Chapter 5 - Measuring a Nation’s Production and Income

Macroeconomics: the branch of economics that deals with a nation’s economy as a whole. It focuses on the economic issues-unemployment, inflation, growth, trade, and the gross domestic product- that are most often discussed in newspapers, on the radio and televisions, and on the Internet.

Macroeconomics focuses on two basic issues: long-run economic growth and economic fluctuations.

During periods of slow economic growth, not enough jobs are created, and large numbers of workers become unemployed.

At other times, unemployment may not be a problem, but we become concerned that the prices of everything that we buy seem to increase rapidly.

Sustained increases in prices are inflation.

5.1 The “Flip” Sides of Macroeconomic Activity: Production and Income

Production and income because these are the “flip” sides of the macroeconomic “coin” so to speak.

Production leads to income and income leads to production.

Macroeconomists collect and analyze production and income data to understand how many people will find jobs and whether their living standards are rising or falling. Government officials use the data and analysis to develop economic policies.

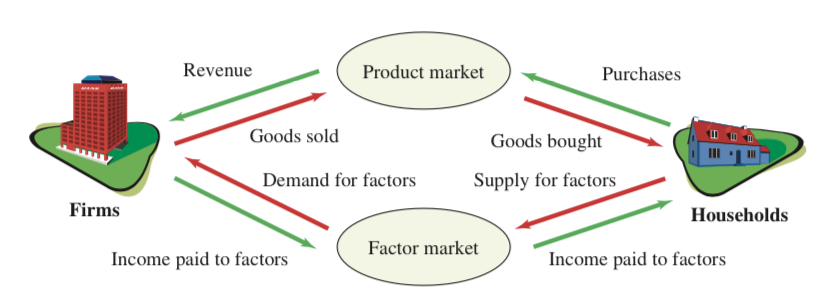

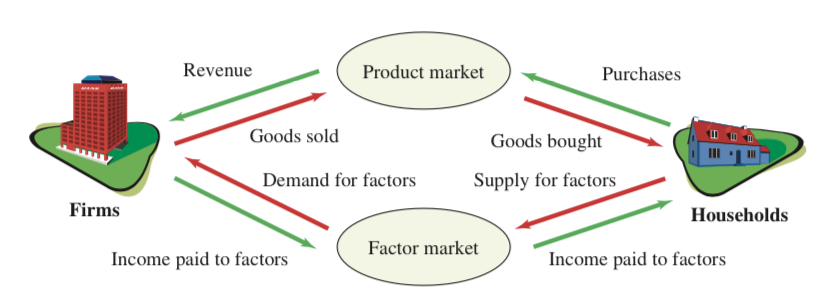

The Circular Flow of Production and Income

In the US, the national income and product accounts, published by the Department of Commerce, are the source for the key data on production and income in the economy.

We can measure the value of output produced in the economy by looking at either the production or income side of the economy.

5.2 The Production Approach: Measuring a Nation’s Macroeconomic Activity Using Gross Domestic Product

To measure the production of the entire economy, we need to combine an enormous array of goods and services.

Gross Domestic Product (GDP) is the total market value of final goods and services produced within an economy in a given year. It is also the most common measure of an economy’s total output.

“Total market value” means we take the quantity of goods produced, multiply them by their respective prices, and then add up the totals.

Using prices allows us to express the value of everything in a common unit of measurement.

“Final goods and services” in the definition of GDP mean those goods and services that are sold to ultimate, or final, purchasers.

GDP is expressed as a rate of production, that is, as an “X” amount of dollars per year.

GDP will increase if prices increase, even if the physical amount of goods that are produced remains the same.

Real-Nominal Principle: What matters to people is the real value of money or income-its purchasing power- not the face value of money or income.

Real GDP is a measure that controls for changes in prices.

When we use current prices to measure GDP, we are using nominal GDP. It can increase for two reasons:

The production of goods and services has increased, or the prices of those goods and services have increased

The prices of those goods and services have increased

Economic growth is sustained increases in the real GDP of an economy over a long period of time.

The Components of GDP

Economists divide GDP into four broad categories that each correspond to different types of purchases represented in GDP:

Consumptions expenditures: purchases by consumers

Private investment expenditures: purchases by firms

Government purchases: purchases by federal, state, and local governments

Net exports: net purchases by the foreign sector (domestic exports minus domestic imports)

Consumption Expenditures

Consumption expenditures are purchases by consumers of currently produced goods and services, either domestic or foreign

Durable goods, such as automobiles, last for a long time

Nondurable foods, such as food, last for a short time.

Services are work in which people play a prominent role in delivery (such as dentists filling a cavity).

