenses. These are the simple actions of running a business (buying supplies, paying employees).

Investing activities involve the process of buying and selling assets that are considered long term (ex: equipment, land, buildings).

Financing activities are more formal actions (not day to day) such as borrowing money from the bank, paying loans, receiving cash, or paying dividends.

Objective 1.2: Describe the purpose, structure, and content of the four basic financial statements.

The Basic Accounting Equation

Resources Owned = | Resources Owed | Resources Owed |

|---|---|---|

by the company | to creditors | to stockholders |

Assets = | Liabilities + | Stockholders’ Equity |

The Basic Accounting Equation:

Assets = Liabilities + Stockholders’ Equity

Must always be balanced.

Separate Entity Assumption- The financial reports of a business are assumed to include the results of only that business’s activities**.**

Assets

Resources the company owns and will benefit from in the future.

Examples:

Cash

Supplies

Equipment

Accounts Receivable

Software

Buildings

Liabilities

Measurable amounts a company owes to creditors.

If you see the word “payable”, it is a liability.

Examples:

Notes Payable - This is when you borrow money from a bank. Considered a formal agreement (legal document, aka promissory note, is required).

Accounts Payable - Less formal agreement. You are paying for something “on account”, no legal document is required.

Stockholders’ Equity

What stockholders (owners) are entitled to.

Stockholders is interchangeable with shareholders.

An owner’s claims to the business can arise from 2 sources:

Common Stock - This is equity PAID by stockholders to get stock.

Retained Earnings - This is equity EARNED by the company. It represents cumulative profit or loss of the company.

Revenues, Expenses, and Net Income

Revenues are the amounts we earn from selling goods or services:

They are recorded when earned (after doing a sale or service).

Expenses are considered to be day to day operations:

They are the cost of what is needed to earn revenue, such as paying employees, paying bills, paying for space/land, etc.

They are recorded when they are incurred (to become liable or subject to).

Equation for calculating net income:

Revenues - Expenses = Net Income

If Revenues > Expenses, it is Net Income and increases equity (Good)

If Revenues are < Expenses, it is Net Loss and decreases equity (Bad)

Example of Net Income:

$6,000 (R) - $2,000 (E) = $4,000 (N/I)

Example of Net Loss:

$2,000 (R) - $6,000 (E) = -$4,000 (N/L)

Dividends

Dividends are considered a financing activity that involves using the profits of the company to “repay” (usually in cash) shareholders as a return on their investments towards the business.

Dividends are a component of Retained Earnings.

They help reduce Retained Earnings.

Dividends are not considered to be an expense.

Using the Basic Accounting Equation:

Example: Use the following information to plug into the basic accounting equation:

Assets = 168

Liabilities = 75

Stockholders’ Equity = 93

75 + 93 adds up to 168, so the equation is balanced.

