Chapter 9 - Aggregate Demand and Aggregate Supply

9.1 Aggregate Demand (AD)

Aggregate demand (AD) - The inverse relationship between all spending on domestic output and the aggregate price level of that output.

Components of AD

Demand in macroeconomy comes from four general sources, which are used to calculate the real GDP.

AD measures the sum of consumption spending by households, investment spending by firms, government purchases of goods and services, and net exports (exports minus imports).

The shape of AD

General groups of substitutes for national output

Foreign sector substitution effect - Goods and services produced in other nations.

Ex. →When the price of U.S. output increases, consumers begin to look for similar items produced elsewhere. A Japanese computer, a German car, and a Mexican textile all begin to look more attractive when inflation heats up in the United States. The resulting increase in imports pushes real GDP down at a higher price level.

Interest rate effect - Goods and services in the future.

Ex.→ When more and more households seek loans, the real interest rate begins to rise, and this increases the cost of borrowing. Firms postpone their investment in plant and equipment, and households postpone their consumption of more expensive items for a future when their spending might go further and borrowing might be more affordable. This wait-andsee mentality reduces current consumption of domestic production as the price level rises and real GDP falls.

Wealth effect - Money and financial assets.

Wealth is the value of accumulated assets like stocks, bonds, savings, and cash on hand.

As the aggregate price level rises, the purchasing power of wealth and savings begins to fall. Higher prices therefore tend to reduce the quantity of domestic output purchased.

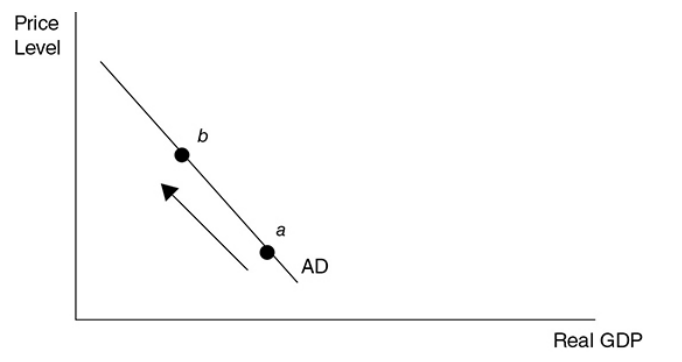

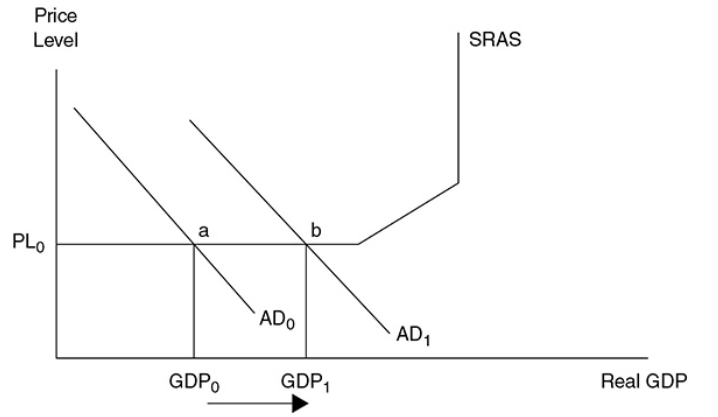

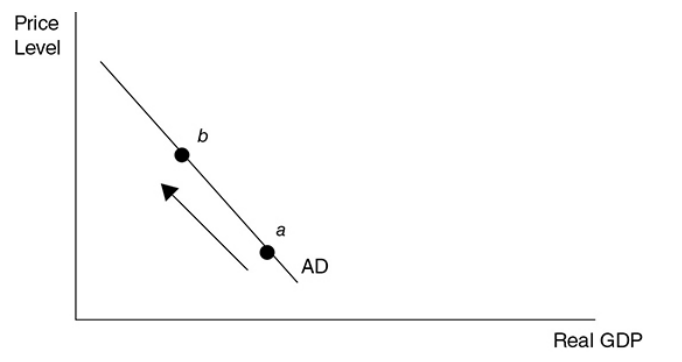

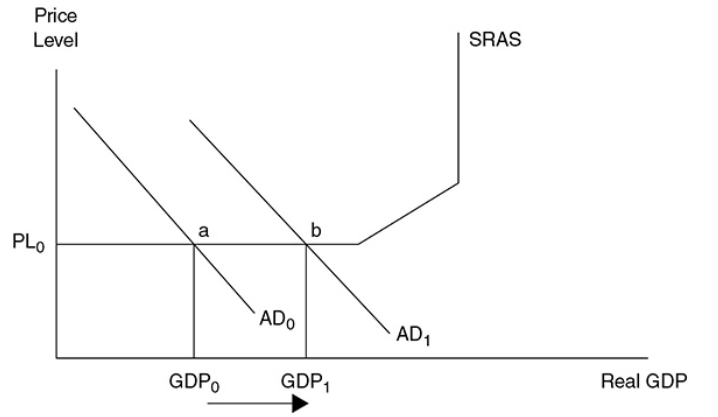

The AD Curve

The combination of the foreign sector substitution, interest rate, and wealth effects predict a downward-sloping AD curve.

As the aggregate price level rises, consumption of domestic output (real GDP) falls along the AD curve. (This is the movement from a to b).

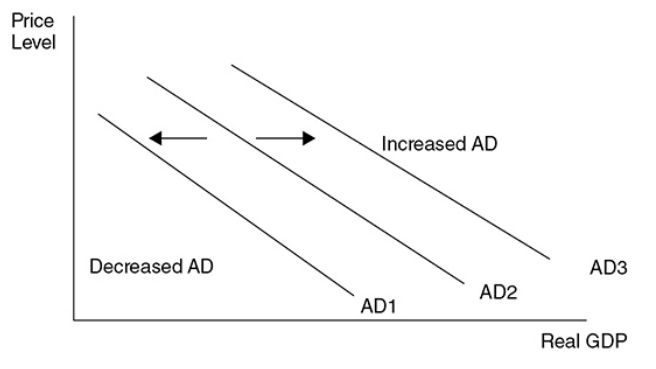

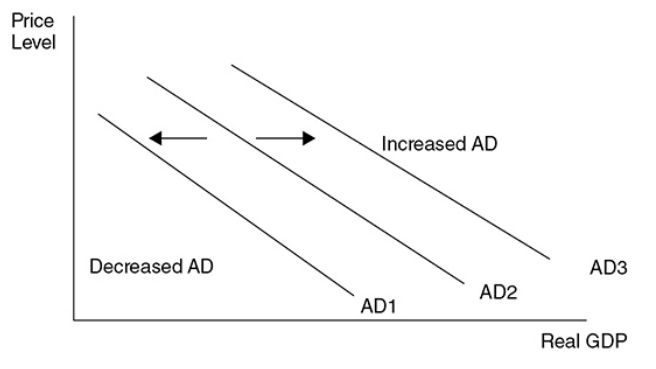

Changes in AD

Since AD is the sum of the four components of domestic spending [C, I, G, (X — M)], if any of these components increases, holding the price level constant, AD increases, which increases real GDP. This is seen as a shift to the right of AD.

If any of these components decreases, holding the price level constant, AD decreases, which decreases real GDP. This is seen as a shift to the left of AD.

If you want to stimulate real GDP and lower unemployment, you need to boost any or all of the components of AD.

If you feel AD must slow down, you need to rein in the components of AD.

Components of AD

Consumer Spending (C) - If you put more money in the pockets of households, it is expected for them to consume a great deal of it and save the rest. Consumers also increase their consumption if they are optimistic about the future.

Investment Spending (I) - Firms increase investment if they believe the investment will be profitable. This expected return on the investment is increased if investors are optimistic about the future profitability or if the necessary borrowing can be done at a low rate of interest.

Government Spending (G) - The government injects money into the economy by spending more on goods and services, by reducing taxes, or by increasing transfer payments.

Government spending on goods and services is a direct increase in AD.

Lowering taxes and increasing transfer payments increase AD through consumer spending by increasing disposable income.

Net Exports ( X - M) - When sales to foreign consumers are high and purchases from foreign producers are low, the net exports increases.

Foreign incomes - Exports increase with strong foreign economies. When foreign consumers have more disposable income, this increases the AD in the United States because those consumers spend some of that income on U.S. made goods.

Consumer tastes - If American blue jeans become more popular in France, American AD increases. If French wines become more preferred by American consumers, AD in France increases.