Private Investment Expenditures

Private investment expenditures in GDP consist of three components:

There is spending on new plants and equipment during the year.

Newly produced housing is included in investment spending.

If firms add to their stock of inventories, the increase in inventories during the current year is included in GDP.

Gross investment is the total of new investment expenditures.

Depreciation (a capital consumption allowance) is where the existing plant, equipment, and housing deteriorate or wear.

If we subtract depreciation from gross investment, we obtain net investment.

In GDP accounting, investment denotes the purchase of new capital.

Government Purchases

Government purchases are the purchases of newly-produced goods and services by federal, state, and local governments. They include any goods that the government purchases plus the wages and benefits of all government workers.

Transfer payments are payments from governments to individuals that do not correspond to the production of goods and services.

Net Exports

Imports are goods and services we buy from other countries.

Exports are goods and services made here and sold to other countries.

Net exports are total exports minus total imports.

When we buy more goods from abroad than we sell, we have a trade deficit.

A trade surplus occurs when our exports exceed our imports.

Putting It All Together: The GDP Equation

Y = C + I + G + NX

Y = GDP

C = Consumption

I = Investment

G = Government purchases

NX = Net exports

GDP = consumption + investment _ government purchases + net exports

This equation is an identity, which means it is always true no matter what the values of the variables are.

5.3 The Income Approach: Measuring a Nation’s Macroeconomic Activity Using National Income

National income is the total income earned by a nation’s residents both domestically and abroad in the production of goods and services.

Measuring National Income

To measure income, economists first make two primary adjustments to GDP:

We add to GDP the net income earned by U.S. firms and residents abroad. The result of these adjustments is the total income earned worldwide by U.S. firms and residents (gross national product (GNP).

Subtract depreciation from GNP.

National income is divided into six basic categories:

Compensation of employees (wages and benefits)

Corporate profits

Rental income

Proprietors’ income (income of unincorporated business)

Net interest (interest payments received by households from businesses and from abroad

Other items

Personal Income is the income, including transfer payments, received by households.

To calculate personal income, we subtract any corporate profits that are retained by the corporation and not paid out as dividends to households from the national income. We also subtract all taxes on production and imports and social insurance taxes. We then add any personal interest incomes received from the government and consumers and all transfer payments.

Personal disposable income is the income that households retain after paying income taxes.

Measuring National Income Through Value Added

Value-added is the sum of all the income -wages, interest, profits, and rent- generated by an organization