168 = 168

168 (Assets) = | 75 (Liabilities) + | 93 (S/E) |

|---|

Financial Statements

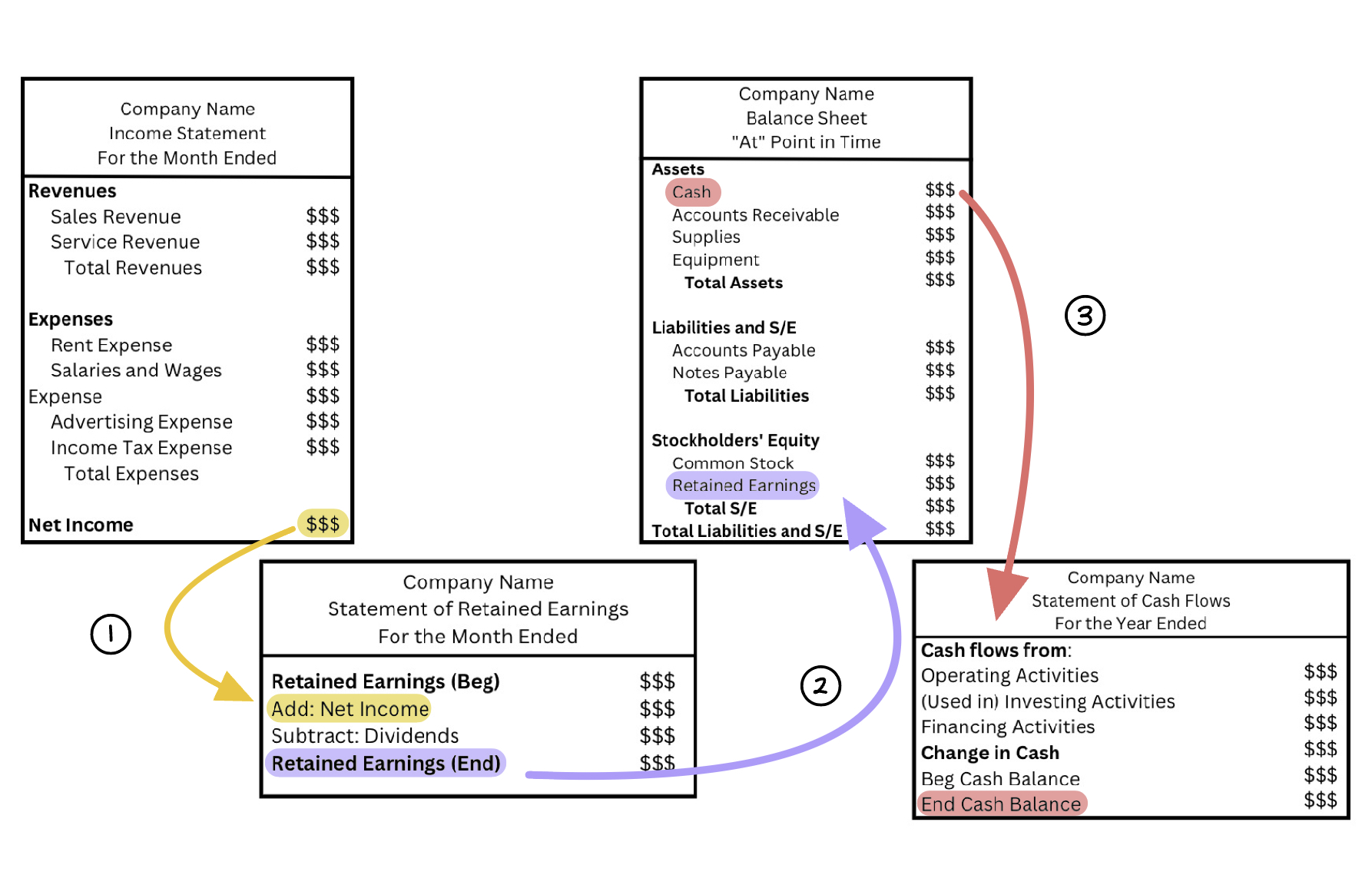

There are four types of financial statements and they are prepared in the following order:

Income Statement

Statements of Retained Earnings

Balance Sheet

Statement of Cash Flows

They can be prepared monthly, quarterly, and annually.

If they are annual reports, they can either be based on a calendar year or fiscal year:

Both are reported in a 12 month period

A calendar year ends on December 31

A fiscal year ends on a day that is not December first (can be anytime during the year)

The Structure of Financial Statements

Financial statements have headings that address who, what, and when.

They include the name of the company, what type of report is being presented, and the accounting period for the report.

The Income Statement

This report provides information regarding profitability for a specific period.

The structure of the Income Statement:

Heading (who, what, when)

Company name

Income Statement

For the Month Ended

Revenue

Ex: Sales/Service Revenue

Total Revenues

Expense

Ex: Rent Expense, Utilities Expense

Total Expenses

Net Income/Loss

Expenses are listed from biggest to smallest.

Income Tax Expense is always listed last.

You want Revenues to be higher than Expenses to get Net Income.

Unit of measurement assumption - the proper monetary unit must be used to report business activities (ex: United States = Dollar).

The amount of Net Income/Loss with carry over into the next Financial Statements.

The Statement of Retained Earnings

This report provides information regarding the company’s dividends and how their distribution affects the company’s financial position.