Exchange rates - Imports decrease when the exchange rate between the dollar and foreign currency falls. This makes foreign goods to be more expensive causing consumers to buy less foreign-produced items.

9.2 Aggregate Supply (AS)

Aggregate supply (AS) - The relationship between the aggregated price level of all domestic output and the level of domestic output produced.

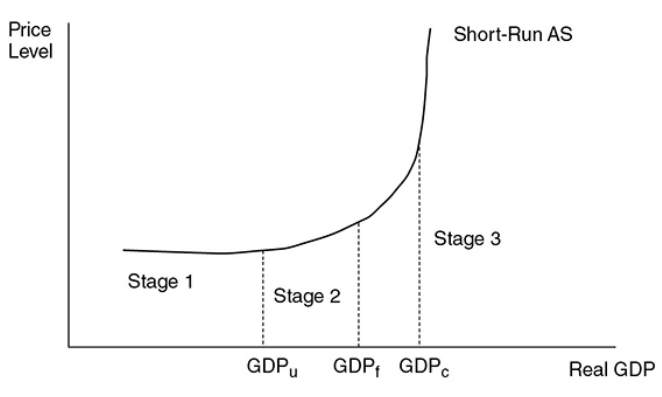

Short-Run and Long-Run Shape of AS

Short-run aggregate supply (SRAS) - The positive relationship between the level of domestic output produced and the aggregate price level of that output.

Macroeconomic Short Run

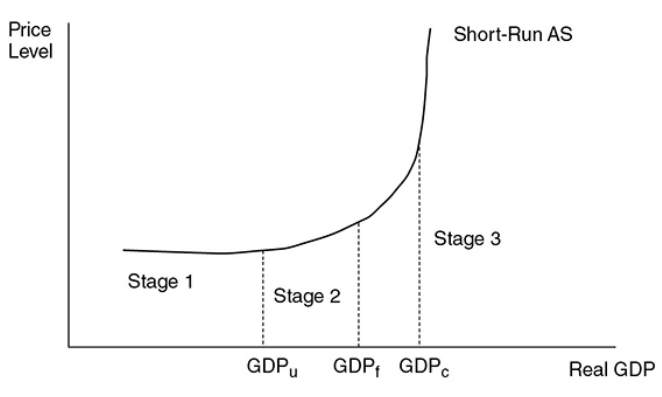

In the macroeconomic short run period of time, the prices of goods and services are changing in their respective markets, but input prices have not been adjusted to those product market changes. In the short run, the SRAS curve is typically drawn as upward sloping.

In stage 1, the economy is in a recession with low production meaning they are many unemployed resources.

In stage 2, real GDP increases and approaches full employement, available resources are harder to find and input costs begin to rise. If the price level for output rises faster than the rising costs, producers have a profit incentive to increase the production.

In stage 3, the AS curve is almost vertical, meaning that the economy is growing and approaching the nation’s productive capacity where firms cannot find unemployed units.

GDPu - Low production

GDPf - Full employement

GDPc - Nation’s productive capacity

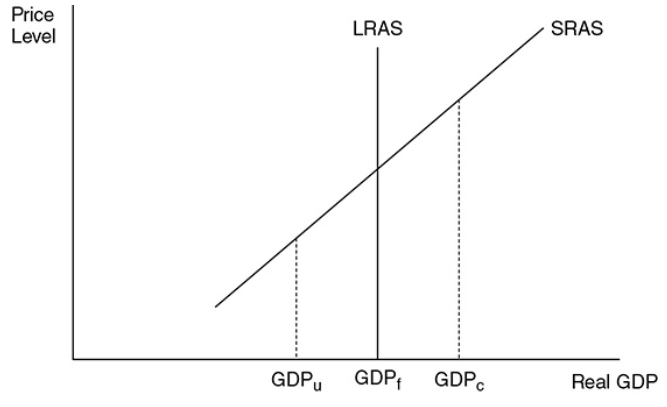

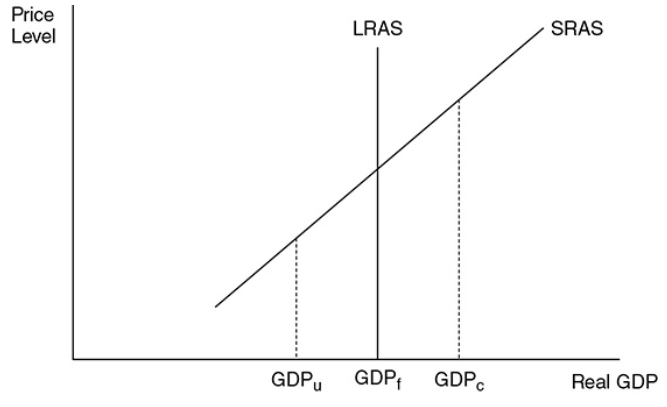

Macroeconomic Long Run

In the macroeconomic long run, the input prices have enough time to fully adjust to market forces. Here all product and input markets are balanced, and economy is at full employement (GDPf).

The Classical school of economics asserts that the economy always gravitates toward full employment, so a cornerstone of classical macroeconomics is a vertical AS curve.

QUICK TIP FOR DRAWING GRAPHS

When drawing the AD/AS graph for a free-response question, it is not acceptable to label the vertical axis “P” or “$” and the horizontal axis “Q.” You want to be very careful to use terms like “Aggregate price level” or “PL” on the vertical axis and “Real output” or “Real GDP” on the horizontal axis.

Changes in AS

In the short run, AS fluctuates without affecting the level of full employement.

It’s not the same in the long run.

Short-Run Shifts

Most common factor that affects short-run AS → An economy-wide change in input (or factor) prices.

Input prices - If input prices fall economy-wide, the short-run AS curve increases without changing the level of full employment.

Tax policy - Some taxes are aimed at producers rather than consumers. If these “supply-side taxes” are lowered, short-run AS shifts to the right.

Deregulation - When the regulation of industries restrict their ability to produce, the short-run AS likely increases.

Political or environmental phenomena - For a nation as large as the United States, wars and natural disasters can decrease the short-run AS without permanently decreasing the level of full employment. For a smaller nation or a large nation hit by an epic disaster, this could be a permanent decrease in the ability to produce.

Long-Run Shifts

Availability of resources - A larger labor force, larger stock of capital, or more widely available natural resources can increase the level of full employment.

Technology and productivity - Better technology raises the productivity of both capital and labor. A more highly trained or educated populace increases the productivity of the labor force.

Policy incentives - If policy provides large incentives to quickly find a job, full-employment real GDP rises. If government gives tax incentives to invest in capital or technology, GDPf rises.

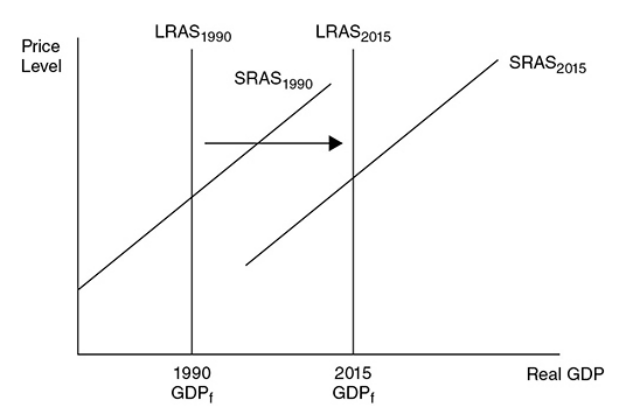

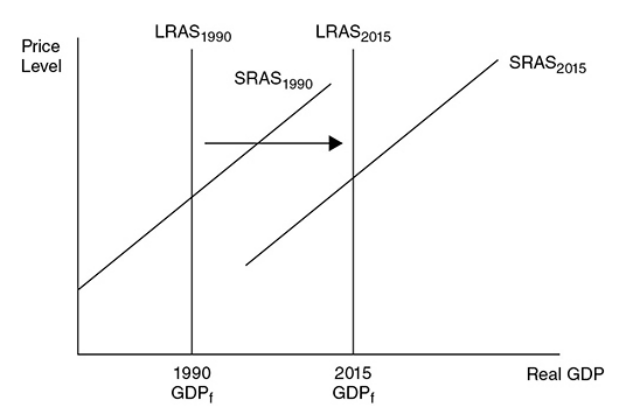

Ex. → Since the 1990s, the U.S. economy has seen dramatic increases in technology and investment in the capital stock. This period produced a significant increase in the real GDP at full employment.