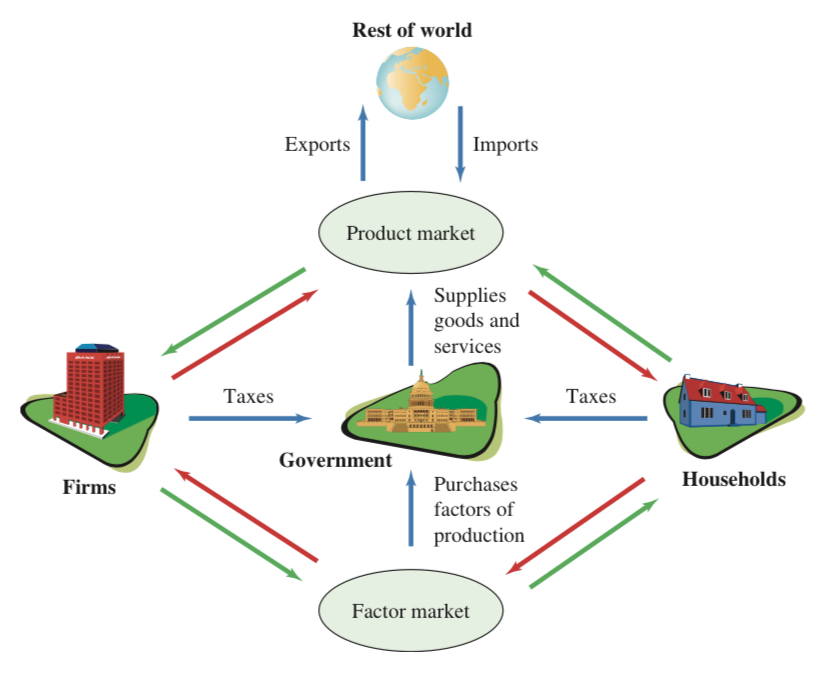

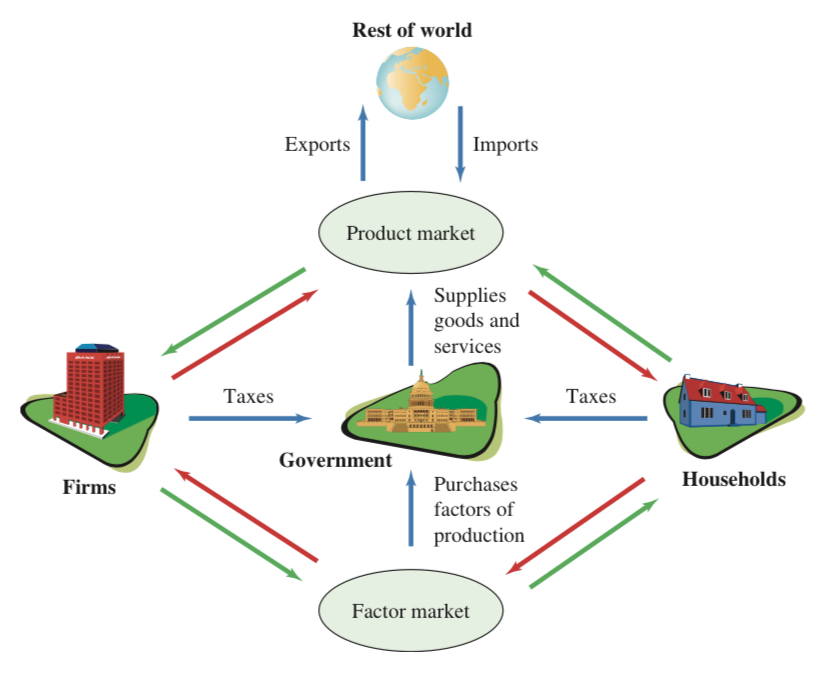

An Expanded Circular Flow

5.4 A Closer Examination of Normal and Real GDP

How to Use the GDP Deflator

The GDP deflator is an index that measures how prices of goods and services change over time.

To calculate GDP Deflator we use the equation (Nominal GDP/Real GDP) x 100

Chain-weighted index is a method for calculating changes in prices that use an average of base years from neighboring years

5.5 Fluctuations in GDP

A recession is a period when real GDP falls for 6 or more consecutive months

The date at which the recession starts - that is when output starts to decline- is called the peak.

The date at which it ends - that is when output starts to increase again- is called the trough.

After a tough, the economy enters a recovery period, or period, or period of expansion.

Depression is the common term for a severe recession.

5.6 GDP as a Measure of Welfare

Economists use GDP and related measures to determine if an economy has fallen into a recession or has entered a depression.

Shortcomings of GDP as a Measure of Welfare

Housework and Childcare: GDP ignores transactions that do not take place in organized markets.

Leisure: Leisure is not included in GDP because GDP is designed to be a measure of the production that occurs in the economy.

Underground Economy: GDP ignores the underground economy, where transactions are not reported to official authorities.

Pollution: GDP does not value changes in the environment that occur in the production of output.

Chapter 5 - Measuring a Nation’s Production and Income

Macroeconomics: the branch of economics that deals with a nation’s economy as a whole. It focuses on the economic issues-unemployment, inflation, growth, trade, and the gross domestic product- that are most often discussed in newspapers, on the radio and televisions, and on the Internet.

Macroeconomics focuses on two basic issues: long-run economic growth and economic fluctuations.

During periods of slow economic growth, not enough jobs are created, and large numbers of workers become unemployed.

At other times, unemployment may not be a problem, but we become concerned that the prices of everything that we buy seem to increase rapidly.

Sustained increases in prices are inflation.

5.1 The “Flip” Sides of Macroeconomic Activity: Production and Income

Production and income because these are the “flip” sides of the macroeconomic “coin” so to speak.

Production leads to income and income leads to production.

Macroeconomists collect and analyze production and income data to understand how many people will find jobs and whether their living standards are rising or falling. Government officials use the data and analysis to develop economic policies.

The Circular Flow of Production and Income

In the US, the national income and product accounts, published by the Department of Commerce, are the source for the key data on production and income in the economy.

We can measure the value of output produced in the economy by looking at either the production or income side of the economy.

5.2 The Production Approach: Measuring a Nation’s Macroeconomic Activity Using Gross Domestic Product

To measure the production of the entire economy, we need to combine an enormous array of goods and services.

Gross Domestic Product (GDP) is the total market value of final goods and services produced within an economy in a given year. It is also the most common measure of an economy’s total output.

“Total market value” means we take the quantity of goods produced, multiply them by their respective prices, and then add up the totals.

Using prices allows us to express the value of everything in a common unit of measurement.

“Final goods and services” in the definition of GDP mean those goods and services that are sold to ultimate, or final, purchasers.

GDP is expressed as a rate of production, that is, as an “X” amount of dollars per year.

GDP will increase if prices increase, even if the physical amount of goods that are produced remains the same.

