Chapter 20: Income Inequality, Poverty, and Discrimination

Income inequality - How income is distributed around the average

Distribution by income category

Distribution by quintiles (fifths) - Dividing into 5 equal groups + examining % of total personal income of each quintile

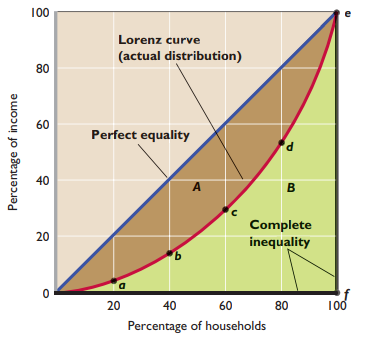

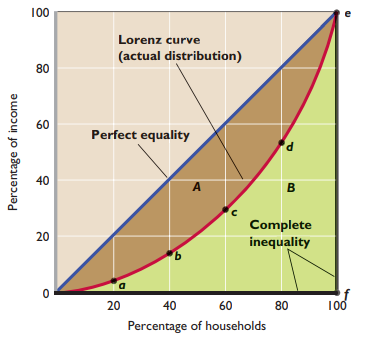

Lorenz curve - Displays quintile distribution of personal income

% of households on horizontal, % of income on vertical

Diagonal line represents perfectly equal distribution of income

Gini ratio - Numerical measure of the overall dispersion of income

Income mobility - Movement of individuals + households between income quintiles

Change time period measured → Significant differences in income inequality

Effect of gov’t redistribution

Non-cash transfers - Provide goods/services rather than cash

Gov’t redistributes income from high to low income households

Causes of income inequality

Different mental, physical, aesthetic abilities

Education + training

Discrimination - Practice of according people inferior treatment (for example, in hiring, occupational access, education and training, promotion, wage rate, or working conditions) on the basis of some factor such as race, gender, or ethnicity

Different preferences for market work

Unequal distribution of wealth

Rigging market power on one’s own behalf

Luck, connections, misfortune

Income inequality over time

More unequal distribution over time

Causes of growing inequality

Greater demand for highly skilled workers

Demographic changes

International trade, immigration, decline in unionism

Equality vs. efficiency

Case for equality - Income equality maximizes total consumer satisfaction (utility) from any particular level of output and income

Yields greater combined total utility

Case for inequality - Income distribution determines amount of output/income produced + available to distribute

Equality-efficiency trade-off - Greater income equality (achieved through redistribution of income) comes at the opportunity cost of reduced production and income

Society must choose how much distribution it wants

Poverty - Condition in which a person or a family does not have the means to satisfy basic needs for food, clothing, shelter, and transportation

Poverty rate - Percent of population living in poverty

US income-maintenance system

Entitlement programs - Social insurance + welfare; eligible persons ensured to benefits in programs

Social insurance programs - Partially replace earnings that have been lost due to retirement, disability, or temporary unemployment; they also provide health insurance for the elderly

Social Security - Federal pension program that replaces part of the earnings lost when workers retire, become disabled, or die

Medicare - Federal insurance program that provides health insurance benefits to those 65 or older and people who are disabled

Unemployment compensation - Social insurance program that makes income available to workers who are unemployed

Public assistance programs - Provide benefits to people who are unable to earn income because of permanent disabling conditions or who have no or very low income and also have dependent children

Supplemental Security Income (SSI) - Provides a uniform nationwide minimum income for the aged, blind, and disabled who are unable to work and who do not qualify for Social Security aid

Temporary Assistance for Needy Families (TANF) - Basic welfare program for low-income families in the United States

Food stamp program - Federal program (financed through general tax revenues) that permits eligible low-income persons to obtain vouchers that can be used to buy food

Medicaid - Federal program (financed by general tax revenues) that provides medical benefits to people covered by the SSI and TANF (basic welfare) programs

Earned income tax credit (EITC) - Refundable Federal tax credit provided to low-income wage earners to supplement their families’ incomes and encourage work

Taste for discrimination model - Views discrimination as resulting from a preference or taste for which the discriminator is willing to pay. The model assumes that, for whatever reason, prejudiced people experience a subjective or psychic cost—a disutility—whenever they must interact with those they are biased against