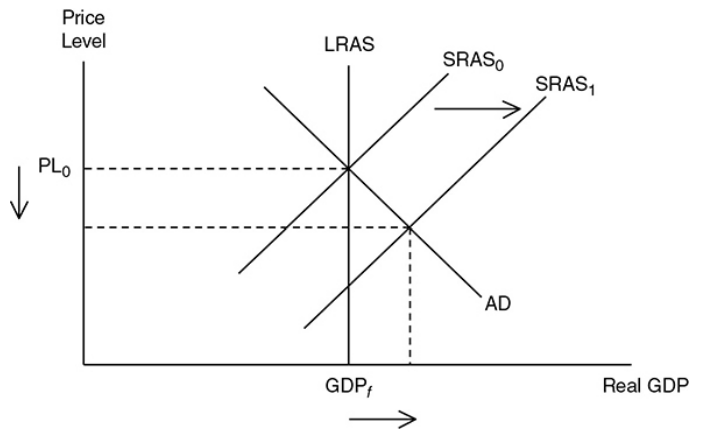

When the LRAS curve shifts to the right, it indicates economic growth.

Determinants of AS - AS is a function of many factors that impact the production capacity of the nation. If these factors make it easier, or less costly, for a nation to produce, AS shifts to the right. If these factors make it more difficult, or more costly, for a nation to produce, AS shifts to the left.

9.3 Macroeconomic Equilibrium

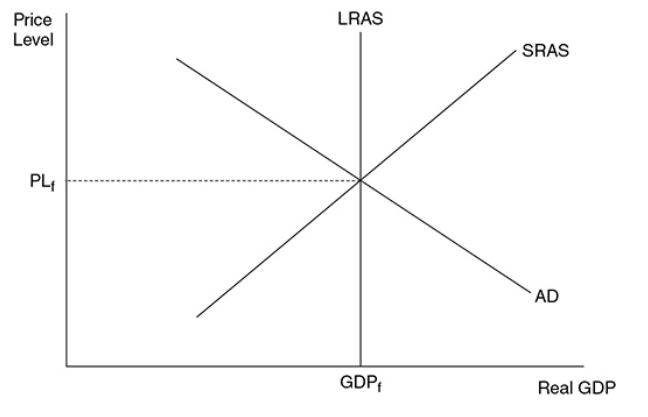

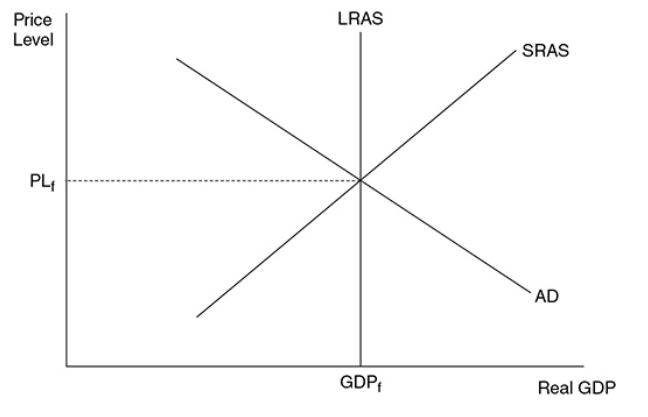

Equilibrium Real GDP and Price Level

Macroeconomic equilibrium - Occurs when the quantity of real output demanded is equal to the quantity of real output supplied. Graphically this is at the intersection of AD and SRAS. Equilibrium can exist at, above, or below full employment.

Recessionary and Inflationary Gaps

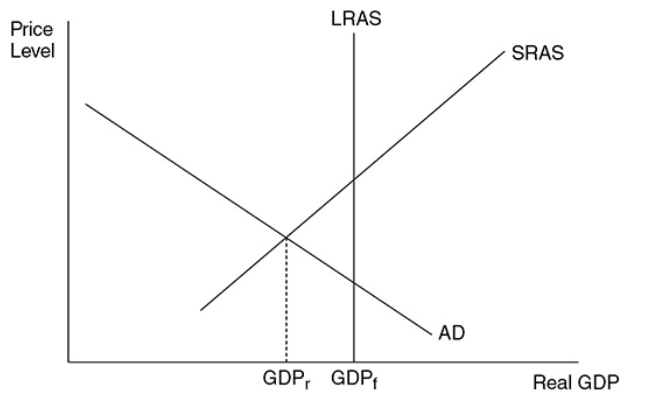

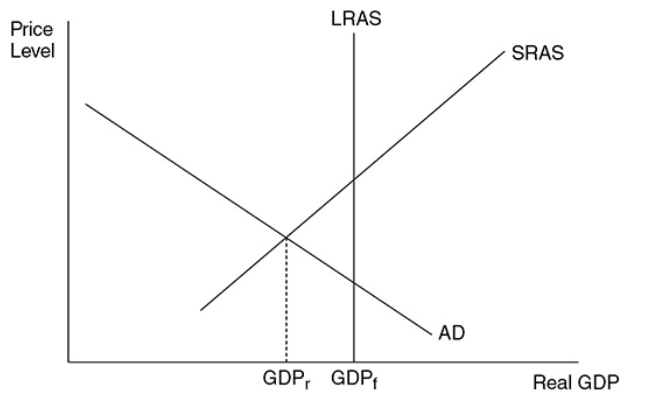

Recessionary gap - The amount by which full-employment GDP exceeds equilibrium GDP.

In this picture, the recessionary gap is the difference between GDPf and GDPr , or the amount that current real GDP must rise to reach GDPf .

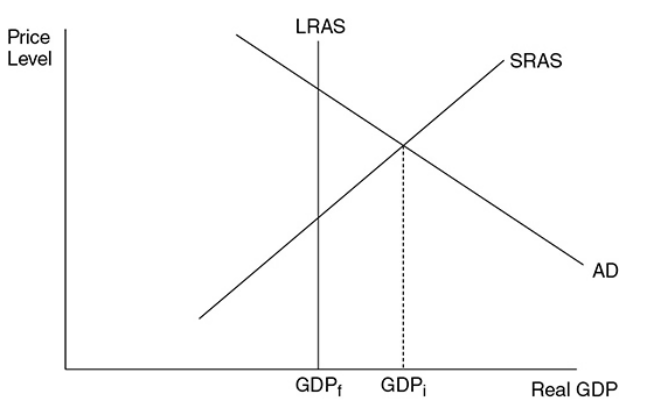

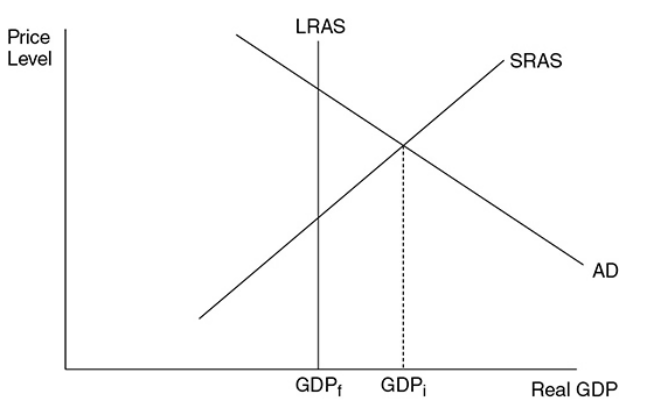

Inflationary gap - The amount by which equilibrium GDP exceeds full employment GDP.

In this picture, the inflationary gap is the difference between GDPi and GDPf , or the amount that real GDP must fall to reach GDPf .