The structure of the Statement of Retained Earnings:

Heading (who, what, when)

Company name

Statement of Retained Earnings

For the Month Ended

Retained Earnings (beginning)

Add/Subtract: Net Income/Loss

Subtract: Dividends

Retained Earnings (ending)

Retained Earnings (beginning) is the balance of the last period. If it is a new business, it will be $0.

The Balance Sheet

In regards to source of financing, this sheet reports:

Assets - What the business owns.

Liabilities - Money borrowed and whats owed to creditors.

Stockholders’ Equity - Money leftover to go to company’s shareholders.

Balance sheets are considered to be a “snapshot” of a business’s resources on a specific date.

The structure of the Balance Sheet:

Heading (who, what, when)

Company name

Balance Sheet

“At” a specific date

Assets

Ex: Cash, Supplies, Equipment

Total Assets

Liabilities and Stockholders’ Equity

Ex: Payables

Total Liabilities (to creditors)

Stockholders’ Equity

Only 2: Common Stock and Retained Earnings

Total Stockholder’s Equity (to stockholders)

Total Liabilities and Stockholders’ Equity

Assets must = liabilities + stockholders’ equity (it “balances”)

Cost principle - Assets are recorded based on what we negotiated to pay for them.

The Statement of Cash Flows

Reports the effects on cash balance based on operating, financing, and investing activities.

The structure of the Statement of Cash Flows:

Heading (who, what, when “For the Month Ended”)

Company name

Statement of Cash Flows

For the Month Ended

Cash Flows from Operating Activities

Cash received from customers

Cash paid to employees and suppliers

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash used to buy equipment and software

Cash from Investing Activities

Cash Flows from Financing Activities

Cash received for stock issuance

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance (beginning of the month)

Ending Cash Balance (end of the month)

Cash from Statement of Cash Flows must be equal to the cash reported on the Balance Sheet

How These Statements Connect

(1.) Net Income/Loss from the Income Statement carries over onto the Statement of Retained Earnings.

(2.) On the Statement of Retained Earnings, the ending Retained Earnings moves to the “Stockholders’ Equity” section on the Balance Sheet.

(3.) Cash amount reported under the “Assets” section of the Balance Sheet must be equal to the “Ending Cash Balance” on the Statement of Cash Flows.

Objective 1.3: Explain how financial statements are used by decision makers.

What Does Each Statement Do For Creditors and Stockholders?

The Income Statement provides the stockholders with what the long term return is.

The Statement of Retained Earnings shows the returns through dividends that are to be distributed to investors.

The Balance Sheet allows creditors to see if the business’s assets will cover their liabilities.

The Statement of Cash Flows shows if a business is making enough money to pay the amounts it owes.

Objective 1.4: Describe factors that contribute to useful financial information.

External Financial Reporting

External users review and utilize the information of different financial statements.

In order for decision makers to use these statements, it is important for the statements to be:

Verifiable

Timely

Comparable

Understandable

Accounting Standards

FASB - Financial Accounting Standards Board (United States)

GAAP - Generally Accepted Accounting Principles (United States)

IASB - International Accounting Standards Board

IFRS - International Financial Reporting Standard

Chapter 1: Business Decisions and Financial Accounting

Objective 1.1: Describe various organizational forms and business decision makers.

The Three Types of Businesses

1.) Sole Proprietorship

Business that is owned by one individual.

The owner is liable for the debts of the business.

It is the easiest form of business to start.

No special legal maneuvers are required.

The profits or losses from the business become a part of the owner’s tax return/income.

2.) Partnership

Business owned by 2 or more individuals.

Each partner is personally liable for the debts of their business.

It is slightly more expense to create and needs a lawyer to come up with a partnership agreement.

The profits or losses are split between the owners.

3.) Corporation

Considered a separate legal entity and is formed by documents filed with a state.

A lawyer is required and legal fees are high.

The owners of the corporations, stockholders, are not personally liable for the debts.

Income taxes are paid by the corporation and the owners (dividends).

Can be a public or private company:

Public company: Your stock is readily available for people to buy

Private company: The stock is owned by individuals and privately conducts the process of buying and selling to others

Corporations commonly start as a private company, but can “go public” if needed.