Discrimination coefficient - Amount of disutility

Suggests that competition will reduce discrimination in very long run

Statistical discrimination - People are judged on the basis of the average characteristics of the group to which they belong, rather than on their own personal characteristics or productivity

Occupational segregation - Crowding of women, African Americans, and certain ethnic groups into less desirable, lower-paying occupations

Minorities unable to move into occupations with higher wages

Loss of output for society

Removal → More efficient allocation of resources

Chapter 20: Income Inequality, Poverty, and Discrimination

Income inequality - How income is distributed around the average

Distribution by income category

Distribution by quintiles (fifths) - Dividing into 5 equal groups + examining % of total personal income of each quintile

Lorenz curve - Displays quintile distribution of personal income

% of households on horizontal, % of income on vertical

Diagonal line represents perfectly equal distribution of income

Gini ratio - Numerical measure of the overall dispersion of income

Income mobility - Movement of individuals + households between income quintiles

Change time period measured → Significant differences in income inequality

Effect of gov’t redistribution

Non-cash transfers - Provide goods/services rather than cash

Gov’t redistributes income from high to low income households

Causes of income inequality

Different mental, physical, aesthetic abilities

Education + training

Discrimination - Practice of according people inferior treatment (for example, in hiring, occupational access, education and training, promotion, wage rate, or working conditions) on the basis of some factor such as race, gender, or ethnicity

Different preferences for market work

Unequal distribution of wealth

Rigging market power on one’s own behalf

Luck, connections, misfortune

Income inequality over time

More unequal distribution over time

Causes of growing inequality

Greater demand for highly skilled workers

Demographic changes

International trade, immigration, decline in unionism

Equality vs. efficiency

Case for equality - Income equality maximizes total consumer satisfaction (utility) from any particular level of output and income

Yields greater combined total utility

Case for inequality - Income distribution determines amount of output/income produced + available to distribute

Equality-efficiency trade-off - Greater income equality (achieved through redistribution of income) comes at the opportunity cost of reduced production and income

Society must choose how much distribution it wants

Poverty - Condition in which a person or a family does not have the means to satisfy basic needs for food, clothing, shelter, and transportation

Poverty rate - Percent of population living in poverty

US income-maintenance system

Entitlement programs - Social insurance + welfare; eligible persons ensured to benefits in programs

Social insurance programs - Partially replace earnings that have been lost due to retirement, disability, or temporary unemployment; they also provide health insurance for the elderly

Social Security - Federal pension program that replaces part of the earnings lost when workers retire, become disabled, or die

Medicare - Federal insurance program that provides health insurance benefits to those 65 or older and people who are disabled

Unemployment compensation - Social insurance program that makes income available to workers who are unemployed

Public assistance programs - Provide benefits to people who are unable to earn income because of permanent disabling conditions or who have no or very low income and also have dependent children

Supplemental Security Income (SSI) - Provides a uniform nationwide minimum income for the aged, blind, and disabled who are unable to work and who do not qualify for Social Security aid

Temporary Assistance for Needy Families (TANF) - Basic welfare program for low-income families in the United States

Food stamp program - Federal program (financed through general tax revenues) that permits eligible low-income persons to obtain vouchers that can be used to buy food

Medicaid - Federal program (financed by general tax revenues) that provides medical benefits to people covered by the SSI and TANF (basic welfare) programs

Earned income tax credit (EITC) - Refundable Federal tax credit provided to low-income wage earners to supplement their families’ incomes and encourage work

Taste for discrimination model - Views discrimination as resulting from a preference or taste for which the discriminator is willing to pay. The model assumes that, for whatever reason, prejudiced people experience a subjective or psychic cost—a disutility—whenever they must interact with those they are biased against

Discrimination coefficient - Amount of disutility

Suggests that competition will reduce discrimination in very long run

Statistical discrimination - People are judged on the basis of the average characteristics of the group to which they belong, rather than on their own personal characteristics or productivity

Occupational segregation - Crowding of women, African Americans, and certain ethnic groups into less desirable, lower-paying occupations

Minorities unable to move into occupations with higher wages

Loss of output for society

Removal → More efficient allocation of resources

Knowt

Knowt