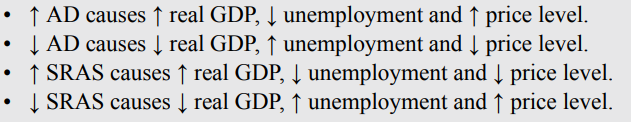

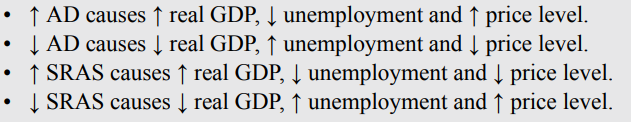

Shifts in AD

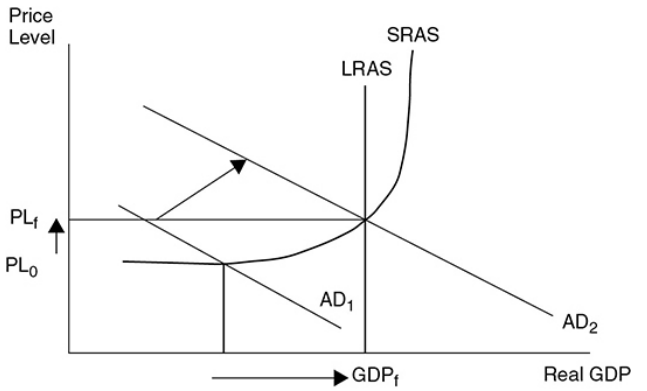

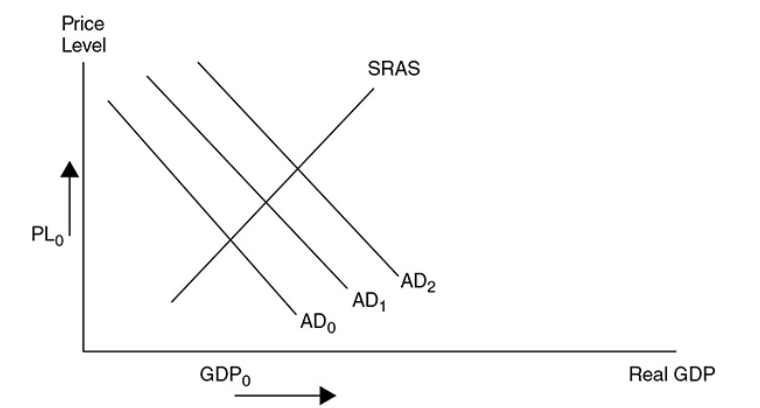

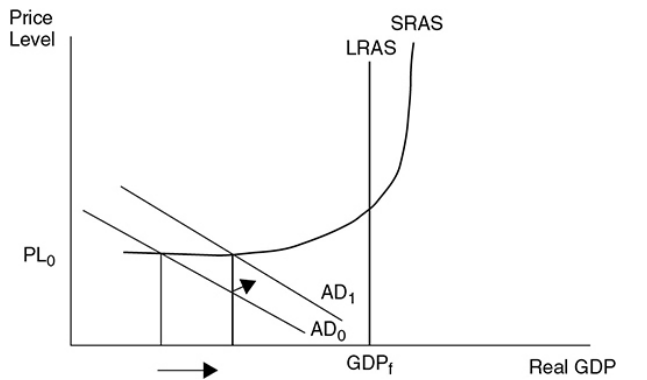

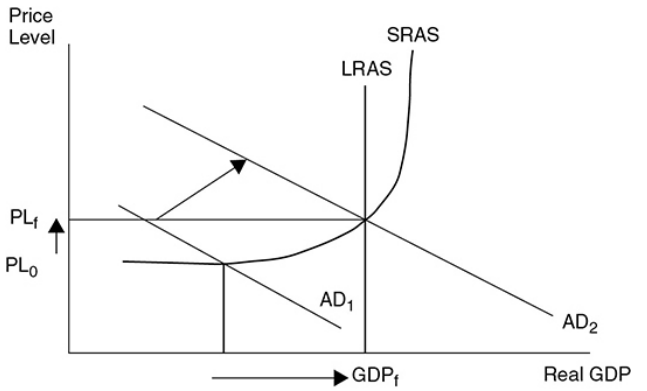

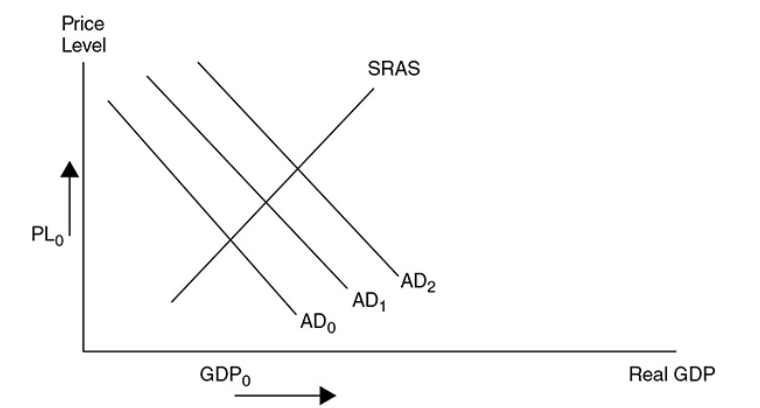

Demand-pull inflation - This inflation is the result of stronger consumption from all sectors of AD as it continues to increase in the upward-sloping range of SRAS.

If AD increases from AD0 to AD1 in the nearly horizontal range of SRAS, the price level may only slightly increase, while real GDP significantly increases and the unemployment rate falls.

If AD continues to increase to AD2 in the upward-sloping range of SRAS, the price level begins to rise and inflation is felt in the economy.

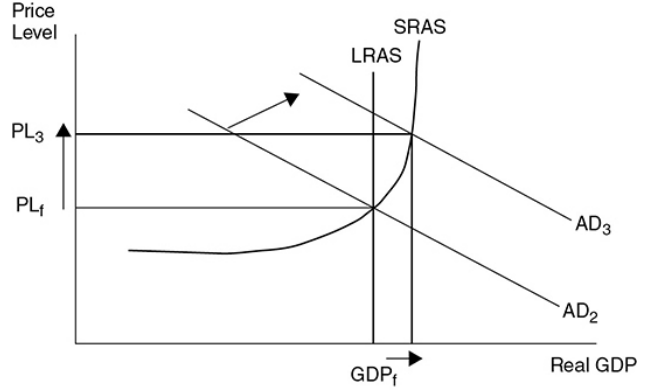

If AD increases much beyond full employment to AD3, inflation is quite significant and real GDP experiences minimal increases.

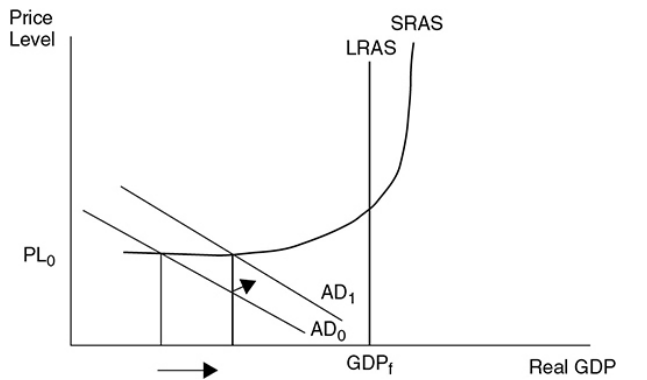

Recession - In the AD and AS model, a recession is typically described as falling AD with a constant SRAS curve. Real GDP falls far below full employment levels and the unemployment rate rises.

Deflation - A sustained falling price level, usually due to severely weakened aggregate demand and a constant SRAS.

If aggregate demand weakens, the opposite is expected. One of the most common causes of recession is falling AD since it lowers real GDP and increases unemployment rate. Deflation is expected here.

The Multiplier Effect

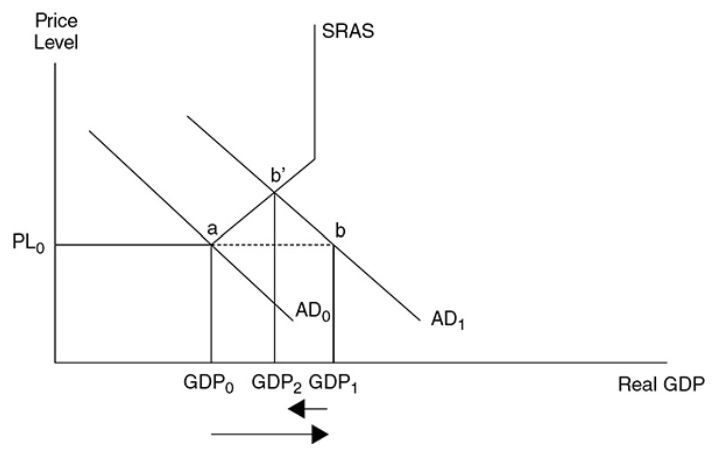

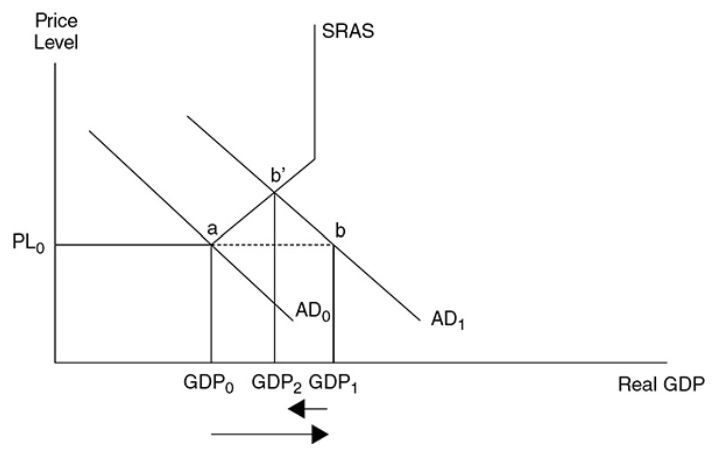

The full multiplier effect is only observed if the price level does not increase, and this only occurs if the economy is operating on the horizontal range of the SRAS curve.