Initial Public Offering (IPO) - “Going public”. This is the very first day that stock is traded on an established stock market.

Limited Liability Companies

Limited Liability Companies (LLC) - A company that is a combination of a corporation and a sole proprietorship or a partnership.

It can have characteristics from the three types of business, depending on the number of owners.

You must file with the state to become a LLC.

Primary characteristics:

Has limited liability like a corporation.

Has access to pass through income taxation like a partnership or sole proprietorship.

If there are two owners, it can be taxed as a partnership.

The Accounting System

In accounting, you are analyzing, recording, and summarizing financial information and reporting the outcome of business activity.

There are two types of reports that can be produced:

1.) Managerial Reports

For internal users

Reports on the operating activities of a business

Includes financial plans

2.) Financial Statements

For external users (those who are not employed at the company)

Periodic statements

There are four types of external users:

1.) creditors (ex: banks)

2.) investors (the stockholders)

3.) directors ( aka the board of directors)

4.) government (ex: IRS, SEC)

Different types of business activities can be reported:

Operating activities generate profit and involve short term expenses. These are the simple actions of running a business (buying supplies, paying employees).

Investing activities involve the process of buying and selling assets that are considered long term (ex: equipment, land, buildings).

Financing activities are more formal actions (not day to day) such as borrowing money from the bank, paying loans, receiving cash, or paying dividends.

Objective 1.2: Describe the purpose, structure, and content of the four basic financial statements.

The Basic Accounting Equation

Resources Owned = | Resources Owed | Resources Owed |

|---|---|---|

by the company | to creditors | to stockholders |

Assets = | Liabilities + | Stockholders’ Equity |

The Basic Accounting Equation:

Assets = Liabilities + Stockholders’ Equity

Must always be balanced.

Separate Entity Assumption- The financial reports of a business are assumed to include the results of only that business’s activities**.**

Assets

Resources the company owns and will benefit from in the future.

Examples:

Cash

Supplies

Equipment

Accounts Receivable

Software

Buildings

Liabilities

Measurable amounts a company owes to creditors.

If you see the word “payable”, it is a liability.

Examples:

Notes Payable - This is when you borrow money from a bank. Considered a formal agreement (legal document, aka promissory note, is required).

Accounts Payable - Less formal agreement. You are paying for something “on account”, no legal document is required.

Stockholders’ Equity

What stockholders (owners) are entitled to.

Stockholders is interchangeable with shareholders.

An owner’s claims to the business can arise from 2 sources:

Common Stock - This is equity PAID by stockholders to get stock.

Retained Earnings - This is equity EARNED by the company. It represents cumulative profit or loss of the company.

Revenues, Expenses, and Net Income

Revenues are the amounts we earn from selling goods or services:

They are recorded when earned (after doing a sale or service).

Expenses are considered to be day to day operations:

They are the cost of what is needed to earn revenue, such as paying employees, paying bills, paying for space/land, etc.

They are recorded when they are incurred (to become liable or subject to).

Equation for calculating net income:

Revenues - Expenses = Net Income

If Revenues > Expenses, it is Net Income and increases equity (Good)

If Revenues are < Expenses, it is Net Loss and decreases equity (Bad)

Example of Net Income:

$6,000 (R) - $2,000 (E) = $4,000 (N/I)

Example of Net Loss:

$2,000 (R) - $6,000 (E) = -$4,000 (N/L)

Dividends

Dividends are considered a financing activity that involves using the profits of the company to “repay” (usually in cash) shareholders as a return on their investments towards the business.

Dividends are a component of Retained Earnings.

They help reduce Retained Earnings.

Dividends are not considered to be an expense.

Using the Basic Accounting Equation:

Example: Use the following information to plug into the basic accounting equation:

Assets = 168

Liabilities = 75

Stockholders’ Equity = 93

75 + 93 adds up to 168, so the equation is balanced.

