Chapter 13: Foreign Exchange and International Trade of Money

The rate at which one currency can be exchanged for another is called the exchange rate, and it is usually stated in terms of how many units of one currency can be bought with one unit of a different currency.

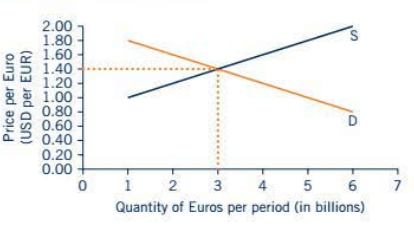

Exchange rates are determined in foreign exchange markets through the interaction between the buyers and sellers of different currencies. For example:

The foreign exchange market for U.S. dollars and Euros. The demand for Euros comes from people who need to exchange U.S. dollars for Euros.

The demanders of Euros include U.S. importers of French wine or other products, tourists, and U.S. investors who want to invest in French companies.

The demand curve for Euros illustrates the quantity of Euros that buyers are willing and able to purchase at different exchange rates. The downward slope of the demand curve shows that as the price per Euro rises, the quantity of Euros demanded falls.

In other words, when buyers have to pay more U.S. dollars to obtain each Euro, the quantity of Euros demanded falls.

When Euros are cheaper, people have to pay fewer U.S. dollars to obtain each Euro, and the quantity of Euros demanded rises.

The supply of Euros in this market comes from people and firms who want to buy U.S. dollars.

lf French citizens or businesses want to purchase U.S. goods and services or travel to the U.S., they need to exchange their Euros for U.S. dollars.

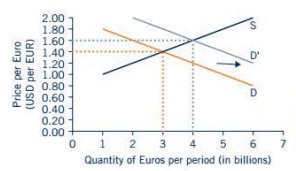

Many of the same factors that shift demand for "regular" goods and services are demand shifters in foreign exchange markets. These include tastes and preferences, income, and expectations. Changes in the relative interest rates, risk, or relative price levels across countries can also cause shifts in the demand for foreign currency.

Tastes and Preferences: Changes in tastes and preferences for a certain country's goods and services can change the demand for that country's currency.

Income :Assuming that foreign goods and services are normal (rather than inferior) goods, increases in people's incomes in one country can increase their demand for foreign goods and services. The increased demand for foreign goods and services will cause an increase in demand for foreign currency as well.

Expectations: People's expectations about the future influence their demand for goods and services today.

Interest rates and Risk :Business firms and individuals are increasingly able to borrow and lend money across international borders.

When the price of currency A rises relative to currency B, currency A has appreciated.

When the price of currency A falls relative to currency B, currency A has depreciated.

For example, when the price of Euros increases, so that it takes more U.S. dollars to obtain each Euro, the Euro has appreciated against the dollar. When the price of U.S. dollars falls, so that it takes fewer Euros to buy each U.S. dollar, the U.S. dollar has depreciated against the Euro.

Under a flexible or floating exchange rate system, the interaction of demand and supply determines the exchange rate for a given currency.

Some countries do not use a flexible exchange rate system and instead keep the rate of exchange between their currency and the currency of other countries at a fixed rate. This is called a fixed or pegged exchange rate system.

ln a fixed exchange rate system, government agencies or central banks intervene in foreign exchange markets in order to increase or decrease the demand and supply of their currency and keep exchange rates at the fixed level.

Chapter 13: Foreign Exchange and International Trade of Money

The rate at which one currency can be exchanged for another is called the exchange rate, and it is usually stated in terms of how many units of one currency can be bought with one unit of a different currency.

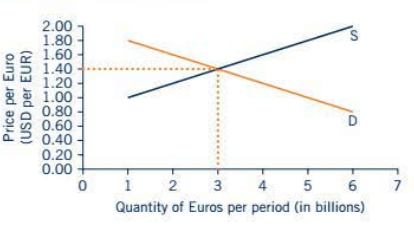

Exchange rates are determined in foreign exchange markets through the interaction between the buyers and sellers of different currencies. For example:

The foreign exchange market for U.S. dollars and Euros. The demand for Euros comes from people who need to exchange U.S. dollars for Euros.

The demanders of Euros include U.S. importers of French wine or other products, tourists, and U.S. investors who want to invest in French companies.

The demand curve for Euros illustrates the quantity of Euros that buyers are willing and able to purchase at different exchange rates. The downward slope of the demand curve shows that as the price per Euro rises, the quantity of Euros demanded falls.

In other words, when buyers have to pay more U.S. dollars to obtain each Euro, the quantity of Euros demanded falls.

When Euros are cheaper, people have to pay fewer U.S. dollars to obtain each Euro, and the quantity of Euros demanded rises.

The supply of Euros in this market comes from people and firms who want to buy U.S. dollars.

lf French citizens or businesses want to purchase U.S. goods and services or travel to the U.S., they need to exchange their Euros for U.S. dollars.

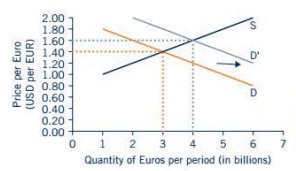

Many of the same factors that shift demand for "regular" goods and services are demand shifters in foreign exchange markets. These include tastes and preferences, income, and expectations. Changes in the relative interest rates, risk, or relative price levels across countries can also cause shifts in the demand for foreign currency.

Tastes and Preferences: Changes in tastes and preferences for a certain country's goods and services can change the demand for that country's currency.

Income :Assuming that foreign goods and services are normal (rather than inferior) goods, increases in people's incomes in one country can increase their demand for foreign goods and services. The increased demand for foreign goods and services will cause an increase in demand for foreign currency as well.

Expectations: People's expectations about the future influence their demand for goods and services today.

Interest rates and Risk :Business firms and individuals are increasingly able to borrow and lend money across international borders.

When the price of currency A rises relative to currency B, currency A has appreciated.

When the price of currency A falls relative to currency B, currency A has depreciated.

For example, when the price of Euros increases, so that it takes more U.S. dollars to obtain each Euro, the Euro has appreciated against the dollar. When the price of U.S. dollars falls, so that it takes fewer Euros to buy each U.S. dollar, the U.S. dollar has depreciated against the Euro.

Under a flexible or floating exchange rate system, the interaction of demand and supply determines the exchange rate for a given currency.

Some countries do not use a flexible exchange rate system and instead keep the rate of exchange between their currency and the currency of other countries at a fixed rate. This is called a fixed or pegged exchange rate system.

ln a fixed exchange rate system, government agencies or central banks intervene in foreign exchange markets in order to increase or decrease the demand and supply of their currency and keep exchange rates at the fixed level.

Knowt

Knowt