The multiplier effect of an increase in AD is greater if there is no increase in the price level.

The full multiplier effect is not observed if there were no increase in the price level because the new equilibrium GDP would be at GDP1, but with a rising price level, it would be smaller at GDP2.

The multiplier effect of an increase in AD is smaller if there is a larger increase in the price level.

Shifting SRAS

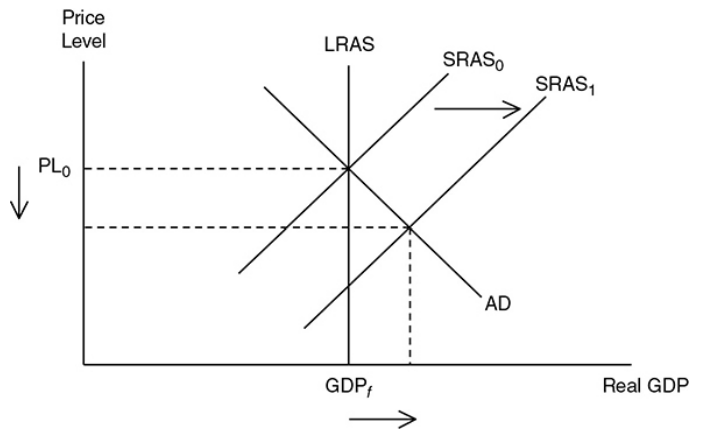

Supply-side boom - When the SRAS curve shifts outward and the AD curve stays constant, the price level falls, real GDP increases and the unemployment rate falls.

If nominal input prices fall, the SRAS curve shifts to the right.

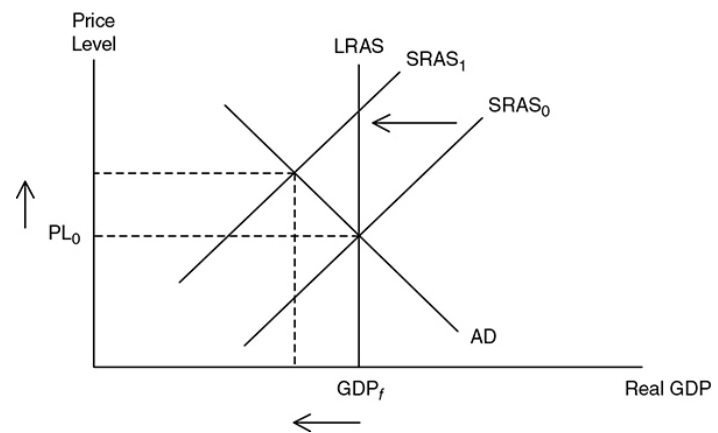

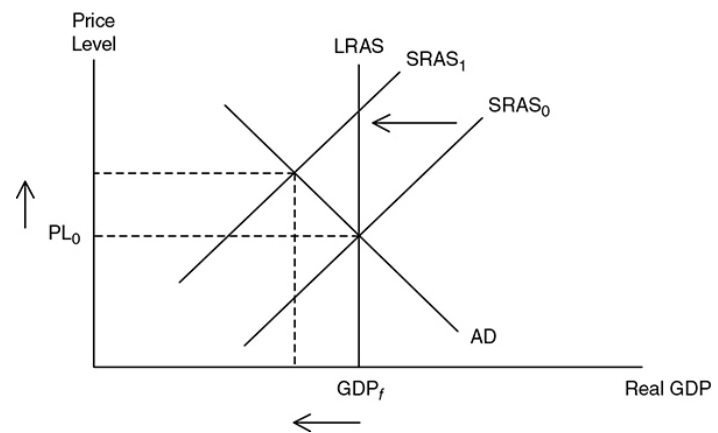

Stagflation (Cost-push inflation) - A situation in the macroeconomy when inflation and the unemployment rate are both increasing. This is most likely the cause of falling SRAS while AD stays constant.

An increase in SRAS is the best possible macroeconomic situation. A decrease is one of the worst.

A decrease creates inflation, lowers real GDP and increases unemployment rate.

Supply Shocks

Supply shocks - An economy-wide phenomenon that affects the costs of firms and the position of the SRAS curve, either positively or negatively. The shifts in SRAS are caused by these.

Positive supply shocks might be the result of higher productivity or lower energy prices.

Negative supply shocks usually occur when economy-wide input prices suddenly increase. Ex. → The Gulf War of 1990 to 1991.

Classical Adjustment from Short-Run to Long-Run Equilibrium

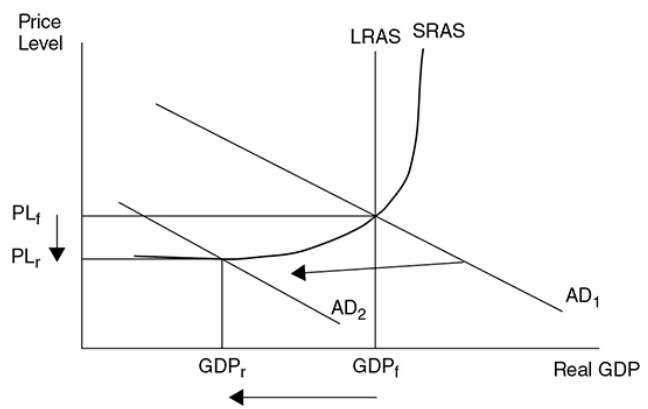

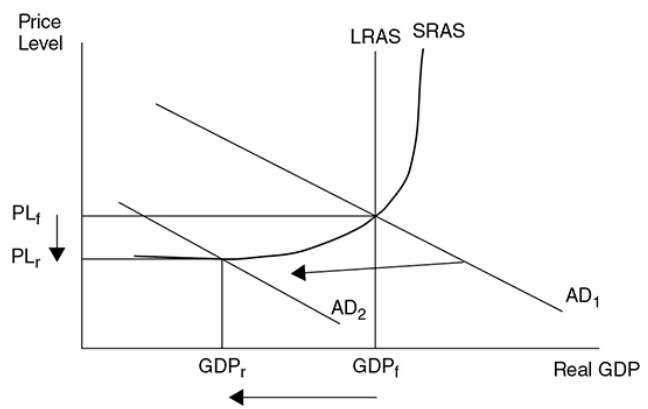

Adjustment to a Recessionary Gap

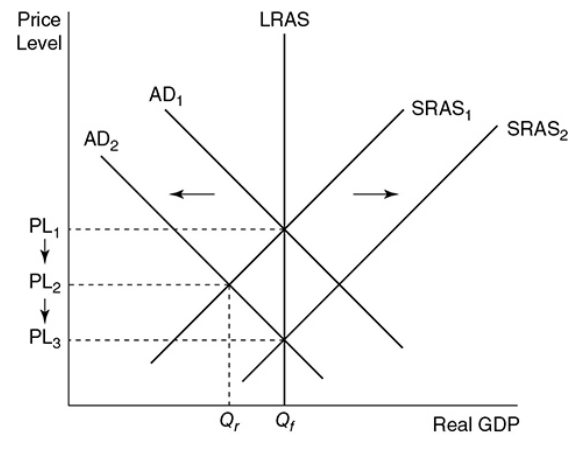

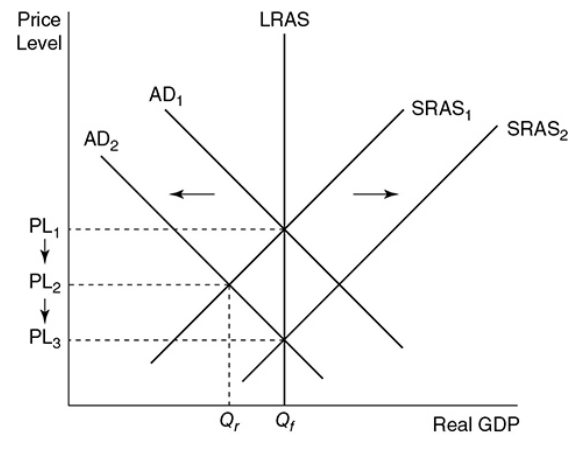

Based on this graph, the economy is currently operating at full employement. If consumers and firms begin to lose confidence in the labor market and overall economy, AD shifts to the left.