168 = 168

168 (Assets) = | 75 (Liabilities) + | 93 (S/E) |

|---|

Financial Statements

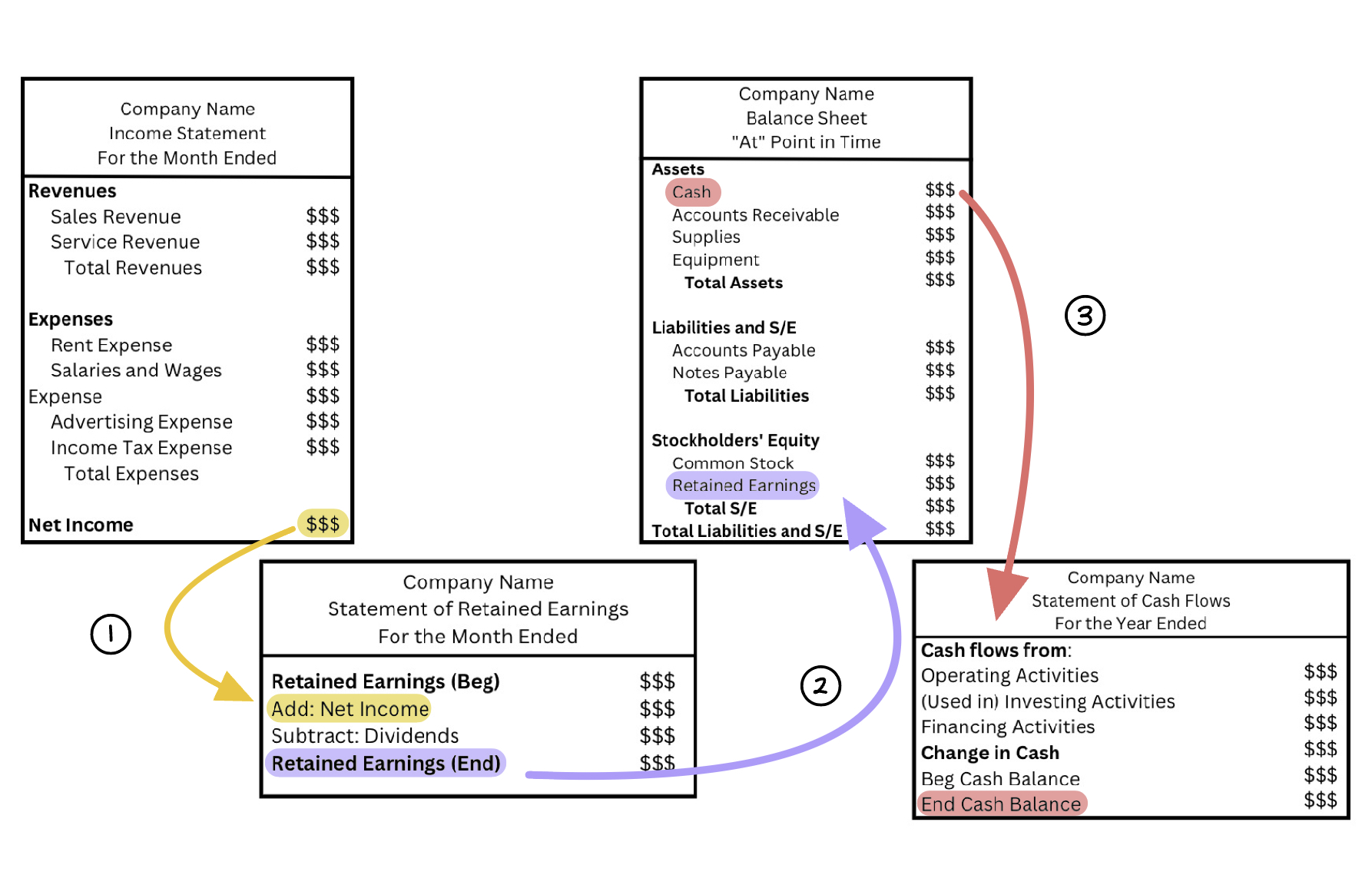

There are four types of financial statements and they are prepared in the following order:

Income Statement

Statements of Retained Earnings

Balance Sheet

Statement of Cash Flows

They can be prepared monthly, quarterly, and annually.

If they are annual reports, they can either be based on a calendar year or fiscal year:

Both are reported in a 12 month period

A calendar year ends on December 31

A fiscal year ends on a day that is not December first (can be anytime during the year)

The Structure of Financial Statements

Financial statements have headings that address who, what, and when.