Real-Nominal Principle: What matters to people is the real value of money or income-its purchasing power- not the face value of money or income.

Real GDP is a measure that controls for changes in prices.

When we use current prices to measure GDP, we are using nominal GDP. It can increase for two reasons:

The production of goods and services has increased, or the prices of those goods and services have increased

The prices of those goods and services have increased

Economic growth is sustained increases in the real GDP of an economy over a long period of time.

The Components of GDP

Economists divide GDP into four broad categories that each correspond to different types of purchases represented in GDP:

Consumptions expenditures: purchases by consumers

Private investment expenditures: purchases by firms

Government purchases: purchases by federal, state, and local governments

Net exports: net purchases by the foreign sector (domestic exports minus domestic imports)

Consumption Expenditures

Consumption expenditures are purchases by consumers of currently produced goods and services, either domestic or foreign

Durable goods, such as automobiles, last for a long time

Nondurable foods, such as food, last for a short time.

Services are work in which people play a prominent role in delivery (such as dentists filling a cavity).

Private Investment Expenditures

Private investment expenditures in GDP consist of three components:

There is spending on new plants and equipment during the year.

Newly produced housing is included in investment spending.

If firms add to their stock of inventories, the increase in inventories during the current year is included in GDP.

Gross investment is the total of new investment expenditures.

Depreciation (a capital consumption allowance) is where the existing plant, equipment, and housing deteriorate or wear.

If we subtract depreciation from gross investment, we obtain net investment.

In GDP accounting, investment denotes the purchase of new capital.

Government Purchases

Government purchases are the purchases of newly-produced goods and services by federal, state, and local governments. They include any goods that the government purchases plus the wages and benefits of all government workers.

Transfer payments are payments from governments to individuals that do not correspond to the production of goods and services.

Net Exports

Imports are goods and services we buy from other countries.

Exports are goods and services made here and sold to other countries.

Net exports are total exports minus total imports.

When we buy more goods from abroad than we sell, we have a trade deficit.

A trade surplus occurs when our exports exceed our imports.

Putting It All Together: The GDP Equation

Y = C + I + G + NX

Y = GDP

C = Consumption

I = Investment

G = Government purchases

NX = Net exports

GDP = consumption + investment _ government purchases + net exports

This equation is an identity, which means it is always true no matter what the values of the variables are.

5.3 The Income Approach: Measuring a Nation’s Macroeconomic Activity Using National Income

National income is the total income earned by a nation’s residents both domestically and abroad in the production of goods and services.

Measuring National Income

To measure income, economists first make two primary adjustments to GDP:

We add to GDP the net income earned by U.S. firms and residents abroad. The result of these adjustments is the total income earned worldwide by U.S. firms and residents (gross national product (GNP).

Subtract depreciation from GNP.

National income is divided into six basic categories:

Compensation of employees (wages and benefits)

Corporate profits

Rental income

Proprietors’ income (income of unincorporated business)

Net interest (interest payments received by households from businesses and from abroad

Other items

Personal Income is the income, including transfer payments, received by households.

To calculate personal income, we subtract any corporate profits that are retained by the corporation and not paid out as dividends to households from the national income. We also subtract all taxes on production and imports and social insurance taxes. We then add any personal interest incomes received from the government and consumers and all transfer payments.

Personal disposable income is the income that households retain after paying income taxes.

Measuring National Income Through Value Added

Value-added is the sum of all the income -wages, interest, profits, and rent- generated by an organization

An Expanded Circular Flow

5.4 A Closer Examination of Normal and Real GDP

How to Use the GDP Deflator

The GDP deflator is an index that measures how prices of goods and services change over time.

To calculate GDP Deflator we use the equation (Nominal GDP/Real GDP) x 100

Chain-weighted index is a method for calculating changes in prices that use an average of base years from neighboring years

5.5 Fluctuations in GDP

A recession is a period when real GDP falls for 6 or more consecutive months

The date at which the recession starts - that is when output starts to decline- is called the peak.

The date at which it ends - that is when output starts to increase again- is called the trough.

After a tough, the economy enters a recovery period, or period, or period of expansion.

Depression is the common term for a severe recession.

5.6 GDP as a Measure of Welfare

Economists use GDP and related measures to determine if an economy has fallen into a recession or has entered a depression.

Shortcomings of GDP as a Measure of Welfare

Housework and Childcare: GDP ignores transactions that do not take place in organized markets.

Leisure: Leisure is not included in GDP because GDP is designed to be a measure of the production that occurs in the economy.

Underground Economy: GDP ignores the underground economy, where transactions are not reported to official authorities.

Pollution: GDP does not value changes in the environment that occur in the production of output.

Knowt

Knowt