In the short run, this causes a recessionary gap as real GDP falls to GDPr meaning that unemployment rises and aggregate price levels falls from PL1 to PL2.

NOTE - One of the hallmarks of a recession is a decreased demand for many factors of production.

This recessionary gap fixes itself since the prices of the products will decrease, causing a gradual rightward shift of the SRAS curve to SRAS2. The curve shifts to the right until the gap is closed and the economy is back at GDPf.

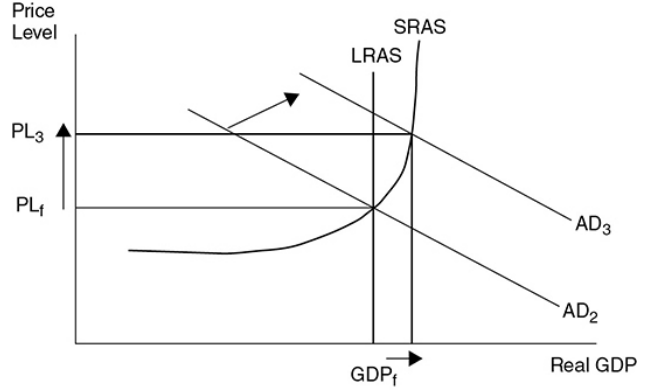

Adjustment to an Inflationary Gap

When the AD curve increases, an inflationary gap happens causing an increase in real GDP to GDPi (lower unemployment rate) and an increase in the aggregate price level to PL2.

When this happens, there’s stronger demand for labor and all of the other factors of production causing factor prices to rise. As the factor prices rise, the SRAS curve shifts to the left to SRAS2 eventually eliminating the inflationary gap, but at a higher aggregate price level of PL3.

9.4 The Trade-Off Between Inflation and Unemployment

Short-Run Changes in AD

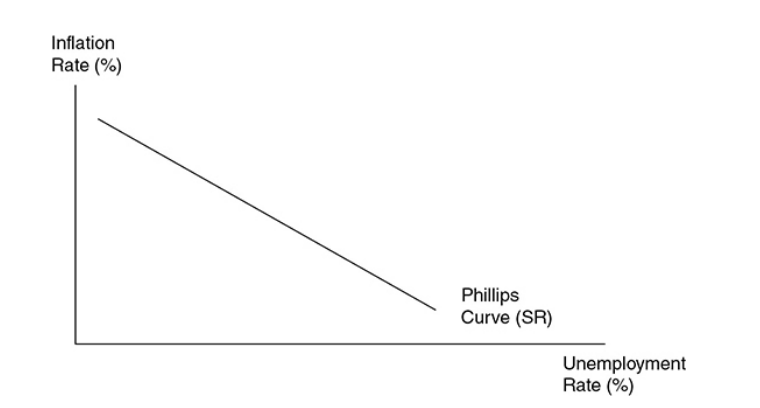

If AD is rising, the price level and real GDP are both rising. Since real GDP creates jobs and lowers unemployment, there’s an inverse relationship between inflation and unemployment rate.

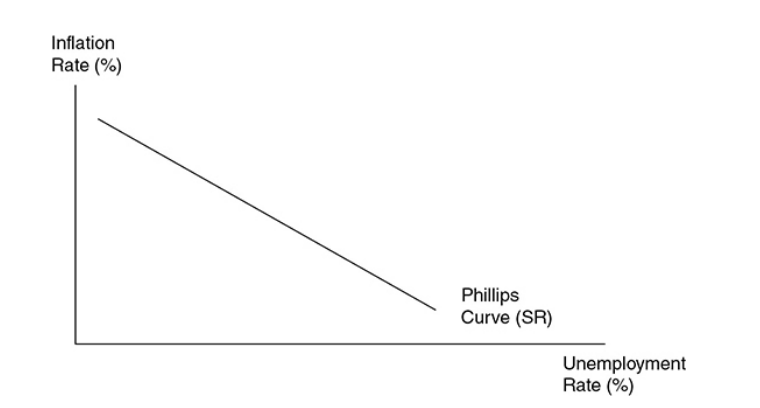

The Phillips Curve

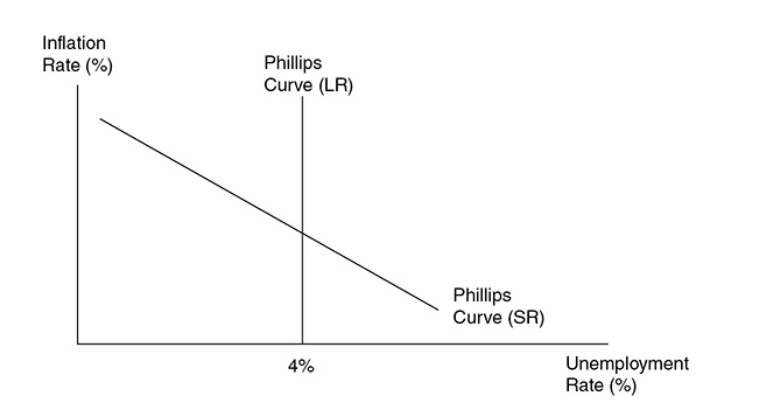

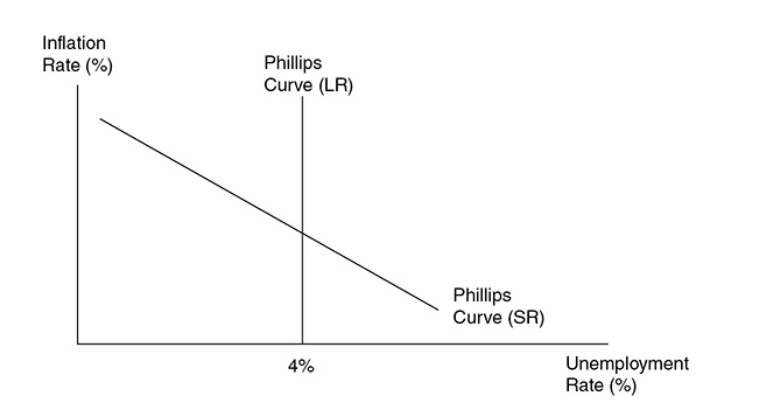

Phillips curve - A graphical device that shows the relationship between inflation and the unemployment rate. In the short run it’s downward sloping, and in the long run it’s vertical at the natural rate of unemployment.

It shows the inverse relationship between inflation and unemployment rate.

The possibility of deflation at extremely high unemployment rates means that the Philips curve may continue to fall below the x-axis.