They include the name of the company, what type of report is being presented, and the accounting period for the report.

The Income Statement

This report provides information regarding profitability for a specific period.

The structure of the Income Statement:

Heading (who, what, when)

Company name

Income Statement

For the Month Ended

Revenue

Ex: Sales/Service Revenue

Total Revenues

Expense

Ex: Rent Expense, Utilities Expense

Total Expenses

Net Income/Loss

Expenses are listed from biggest to smallest.

Income Tax Expense is always listed last.

You want Revenues to be higher than Expenses to get Net Income.

Unit of measurement assumption - the proper monetary unit must be used to report business activities (ex: United States = Dollar).

The amount of Net Income/Loss with carry over into the next Financial Statements.

The Statement of Retained Earnings

This report provides information regarding the company’s dividends and how their distribution affects the company’s financial position.

The structure of the Statement of Retained Earnings:

Heading (who, what, when)

Company name

Statement of Retained Earnings

For the Month Ended

Retained Earnings (beginning)

Add/Subtract: Net Income/Loss

Subtract: Dividends

Retained Earnings (ending)

Retained Earnings (beginning) is the balance of the last period. If it is a new business, it will be $0.

The Balance Sheet

In regards to source of financing, this sheet reports:

Assets - What the business owns.

Liabilities - Money borrowed and whats owed to creditors.

Stockholders’ Equity - Money leftover to go to company’s shareholders.

Balance sheets are considered to be a “snapshot” of a business’s resources on a specific date.

The structure of the Balance Sheet:

Heading (who, what, when)

Company name

Balance Sheet

“At” a specific date

Assets

Ex: Cash, Supplies, Equipment

Total Assets

Liabilities and Stockholders’ Equity

Ex: Payables

Total Liabilities (to creditors)

Stockholders’ Equity

Only 2: Common Stock and Retained Earnings

Total Stockholder’s Equity (to stockholders)

Total Liabilities and Stockholders’ Equity

Assets must = liabilities + stockholders’ equity (it “balances”)

Cost principle - Assets are recorded based on what we negotiated to pay for them.

The Statement of Cash Flows

Reports the effects on cash balance based on operating, financing, and investing activities.

The structure of the Statement of Cash Flows:

Heading (who, what, when “For the Month Ended”)

Company name

Statement of Cash Flows

For the Month Ended

Cash Flows from Operating Activities

Cash received from customers

Cash paid to employees and suppliers

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash used to buy equipment and software

Cash from Investing Activities

Cash Flows from Financing Activities

Cash received for stock issuance

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance (beginning of the month)

Ending Cash Balance (end of the month)

Cash from Statement of Cash Flows must be equal to the cash reported on the Balance Sheet

How These Statements Connect

(1.) Net Income/Loss from the Income Statement carries over onto the Statement of Retained Earnings.

(2.) On the Statement of Retained Earnings, the ending Retained Earnings moves to the “Stockholders’ Equity” section on the Balance Sheet.

(3.) Cash amount reported under the “Assets” section of the Balance Sheet must be equal to the “Ending Cash Balance” on the Statement of Cash Flows.

Objective 1.3: Explain how financial statements are used by decision makers.

What Does Each Statement Do For Creditors and Stockholders?

The Income Statement provides the stockholders with what the long term return is.

The Statement of Retained Earnings shows the returns through dividends that are to be distributed to investors.

The Balance Sheet allows creditors to see if the business’s assets will cover their liabilities.

The Statement of Cash Flows shows if a business is making enough money to pay the amounts it owes.

Objective 1.4: Describe factors that contribute to useful financial information.

External Financial Reporting

External users review and utilize the information of different financial statements.

In order for decision makers to use these statements, it is important for the statements to be:

Verifiable

Timely

Comparable

Understandable

Accounting Standards

FASB - Financial Accounting Standards Board (United States)

GAAP - Generally Accepted Accounting Principles (United States)

IASB - International Accounting Standards Board

IFRS - International Financial Reporting Standard

Knowt

Knowt