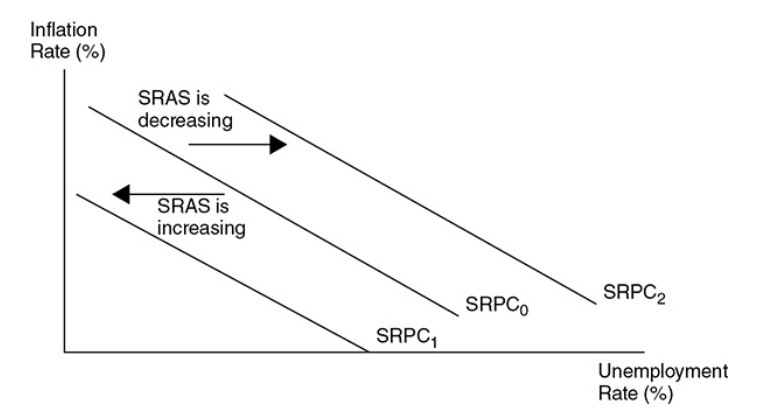

Supply Shocks and the Phillips Curve

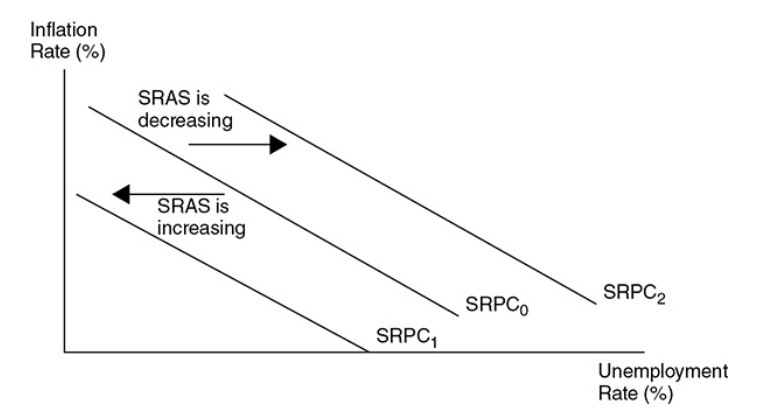

Supply shocks shift the Philips curve inward when SRAS shifts to the right and outward when SRAS shifts to the left.

The Long-Run Phillips Curve

The AS model assumes that the long-run AS curve is vertical and at full employement. This causes the Philips curve to be vertical at the natural rate of employement.

Natural rate of employment - The unemployment rate where cyclical unemployment is zero.

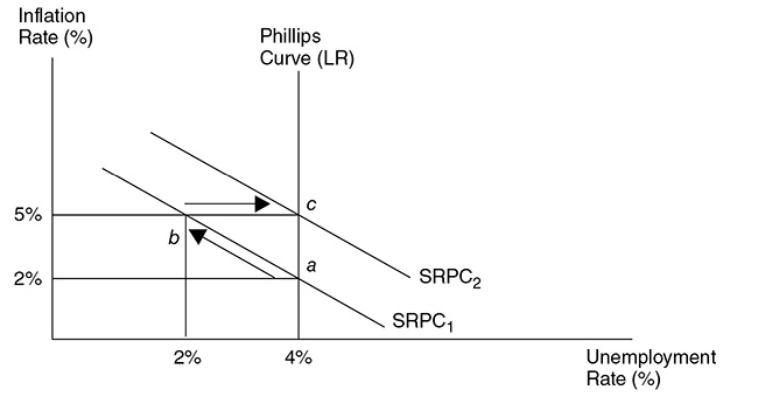

Expectations

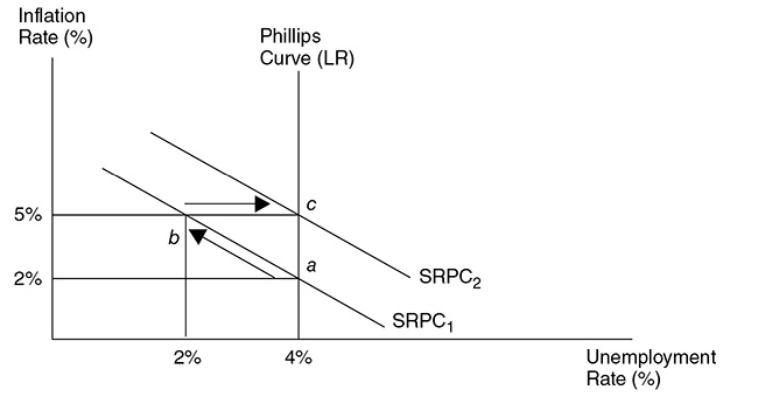

In the short term, there’s an inverse relationship between inflation and unemployment.

In the long term, unemployment is always at the natural rate.

This can be confusing, but it happens because sometimes there’s a gap between the actual rate of inflation and the expected rate of inflation.

Here the expected inflation rate is 2% at a 4% natural rate of unemployment (point a). If AD increases, the inflation rate goes up to 5% causing firms to earn higher profits and hire more people. This temporarily drops the unemployment rate to 2% (point b).

This is the movement along the short-run PC from a to b.

This situation won’t last since employees will request higher wages causing the profits of the firms to fall getting employment back to 4% (point c). Here both actual and expected inflation is 5%.

This process can repeat itself if AD continues to increase or it can be reversed if AD falls.

Chapter 9 - Aggregate Demand and Aggregate Supply

9.1 Aggregate Demand (AD)

Aggregate demand (AD) - The inverse relationship between all spending on domestic output and the aggregate price level of that output.

Components of AD

Demand in macroeconomy comes from four general sources, which are used to calculate the real GDP.

AD measures the sum of consumption spending by households, investment spending by firms, government purchases of goods and services, and net exports (exports minus imports).

The shape of AD

General groups of substitutes for national output

Foreign sector substitution effect - Goods and services produced in other nations.

Ex. →When the price of U.S. output increases, consumers begin to look for similar items produced elsewhere. A Japanese computer, a German car, and a Mexican textile all begin to look more attractive when inflation heats up in the United States. The resulting increase in imports pushes real GDP down at a higher price level.

Interest rate effect - Goods and services in the future.

Ex.→ When more and more households seek loans, the real interest rate begins to rise, and this increases the cost of borrowing. Firms postpone their investment in plant and equipment, and households postpone their consumption of more expensive items for a future when their spending might go further and borrowing might be more affordable. This wait-andsee mentality reduces current consumption of domestic production as the price level rises and real GDP falls.

Wealth effect - Money and financial assets.

Wealth is the value of accumulated assets like stocks, bonds, savings, and cash on hand.

As the aggregate price level rises, the purchasing power of wealth and savings begins to fall. Higher prices therefore tend to reduce the quantity of domestic output purchased.

The AD Curve

The combination of the foreign sector substitution, interest rate, and wealth effects predict a downward-sloping AD curve.

As the aggregate price level rises, consumption of domestic output (real GDP) falls along the AD curve. (This is the movement from a to b).

Changes in AD

Since AD is the sum of the four components of domestic spending [C, I, G, (X — M)], if any of these components increases, holding the price level constant, AD increases, which increases real GDP. This is seen as a shift to the right of AD.

If any of these components decreases, holding the price level constant, AD decreases, which decreases real GDP. This is seen as a shift to the left of AD.

If you want to stimulate real GDP and lower unemployment, you need to boost any or all of the components of AD.

If you feel AD must slow down, you need to rein in the components of AD.

Components of AD

Consumer Spending (C) - If you put more money in the pockets of households, it is expected for them to consume a great deal of it and save the rest. Consumers also increase their consumption if they are optimistic about the future.

Investment Spending (I) - Firms increase investment if they believe the investment will be profitable. This expected return on the investment is increased if investors are optimistic about the future profitability or if the necessary borrowing can be done at a low rate of interest.

Government Spending (G) - The government injects money into the economy by spending more on goods and services, by reducing taxes, or by increasing transfer payments.

Government spending on goods and services is a direct increase in AD.

Lowering taxes and increasing transfer payments increase AD through consumer spending by increasing disposable income.

Net Exports ( X - M) - When sales to foreign consumers are high and purchases from foreign producers are low, the net exports increases.

Foreign incomes - Exports increase with strong foreign economies. When foreign consumers have more disposable income, this increases the AD in the United States because those consumers spend some of that income on U.S. made goods.

Consumer tastes - If American blue jeans become more popular in France, American AD increases. If French wines become more preferred by American consumers, AD in France increases.

Exchange rates - Imports decrease when the exchange rate between the dollar and foreign currency falls. This makes foreign goods to be more expensive causing consumers to buy less foreign-produced items.

9.2 Aggregate Supply (AS)

Aggregate supply (AS) - The relationship between the aggregated price level of all domestic output and the level of domestic output produced.

Short-Run and Long-Run Shape of AS

Short-run aggregate supply (SRAS) - The positive relationship between the level of domestic output produced and the aggregate price level of that output.

Macroeconomic Short Run

In the macroeconomic short run period of time, the prices of goods and services are changing in their respective markets, but input prices have not been adjusted to those product market changes. In the short run, the SRAS curve is typically drawn as upward sloping.

In stage 1, the economy is in a recession with low production meaning they are many unemployed resources.

In stage 2, real GDP increases and approaches full employement, available resources are harder to find and input costs begin to rise. If the price level for output rises faster than the rising costs, producers have a profit incentive to increase the production.

In stage 3, the AS curve is almost vertical, meaning that the economy is growing and approaching the nation’s productive capacity where firms cannot find unemployed units.

GDPu - Low production

GDPf - Full employement

GDPc - Nation’s productive capacity

Macroeconomic Long Run

In the macroeconomic long run, the input prices have enough time to fully adjust to market forces. Here all product and input markets are balanced, and economy is at full employement (GDPf).

The Classical school of economics asserts that the economy always gravitates toward full employment, so a cornerstone of classical macroeconomics is a vertical AS curve.

QUICK TIP FOR DRAWING GRAPHS

When drawing the AD/AS graph for a free-response question, it is not acceptable to label the vertical axis “P” or “$” and the horizontal axis “Q.” You want to be very careful to use terms like “Aggregate price level” or “PL” on the vertical axis and “Real output” or “Real GDP” on the horizontal axis.

Changes in AS

In the short run, AS fluctuates without affecting the level of full employement.

It’s not the same in the long run.

Short-Run Shifts

Most common factor that affects short-run AS → An economy-wide change in input (or factor) prices.

Input prices - If input prices fall economy-wide, the short-run AS curve increases without changing the level of full employment.

Tax policy - Some taxes are aimed at producers rather than consumers. If these “supply-side taxes” are lowered, short-run AS shifts to the right.

Deregulation - When the regulation of industries restrict their ability to produce, the short-run AS likely increases.

Political or environmental phenomena - For a nation as large as the United States, wars and natural disasters can decrease the short-run AS without permanently decreasing the level of full employment. For a smaller nation or a large nation hit by an epic disaster, this could be a permanent decrease in the ability to produce.

Long-Run Shifts

Availability of resources - A larger labor force, larger stock of capital, or more widely available natural resources can increase the level of full employment.

Technology and productivity - Better technology raises the productivity of both capital and labor. A more highly trained or educated populace increases the productivity of the labor force.

Policy incentives - If policy provides large incentives to quickly find a job, full-employment real GDP rises. If government gives tax incentives to invest in capital or technology, GDPf rises.

Ex. → Since the 1990s, the U.S. economy has seen dramatic increases in technology and investment in the capital stock. This period produced a significant increase in the real GDP at full employment.

When the LRAS curve shifts to the right, it indicates economic growth.

Determinants of AS - AS is a function of many factors that impact the production capacity of the nation. If these factors make it easier, or less costly, for a nation to produce, AS shifts to the right. If these factors make it more difficult, or more costly, for a nation to produce, AS shifts to the left.

9.3 Macroeconomic Equilibrium

Equilibrium Real GDP and Price Level

Macroeconomic equilibrium - Occurs when the quantity of real output demanded is equal to the quantity of real output supplied. Graphically this is at the intersection of AD and SRAS. Equilibrium can exist at, above, or below full employment.

Recessionary and Inflationary Gaps

Recessionary gap - The amount by which full-employment GDP exceeds equilibrium GDP.

In this picture, the recessionary gap is the difference between GDPf and GDPr , or the amount that current real GDP must rise to reach GDPf .

Inflationary gap - The amount by which equilibrium GDP exceeds full employment GDP.

In this picture, the inflationary gap is the difference between GDPi and GDPf , or the amount that real GDP must fall to reach GDPf .

Shifts in AD

Demand-pull inflation - This inflation is the result of stronger consumption from all sectors of AD as it continues to increase in the upward-sloping range of SRAS.

If AD increases from AD0 to AD1 in the nearly horizontal range of SRAS, the price level may only slightly increase, while real GDP significantly increases and the unemployment rate falls.

If AD continues to increase to AD2 in the upward-sloping range of SRAS, the price level begins to rise and inflation is felt in the economy.

If AD increases much beyond full employment to AD3, inflation is quite significant and real GDP experiences minimal increases.

Recession - In the AD and AS model, a recession is typically described as falling AD with a constant SRAS curve. Real GDP falls far below full employment levels and the unemployment rate rises.

Deflation - A sustained falling price level, usually due to severely weakened aggregate demand and a constant SRAS.

If aggregate demand weakens, the opposite is expected. One of the most common causes of recession is falling AD since it lowers real GDP and increases unemployment rate. Deflation is expected here.

The Multiplier Effect

The full multiplier effect is only observed if the price level does not increase, and this only occurs if the economy is operating on the horizontal range of the SRAS curve.

The multiplier effect of an increase in AD is greater if there is no increase in the price level.

The full multiplier effect is not observed if there were no increase in the price level because the new equilibrium GDP would be at GDP1, but with a rising price level, it would be smaller at GDP2.

The multiplier effect of an increase in AD is smaller if there is a larger increase in the price level.

Shifting SRAS

Supply-side boom - When the SRAS curve shifts outward and the AD curve stays constant, the price level falls, real GDP increases and the unemployment rate falls.

If nominal input prices fall, the SRAS curve shifts to the right.

Stagflation (Cost-push inflation) - A situation in the macroeconomy when inflation and the unemployment rate are both increasing. This is most likely the cause of falling SRAS while AD stays constant.

An increase in SRAS is the best possible macroeconomic situation. A decrease is one of the worst.

A decrease creates inflation, lowers real GDP and increases unemployment rate.

Supply Shocks

Supply shocks - An economy-wide phenomenon that affects the costs of firms and the position of the SRAS curve, either positively or negatively. The shifts in SRAS are caused by these.

Positive supply shocks might be the result of higher productivity or lower energy prices.

Negative supply shocks usually occur when economy-wide input prices suddenly increase. Ex. → The Gulf War of 1990 to 1991.

Classical Adjustment from Short-Run to Long-Run Equilibrium

Adjustment to a Recessionary Gap

Based on this graph, the economy is currently operating at full employement. If consumers and firms begin to lose confidence in the labor market and overall economy, AD shifts to the left.

In the short run, this causes a recessionary gap as real GDP falls to GDPr meaning that unemployment rises and aggregate price levels falls from PL1 to PL2.

NOTE - One of the hallmarks of a recession is a decreased demand for many factors of production.

This recessionary gap fixes itself since the prices of the products will decrease, causing a gradual rightward shift of the SRAS curve to SRAS2. The curve shifts to the right until the gap is closed and the economy is back at GDPf.

Adjustment to an Inflationary Gap

When the AD curve increases, an inflationary gap happens causing an increase in real GDP to GDPi (lower unemployment rate) and an increase in the aggregate price level to PL2.

When this happens, there’s stronger demand for labor and all of the other factors of production causing factor prices to rise. As the factor prices rise, the SRAS curve shifts to the left to SRAS2 eventually eliminating the inflationary gap, but at a higher aggregate price level of PL3.

9.4 The Trade-Off Between Inflation and Unemployment

Short-Run Changes in AD

If AD is rising, the price level and real GDP are both rising. Since real GDP creates jobs and lowers unemployment, there’s an inverse relationship between inflation and unemployment rate.

The Phillips Curve

Phillips curve - A graphical device that shows the relationship between inflation and the unemployment rate. In the short run it’s downward sloping, and in the long run it’s vertical at the natural rate of unemployment.

It shows the inverse relationship between inflation and unemployment rate.

The possibility of deflation at extremely high unemployment rates means that the Philips curve may continue to fall below the x-axis.

Supply Shocks and the Phillips Curve

Supply shocks shift the Philips curve inward when SRAS shifts to the right and outward when SRAS shifts to the left.

The Long-Run Phillips Curve

The AS model assumes that the long-run AS curve is vertical and at full employement. This causes the Philips curve to be vertical at the natural rate of employement.

Natural rate of employment - The unemployment rate where cyclical unemployment is zero.

Expectations

In the short term, there’s an inverse relationship between inflation and unemployment.

In the long term, unemployment is always at the natural rate.

This can be confusing, but it happens because sometimes there’s a gap between the actual rate of inflation and the expected rate of inflation.

Here the expected inflation rate is 2% at a 4% natural rate of unemployment (point a). If AD increases, the inflation rate goes up to 5% causing firms to earn higher profits and hire more people. This temporarily drops the unemployment rate to 2% (point b).

This is the movement along the short-run PC from a to b.

This situation won’t last since employees will request higher wages causing the profits of the firms to fall getting employment back to 4% (point c). Here both actual and expected inflation is 5%.

This process can repeat itself if AD continues to increase or it can be reversed if AD falls.

Knowt

Knowt